EURGBP near floor level; 2023 downtrend intact

2023.06.08 06:37

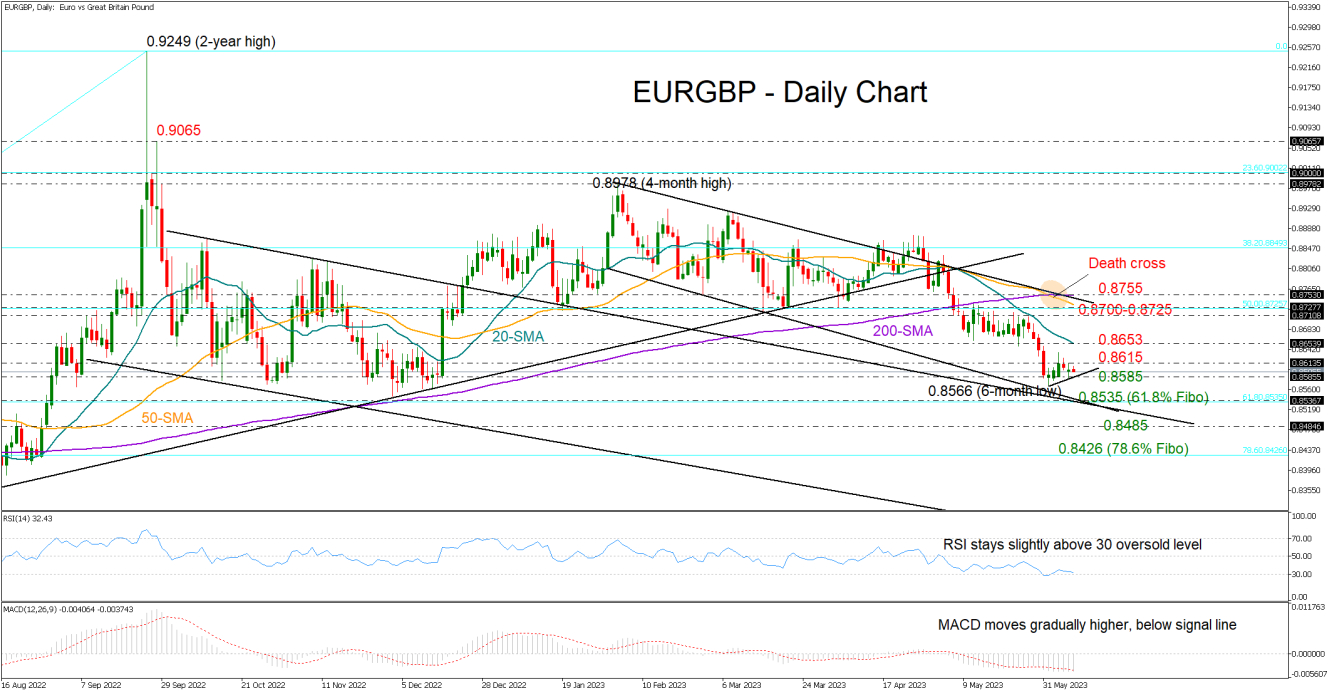

EURGBP posted limited gains following the pivot from a six-month low of 0.8566 as the 0.8615 territory proved a tough obstacle this week.

Previously, the pair stopped near the lower boundary of the channel containing the price action since the beginning of the year, hinting at a possible bullish reversal. The momentum indicators are higher than their recent lows, sustaining some hopes for a short-term recovery. However, the negative slope of the SMAs and the “death cross” between the 50- and 200-day SMAs suggest the 2023 downtrend will remain intact.

A clear close above the 0.8615 bar could initially face the constraining 20-day SMA, currently at 0.8653. If the bulls breach that line, the door will open for the 0.8700-0.8725 resistance region, where the 50% Fibonacci retracement of the 0.8200-0.9249 uptrend is placed. Nevertheless, traders might wait for a decisive extension above the downward-sloping channel and the 200-day SMA at 0.8750 in order to raise buying orders up to the 38.2% Fibonacci level of 0.8850.

Alternatively, a break below 0.8585 could cause the price to fall towards the channel’s lower boundary and the 61.8% Fibonacci of 0.8535. Another failure here could add more fuel to the sell-off, bringing the 0.8485 zone under examination ahead of the 78.6% Fibonacci mark of 0.8425.

In summary, could remain supported in the short term, though a broad bullish trend reversal seems unlikely at the moment.