EUR/USD: We’re Giving Our Euro/Dollar Forecast a Factory Reset

2023.01.17 14:53

[ad_1]

To quote a former UK Prime Minister, when asked about the most significant challenges faced by his administration, the answer came: “Events, dear boy, events”. The same can be said for foreign exchange strategists making FX forecasts.

We undertook our last major FX forecast round with the release of our 2023 FX Outlook, ‘The dollar’s high-wire act’. In it, we presented a scenario analysis and argued that the permutations of four major inputs would determine where EUR/USD would trade in 2023. Those inputs were:

- Fed policy,

- Europe’s energy crisis,

- China’s economy, and

- global risk sentiment.

Back then, we sided with a more negative set of outcomes and felt that could end 2023 near parity.

Instead, the year is shaping up a little better than most had imagined. Since we published that outlook, there have been clear signs of decelerating US price pressures, and it also looks like the US economy heading toward a recession. This gives the Fed the motive and the means to respond with an easing cycle later this year. Forecasting the US economy to contract in the second half of this year, our US economist James Knightley predicts a deeper than consensus 250bp easing cycle from the Fed starting in the third quarter. Reflationary Fed policy is a dollar negative.

On Europe, the surprisingly warm winter has seen prices plummet. The negative terms of trade shock that had been so bearish for the euro last summer has now completely reversed. Our commodities team is now looking at a much lower profile for natural gas, where Europe could exit the heating season with storage above 50% full. This could limit the bounce in natural gas in 2H23 towards the EUR140-160/MWh area. That’s still high but way below the EUR250-300/MWh levels seen last summer.

The European Central Bank’s hawkish pivot in December also has some critical implications for the euro. We expect the ECB to hike the policy rate by 125bp into 2Q23, taking the deposit rate to 3.25%. Crucially, our team expects the Bank to keep the policy rate there until late 2024. That will lead to some substantial compression in EUR:USD interest rate differentials, and we’ve got more on that below.

Beijing’s policy U-turn on zero-Covid has also shown more pragmatism and less dogmatism in local policy than the market was expecting. After the Lunar New Year in late January, our Greater China economist Iris Pang expects clear signs of a pick-up in domestic activity and demand to build through the second quarter and into the second half. It now looks like Chinese domestic demand can pose an important counterweight to slowing trajectories in the US and Europe. Investors are already positioning for this by reducing underweight positions in emerging market assets. Flows back into emerging markets are typically positive for EUR/USD.

And the early-year investment environment has started on a strong footing. Most asset classes are firmer. Assuming that the factors outlined above do not reverse, investors want to be positioned for a better outcome than the 20%+ losses suffered on many asset classes last year. A rally in risk assets is the typical corollary of a reflationary dollar decline.

In short, this new set of assumptions is more consistent with the most bullish ‘safe and sound’ EUR/USD scenario we presented last November.

