Euro Parity: What Will it Take to Drive the EUR/USD to 1.00?

2024.11.27 02:34

EUR/USD Key Points

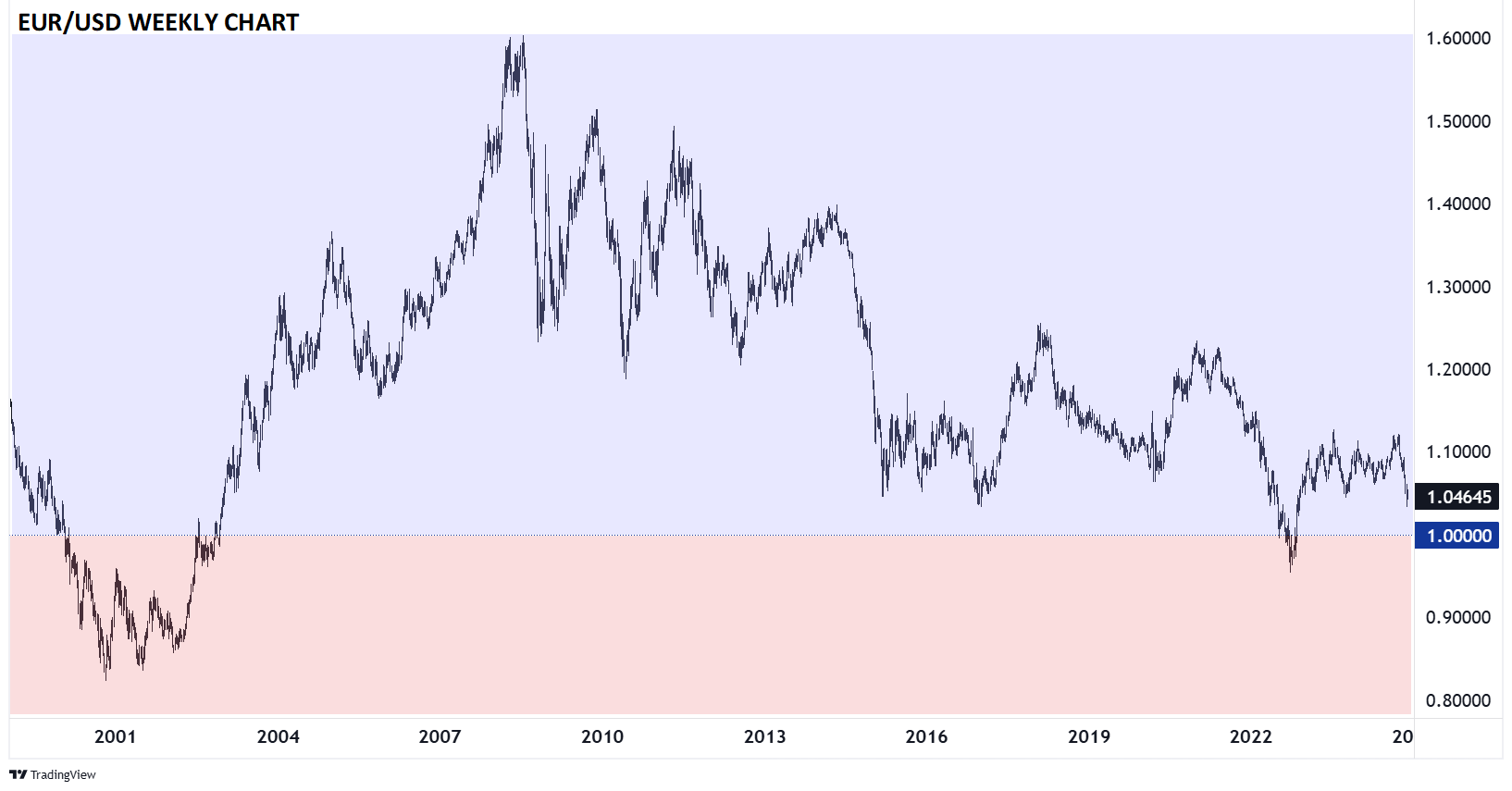

- EUR/USD has only traded below parity (1.00) on two occasions in its 25-year history.

