Euro Steady on Light Data Calendar

2022.12.23 03:30

[ad_1]

Euro continues to drift this week, with the pair sticking close to the 1.06 line. There are no eurozone releases today, so I expect the euro to continue treading in place for the remainder of the day.

This week’s data calendar in Europe has been very light, with mostly tier-2 releases. On Thursday, Germany and the US released consumer confidence data pointing to very different consumer mindsets. Germany’s Index remained in deep freeze at -37.8, although the index has been inching higher, courtesy of energy prices stabilizing.

Still, the German consumer is deeply pessimistic. At home, high and rising interest rates are squeezing consumers, while the war in Ukraine, which has dampened economic activity, shows no signs of ending anytime soon. The German release mirrored Tuesday’s eurozone , which is also mired deep in negative territory.

Contrast this gloomy outlook with the US, where surprised the markets by climbing to a 5-month high, with a reading of 108.3 in December. This blew past the November reading of 101.4 and the consensus of 101.0. The CB noted that inflation expectations fell to their lowest level since September 2021, mainly due to the drop in gas prices.

The strong improvement in consumer confidence is interesting, as the US economy is expected to tip into recession – perhaps consumers are confident that the recession will not be all that bad.

ECB’s De Guindos Talks Hawkish

The ECB eased up on the pace of rates at the December meeting, as it delivered a 50-bp increase after two consecutive 75-bp increases. ECB President Lagarde warned that this was not a dovish pivot and that further rate hikes were coming. ECB Vice-President Luis de Guindos sounded hawkish on Thursday, saying,

“Increases of 50 basis points may become the new norm in the near term.”

De Guindos said the ECB had to do more in the fight against and voiced concern that the markets might underestimate the persistence of inflation. Fed Chair Jerome Powell would likely agree, as the Fed has had a tough time convincing the markets that it plans to continue tightening to curb inflation.

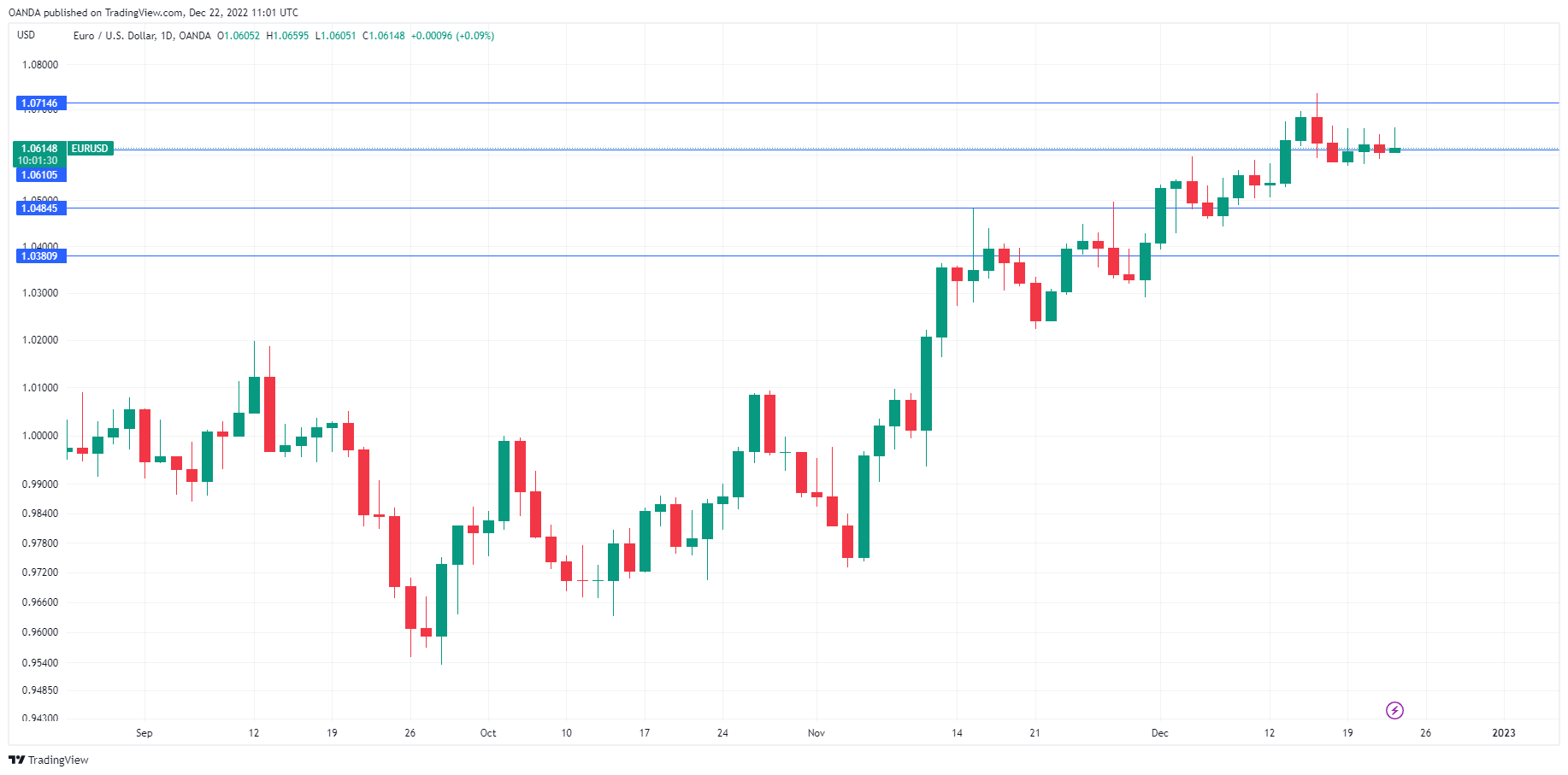

EUR/USD Technical

- EUR is testing resistance at 1.0610. Above, there is resistance at 1.0714

- 1.0484 and 1.0380 provide support

[ad_2]