Back to Basics and Back to 2007

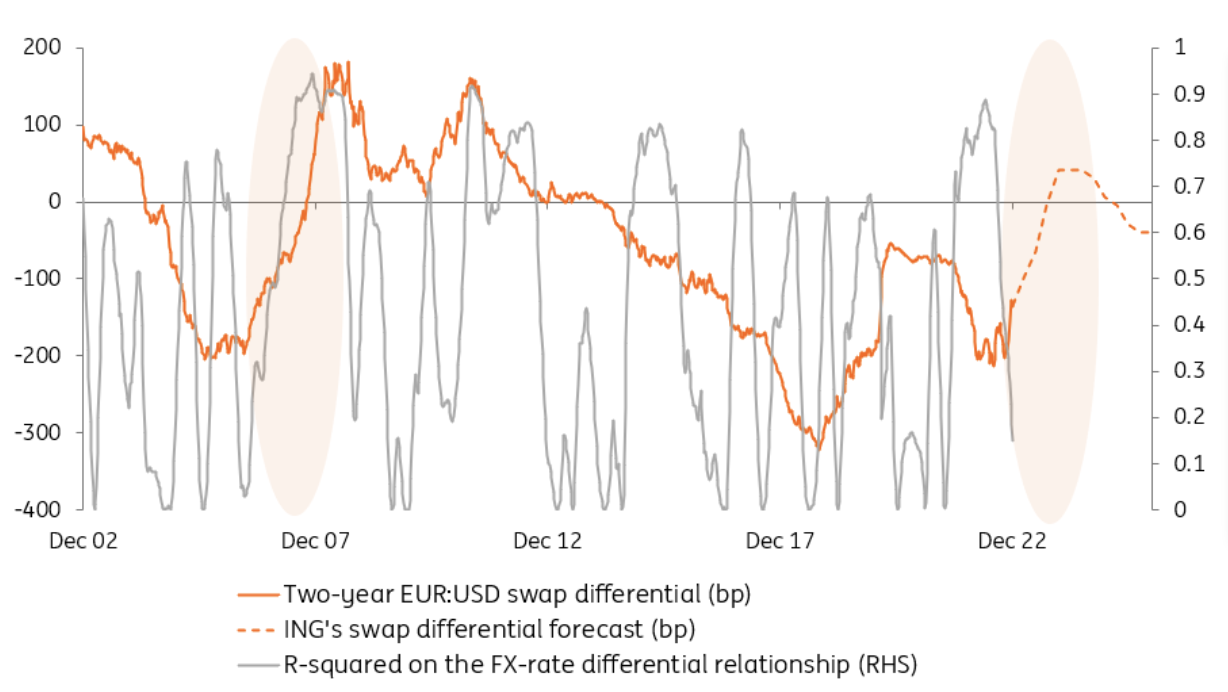

Returning to the issue of a substantial spread compression between USD and EUR short-term interest rates this year, we now argue that rate differentials will start to re-assert themselves in FX market pricing. At the end of last year, those differentials had little say in driving FX rates where instead, energy markets and the investment environment were more important. Arguably, those two-year rate spreads had less say as they bounced around in a relatively narrow 150-215bp range.

Yet short-term rate differentials are a good indicator of the future path of relative monetary policy cycles and, by extension, the role currencies can play in policy settings. Using our macro team’s central bank policy forecasts, our rate strategists expect a substantial reversal in the two-year EUR:USD swap differential this year. Trading now at around 125bp in favor of the dollar, this differential could shift to 40bp in favor of the euro by the end of this year.

Should this adjustment in interest differentials materialise, the pandemic aside, this would mark one of the biggest shifts in relative policy settings since 2007. We mention that year because in the second half of 2007, Fed easing expectations grew (US two-year swap rates tumbled 120bp+), while eurozone swap rates resolutely held near 4.50% on the back of a hawkish ECB. EUR/USD did very well.

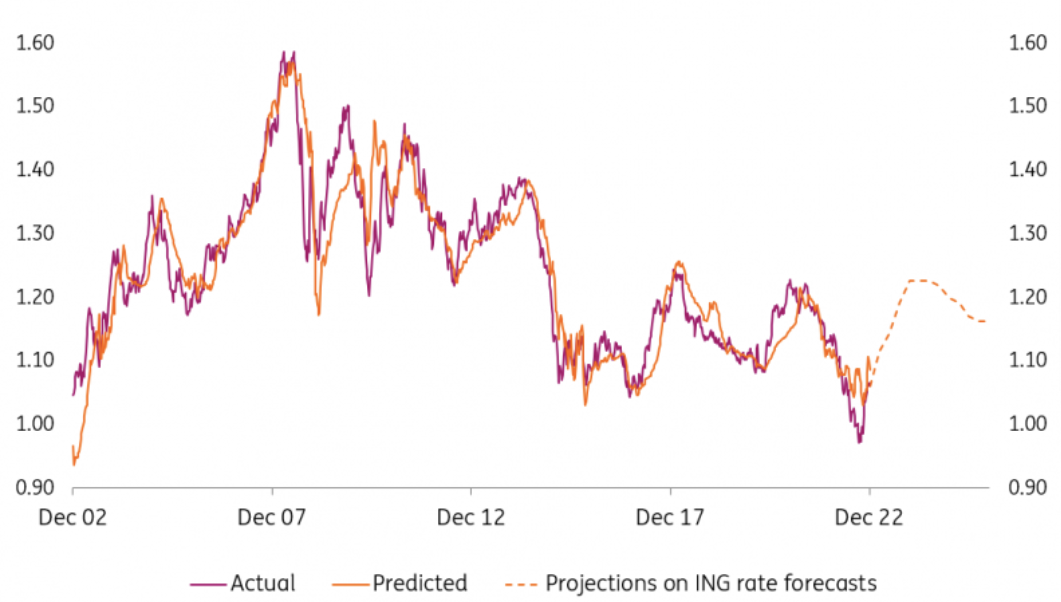

Our points here are twofold: the first is that interest rates will matter more this year. The second is that using rate spreads alone to forecast EUR/USD, the latest relationship and our rate profile forecasts would deliver a model-based estimate of EUR/USD trading above 1.20 towards the end of the year.

You can see what we mean when you look at the charts below. The first shows that a big adjustment in short-term interest rates creates a statistically more significant relationship with FX.

EUR/USD relationship with interest spread:

EUR/USD Swap Differential vs. Forecasts

EUR/USD Swap Differential vs. Forecasts

What a Model Might Predict

What an interest rate model might predict for EUR/USD trading above 1.20 towards the end of the year based on past relationships and ING’s interest rate projection.