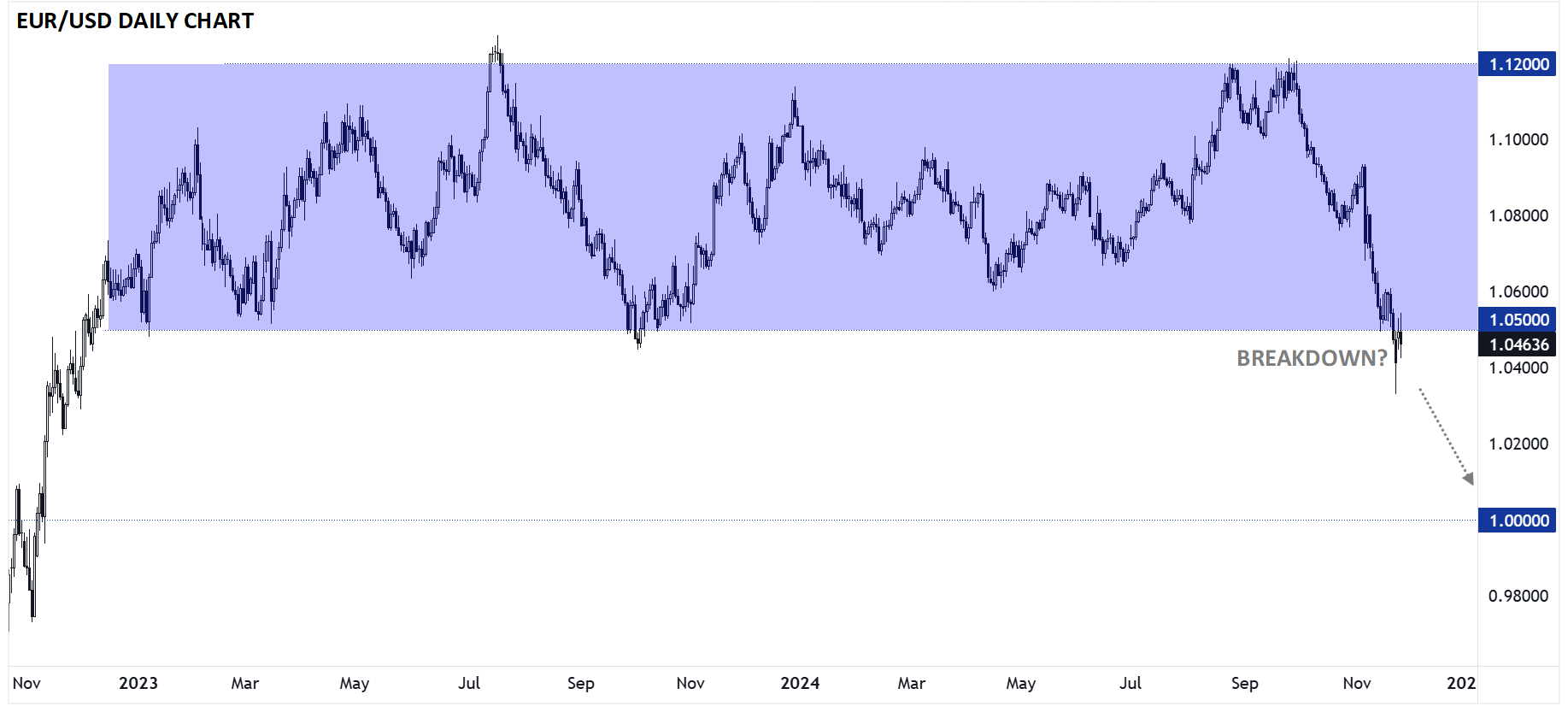

- EUR/USD is threatening to break down from its nearly 2-year range between 1.05 and 1.12.

- A confirmed breakdown could bring the psychologically-significant 1.00 level back onto trader’s radars.

Numbers often carry more weight than their mere value. They can symbolize achievement, effort, or even disappointment.

Take a marathon finish, for example: runners crossing the line at 2:59:30 are elated, celebrating the accomplishment of breaking the elusive 3-hour barrier. But those crossing a minute later—just as fit, just as well-trained—may feel deflated, their months of preparation overshadowed by missing that key milestone. Sometimes, a number isn’t just a number—it’s a defining moment.

