EUR/USD Weekly Forecast: Outlook Turning Brighter for Europe

2023.11.27 05:18

held ground in an uneventful week, ending it as it had started, at around the 1.0900 mark. The Thanksgiving holiday and a scarce macroeconomic calendar kept the pair within a limited range, although some encouraging data maintained the sentiment upbeat, as figures supported the case for a softer economic setback and on-hold central banks.

Eurozone downturn slows

The Old Continent moves two steps behind the United States (US), but at least there were tepid signs the Eurozone may have left the worst behind. S&P Global released the preliminary estimates of the November Purchaser Manager Indexes (PMIs), most of which surprised to the upside.

The indexes still indicated contraction, but improved from October readings and beat the market expectations. The EU Composite PMI jumped from 46.5 to 47.1, also above the 46.9 forecast. The official report noted that the contraction rate was softer than anticipated, although business activity continued to fall amid a further solid decline in new orders.

Meanwhile, Germany confirmed the Q3 Gross Domestic Product (GDP) fell by 0.1% QoQ. At the same time, the October Producer Price Index (PPI) contracted 11% from a year earlier. The numbers were no surprise, and in fact, falling wholesale prices are encouraging for the inflation outlook.

Central banks in a firm path

European Central Bank (ECB) officials continue to maintain a cautious stance regarding the region’s future. Inflation remains high, growth is still on the back foot, and rates stand at multi-year highs, leaving them with little room to manoeuver to fix it all. It is clear that additional hikes are not the preferred path.

The ECB held interest rates unchanged in the last meeting and adopted the “higher for longer” mantra while reaffirming its data dependence for future decisions. Still, market participants continuously increase bets for a soon-to-come rate cut, anticipating the first one in April.