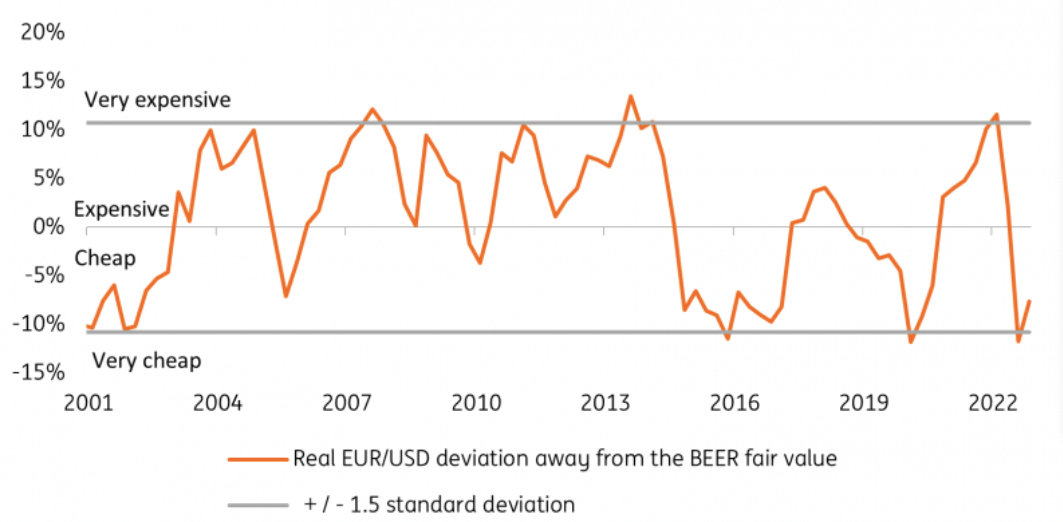

Our BEER Model Points to 7-8% EUR/USD Undervaluation

Another argument in favor of EUR/USD strength in 2023 is that the pair is undervalued. We estimate the medium-term real fair value of G10 currency pairs using a Behavioral Effective Exchange Rate (BEER) model, which includes terms of trade (ToT), productivity, current account, and government consumption differentials as explanatory variables.

Given our model uses OECD quarterly data – which is published with a delay – we have adjusted the terms of trade (the ratio of export prices to import prices) series with higher-frequency commodity price data. This was a necessary adjustment considering that the eurozone-US terms of trade differential is statistically the most important driver of EUR/USD BEER fair value in the medium-term. And also, the recent volatility in energy prices (which has an enormous impact on the eurozone’s ToT) required a more up-to-date input in the model.

The recent drop in energy prices triggered a substantial rebound in eurozone Terms of Trade and a contraction in the US equivalent. Accordingly, the EUR/USD fair value has spiked. At the current 1.08 level, we estimate that EUR/USD is approximately 7-8% undervalued in real terms.

EUR/USD in Relation to BEER Model

EUR/USD in Relation to BEER Model

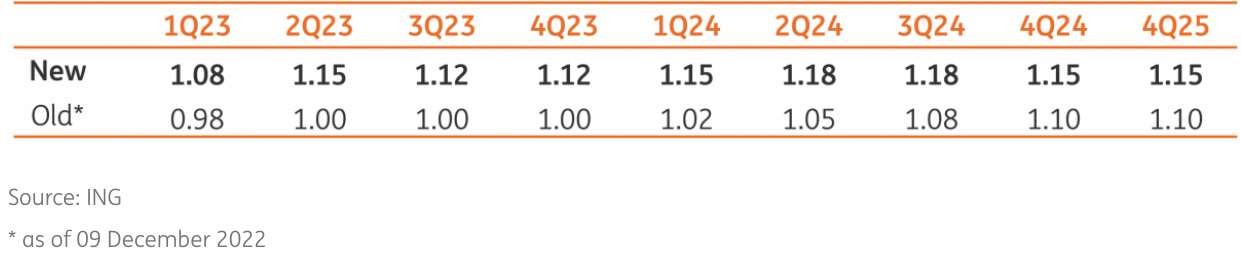

The forecast

Bearing in mind the importance of EUR/USD in driving FX trends globally, we no longer feel we can justify a sub-consensus profile over the coming years. Instead, we expect EUR/USD to work its way back to medium-term fair value, now around the 1.15 area.

In terms of a quarterly profile this year, a good proportion of the year’s EUR/USD gains could come in the second quarter when we expect US core inflation to fall sharply, allowing the short end of the US yield curve to adjust lower too. 2Q should also be the period when China re-opening trends gain a further leg higher. However, 3Q and 4Q could prove trickier for EUR/USD: the third quarter on the basis that the extension of the US debt ceiling could become a very contentious political debate around that period and be bad for the risk environment and the fourth on the basis that higher energy prices could again hit the euro.

Our New EUR/USD Forecasts

ING’s actual EUR/USD Forecast vs. Previous Forecast

ING’s actual EUR/USD Forecast vs. Previous Forecast

[ad_2]