Euro Pauses After Sharp Gains, Nonfarm Payrolls Loom

2022.12.02 09:05

[ad_1]

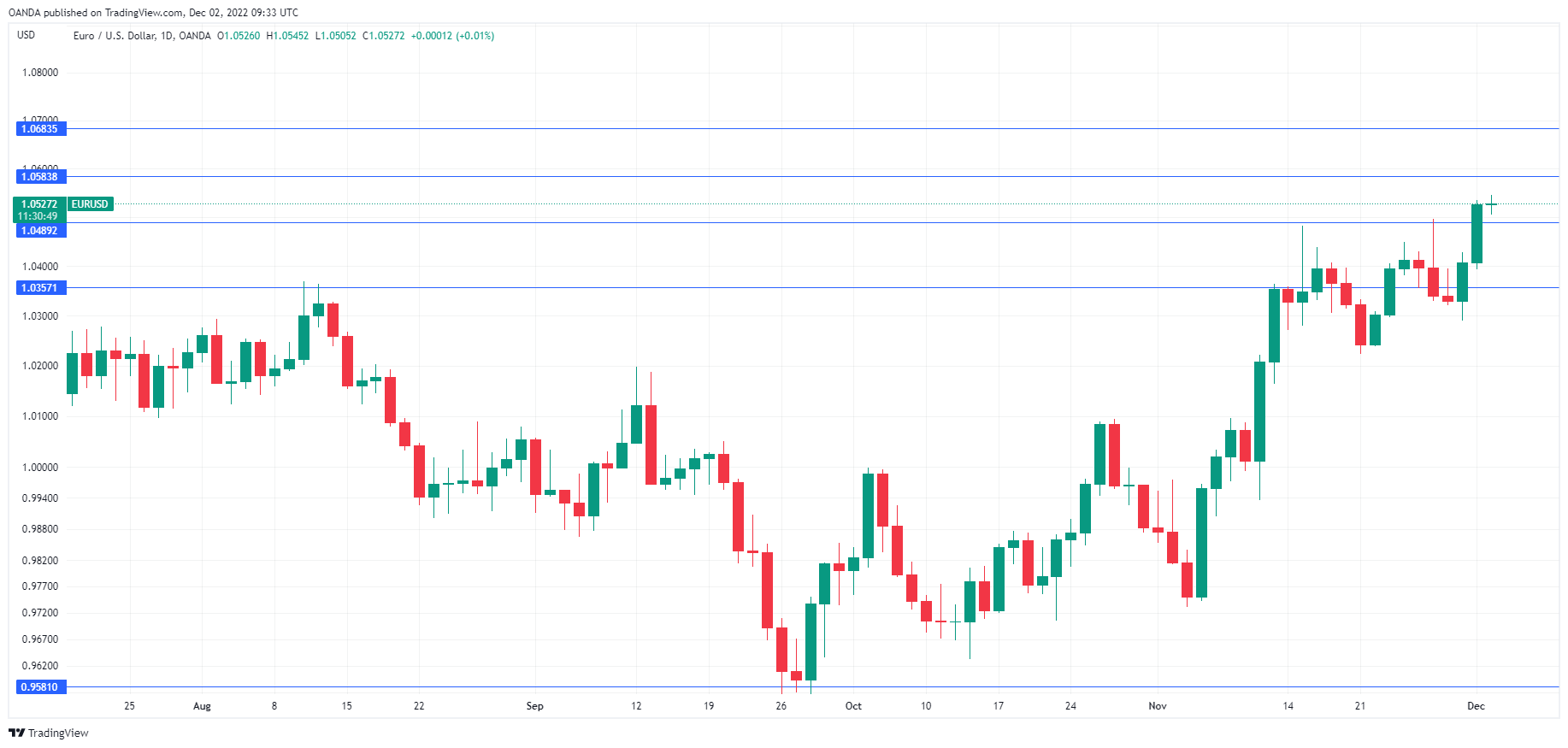

is unchanged on Friday, trading at 1.0524.

US nonfarm payrolls expected to drop to 200,000

The week wraps up with one of most important releases on the calendar, US . The robust labour market is showing signs of cooling down, as rising interest rates have slowed economic activity. Nonfarm payrolls have been falling and the trend is expected to continue, with a consensus of 200,000 for November, down from 261,000 a month earlier. With the Fed holding its policy meeting on Dec. 14, the NFP report will be closely watched by policy makers, who have relied on a strong job market to press ahead with an aggressive rate cycle.

The US dollar has been in retreat since Jerome Powell’s speech on Wednesday. The speech was balanced, with Powell reiterating that inflation remained too high and rates would continue to rise higher. Still, the markets focussed on the fact that Powell strongly hinted the Fed would ease rates at the December meeting with a 50-bp hike, and the optimism sent equities higher and the dollar lower.

The euro has made the most of the dollar’s weakness, and EUR/USD posted its best month since 2012, with gains in November of 5.3%. Still, the euro has been on a prolonged decline and started 2022 close to 1.14. The outlook for the euro is weak, as the European Commission expects the eurozone economy to decline in Q4 2022 and Q1 2023. The driver of the expected decline is the huge jump in energy prices caused by the war in Ukraine. The eurozone has been hit hard by double-digit inflation, and the ECB will have to continue raising rates, despite weak economic conditions, until it is convinced that inflation has peaked.

EUR/USD Technical

- EUR/USD faces resistance at 1.0583, followed by a monthly line at 1.0683

- There is support at 1.0490 and 1.03537

Original Post

[ad_2]

Source link