Eurozone Trade Deficit Calls For A Stronger Euro

2022.09.15 11:01

[ad_1]

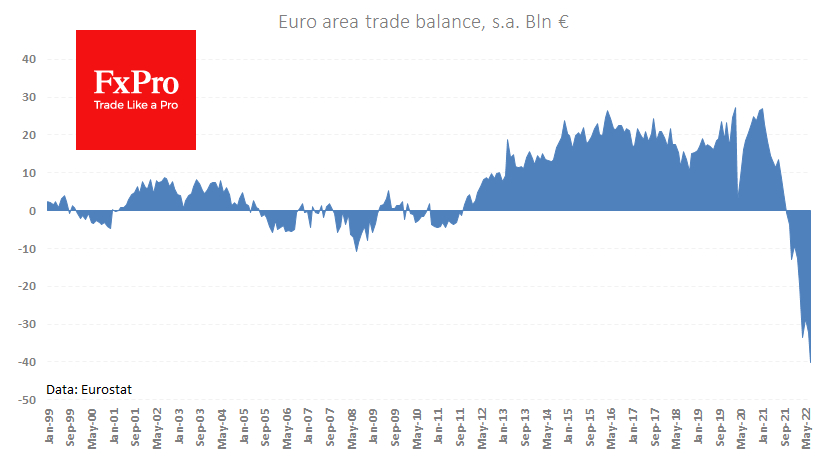

According to a new Eurostat publication, the Eurozone’s seasonally adjusted foreign widened to 40bn in July. Since last October, the region has found itself in the unfamiliar role of a net importer.

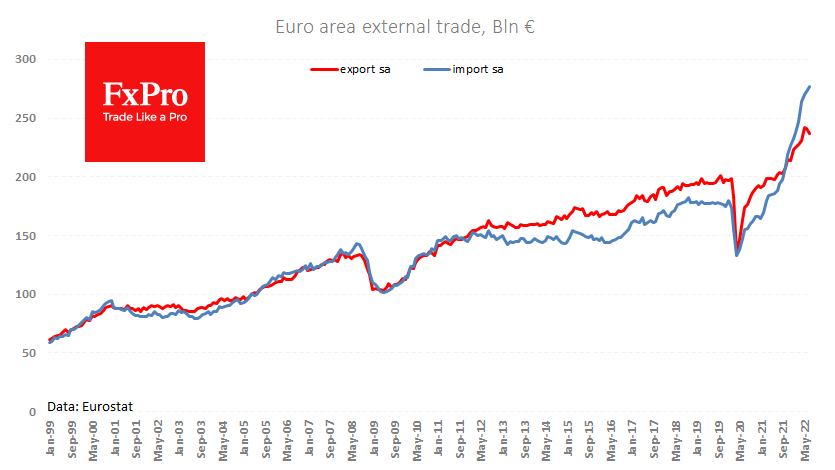

That is a notable reversal after about ten years of exports significantly exceeding imports. From 1999 to 2012, exports and imports held together even in the crisis period of 2008-2009.

Euro area foreign trade deficit widened to 40bn in July.

Euro area foreign trade deficit widened to 40bn in July.

Following a series of energy shocks, imports have been growing faster than exports for the last 18 months, in 10 of which there is a ballooning deficit. It is interesting that during this whole time, i.e., since the start of 2021, the has been systematically falling.

In the case of Europe, it is not yet possible to say that a currency depreciation improves foreign trade performance, it is instead the opposite. The falling euro is inflating energy import bills.

We also see a peak in exports, which have fallen for the past two months despite the import jump. The reason on the surface is the loss of competitiveness of the region’s goods, as energy costs Europe more than some competing regions, such as the US.

Signs of a peak in exports

Signs of a peak in exports

Surging energy prices are responsible for a rise in EU imports from Norway (+151% between January and July) and Russia (+70%). Still, there is also an increase in the trade deficit with China of over 100 billion and sizeable increases in imports from the UK and India, suggesting a weaker competitive position of European goods.

The latter should be a wake-up call for Eurozone monetary authorities, as soft policies are now working against the economy by depreciating the single currency and inflating import costs.

It may sound a bit unusual, but the Eurozone should adopt the policies of emerging economies, which are fighting the economic crisis by supporting the national currency and trying to keep capital in.

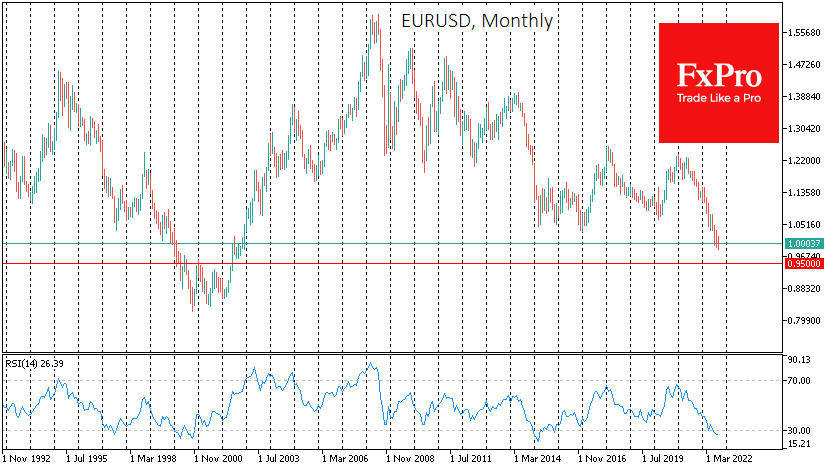

EUR/USD monthly price chart.

EUR/USD monthly price chart.

More and more ECB officials may share this thought, so the resolution to raise rates we saw last week might be a long-term shift rather than a passing episode.

If that is the case, we should expect a tightening of the monetary authority’s tone and more overt moves to protect the euro from declining.

However, traders and investors should be aware that such political shifts will not be able to reverse the exchange rate in one go.

At best, a slowdown in the euro depreciation can become the case in the coming months, not days. That said, we believe a EUR/USD initial decline towards 0.95 is likely before the euro gains a solid footing.

[ad_2]

Source link