Similarly, in financial markets, certain numbers—like parity—hold symbolic significance far beyond their numerical value, shaping sentiment and strategy in profound ways. For the uninitiated, “parity” in the context of foreign exchange refers to a situation where two currencies are equal in value. When the EUR/USD exchange rate is 1.00, one euro is worth exactly one . While parity is just a number in theory, it often carries significant psychological and economic weight.

A Brief History of EUR/USD Parity

- Launch of the Euro (1999): The euro was introduced as an accounting currency in 1999, replacing a basket of European currencies. Initially, the EUR/USD exchange rate started around 1.17 but quickly declined below parity due to skepticism about the euro’s strength and the Eurozone’s economic cohesion.

- 2000-2002 Decline Below Parity: By late 2000, EUR/USD fell to a historic low of 0.8230 as investors favored the stronger US economy and dollar. Concerns over the Eurozone’s economic growth weighed on the euro.

- Rise Above Parity (2002): The euro regained parity in mid-2002, driven by improving Eurozone economic data and waning confidence in the US dollar due to geopolitical risks and the aftermath of the dot-com bubble.

- Bull Market for the Euro (2003-2008): The euro climbed to historic highs of over 1.60 by 2008, fueled by a weaker US dollar during the Global Financial Crisis (GFC) and a growing belief in the euro as a viable alternative reserve currency.

- Fluctuations Post-Crisis: Since the GFC, the EUR/USD has seen periods of strength and weakness, influenced by Eurozone sovereign debt crises, US Federal Reserve policy changes, and other global economic factors.

- Parity in Recent Years (2022): For a couple of months in late 2022, EUR/USD fell back below parity for the first time in two decades due to a combination of aggressive Federal Reserve rate hikes, the economic impact of the Russia-Ukraine conflict on Europe, and surging energy prices that threatened Eurozone growth.

Source: TradingView, StoneX

Will We See EUR/USD Parity Again?

As traders have started to appreciate some of the structural issues with the Eurozone economy and the potential for outperformance in the US (the “US Economic Exceptionalism” narrative) in recent months, traders have started to wonder whether EUR/USD may fall to parity again in 2025.

Ultimately, exchange rates are driven by central bank interest rates more than any other factor, or to be more accurate, expectations for changes in future central bank interest rates. As of writing, traders expect the European Central Bank (ECB) to cut interest rates relatively aggressively in the coming year, from the current 3.25% to 1.80% in one years’ time. The current political turmoil in European leaders Germany and France no doubt plays a role as well.

Meanwhile, expectations for interest rate reductions from the US Federal Reserve have faded, with traders pricing in only a 2-3 25bps interest rate cuts over that period from the current 4.50-4.75% range to closer to 4.00%. In other words, traders are currently pricing in the US-Europe interest rate spread widening from 1.25% today to closer to 2.00% at this time next year. This spread (along with expectations for how it will evolve in the coming days) will continue to evolve with economic data in the weeks and months to come, with a special focus on inflation and employment data on either side of the Atlantic playing the biggest role.

In order for EUR/USD to approach parity again, inflation figures in the US will likely have to remain stubbornly above the Fed’s 2% target backed by continued strength in the labor market; conversely, weakening Eurozone economic data could prompt even more aggressive easing from Madame Lagarde and Company at the ECB, likely weighing on EUR/USD.

Euro Technical Analysis – EUR/USD Daily Chart

Source: TradingView, StoneX

Turning to the chart, EUR/USD is threatening to break down from the 1.0500-1.1200 range that has kept prices contained since the start of 2013. After a nearly 2-year sideways consolidation, a strong directional thrust is possible if the breakdown is confirmed. In that scenario, a continuation toward at least 1.02, if not outright parity (1.00) could be in the cards as we flip the calendars to 2025.

On the other hand, a bullish reversal and “false breakdown” scenario could lead to a snapback rally toward the middle of the range in the 1.07-1.08 zone as aggressive shorts get squeezed. One way or another, we’ll soon know whether EUR/USD parity is an imminent possibility.

Original Post