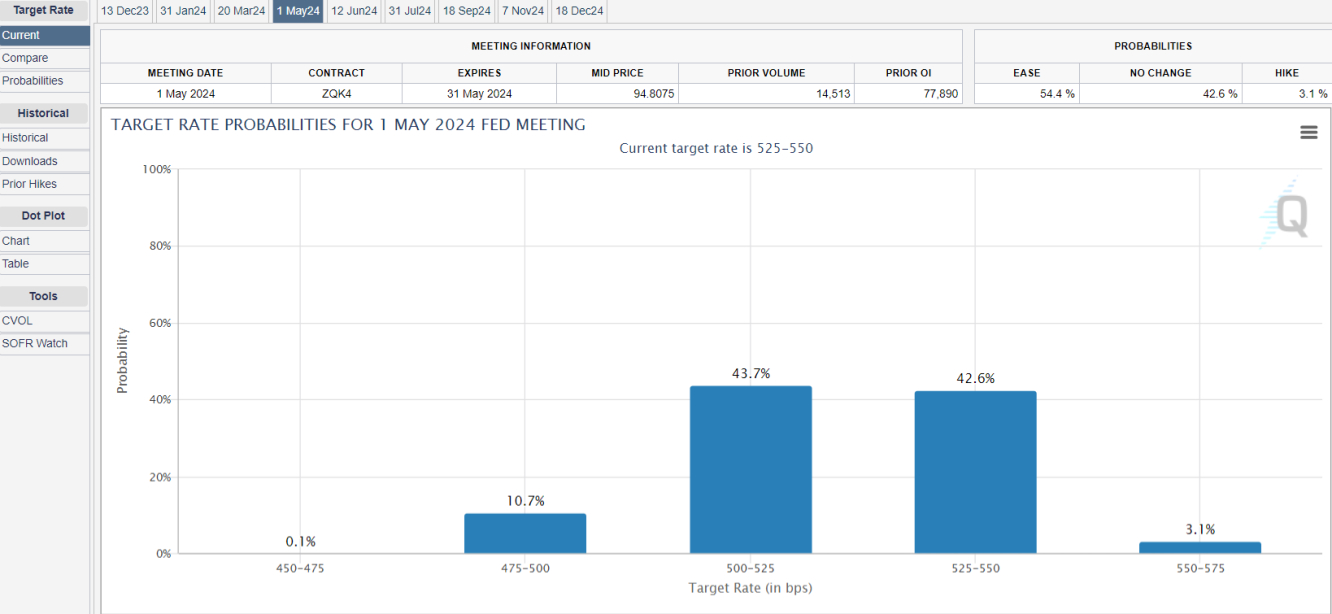

The US Federal Reserve (Fed) is standing in a similar spot. The central bank refrained from acting in its last two meetings and anticipated upcoming decisions would depend on macroeconomic data. US officials are also looking to cool down rate cut speculation, although financial markets are pricing in roughly 44% odds for a rate cut next May, according to the CME Group FedWatch Tool.

The Federal Open Market Committee (FOMC) released the Minutes of its latest meeting on Tuesday, but the document did not impress market participants. Policymakers noted that recent indicators suggest economic activity has been expanding at a strong pace, while job gains remain strong, although moderating. At the same time, they are confident tighter credit and financial conditions are likely to weigh on economic activity, hiring, and inflation, although the extent of these effects remains uncertain.

Data-wise, US figures were mixed, as Durable Goods Orders plunged 5.4% MoM in October, while Initial Jobless Claims for the week ended November 17 were 209K, much better than the previous 233K. Finally, S&P Global Services PMI improved to 50.8 in November from 50.6 in the previous month, although the manufacturing index contracted by more than anticipated, to 49.4, according to preliminary estimates. The Composite PMI was reported at 50.7 matching the October final reading.

Inflation takes center stage once again

Speculative interest is optimistic, dropping the US Dollar and demanding high-yielding assets. US indexes are poised to close their best month in over a year despite the Thanksgiving holiday’s limited activity on Friday. Even though the US economy is showing better signs than the Eurozone one, the EUR/USD pair will likely extend gains. At some point, however, the USD will start taking advantage of America’s self-strength. Data scheduled to be out in the upcoming few weeks will be critical on that matter, as market participants will get fresh inflation updates and the final monetary policy announcements of the year.

Germany and the Eurozone will release the preliminary estimates of their respective November Harmonized Index of Consumer Prices (HICP) next week, while the US will unveil the October Core Personal Consumption Expenditures (PCE) Price Index, the Fed’s favorite inflation measure. The country will also publish the final estimate of the Q3 GDP and the November ISM Manufacturing PMI.

EUR/USD technical outlook

The EUR/USD pair traded between Fibonacci levels last week, peaking at 1.0964, just a couple of pips above the 61.8% retracement of the 1.1275-1.0447 decline. After retreating from the level, it slid to 1.0852, with buyers surging around the 50% retracement of the mentioned slide at 1.0861.

From a technical perspective, the weekly chart shows that EUR/USD has posted a higher high and a higher low while moving forward above a directionless 20 Simple Moving Average (SMA). The 100 SMA maintains a modest bearish bias well below the shorter one, while a flat 200 SMA stands at around 1.1150. Meanwhile, technical indicators have extended their advances but lost upward strength, with the Momentum indicator currently at around its 100 line and the Relative Strength Index (RSI) indicator consolidating at 57. Both indicators skew the risk to the upside, although without confirming enough strength among bulls.

The EUR/USD pair is poised to extend its advance, according to the daily chart, although it needs to clear the 1.0960 Fibonacci resistance to confirm so. The pair keeps developing above all its moving averages, with a firmly bullish 20 SMA approaching from below to flat 100 and 200 SMAs, both converging in the 1.0790-1.0810 price zone. Finally, technical indicators have stabilized well into positive territory after correcting overbought conditions.

Once above 1.0960, EUR/USD can test sellers’ determination at around the 1.1000 mark, while once above the latter, the pair will face resistance at 1.1060 and 1.1120. Meanwhile, a clear break through the 1.0860 support could lead to a slide towards 1.0790 first, en route to the 1.0740 price zone.