EUR/USD waiting for a sell signal

2023.02.06 06:24

EUR/USD waiting for a sell signal

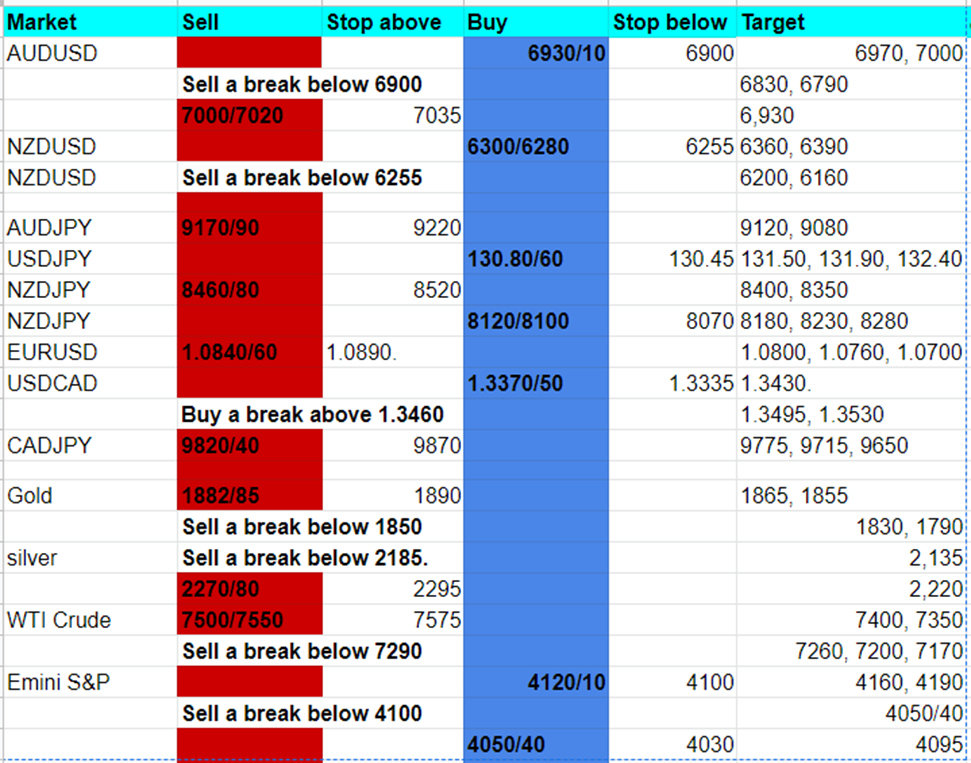

On Friday, EUR/USD crashed through support at 7060/50 and rejected the 100-week and 500-day moving averages at 7160/80, sending a sell signal toward 6990/80 and 6930/20. A low for the day precisely here.

At 6930/10, this is the crucial 23.6% Fibonacci & 3-month trend line support. The minimum stop for longs is 6300. A sell signal with a target of 6830/20 and possibly as far as 6790/80 is a Sunday night open below 6300 or a Monday low.

On the weekly chart, a large bearish engulfing candle indicates that the longer-term bull trend for has resumed.

Holding support at 6930/10 targets 6970/80. It’s possible we continue higher to strong resistance at 7000/7020. Shorts need stops above 7035.

Shorts at 6430/60 certainly worked perfectly if you held them over the NFP number (although I would never advise that of course). Again a huge bearish engulfing candle on the weekly chart suggests the longer-term bull trend for the US dollar has resumed.

Chart

After a bearish engulfing candle, we still have a chance of rebounding at key support at 6300/6280. If you want to try longs, stop below 6255; your targets are 6360/70 and maybe even 6400/20. Stops above 6435 are needed by shorts.

A sell signal is a break below 6255 that may target 6200/6190 or even 6160/50. resistance between 9180 and 9200 Stops above 9220 are needed for shorts.

A break below 9065 will re-target 9040 and 9010/00, possibly even 8970. shot higher after overcoming significant resistance at 130.65/85 in search of a buy signal.

The longer-term bull trend for the US dollar has resumed, as indicated by the bullish engulfing candle on the weekly chart. Holding above strong support at 130.80/60, 132.40/50, and 131.90 are the targets.

Longs at 130.80/60 stop below 130.45.

Is extremely choppy – up one day, down the next in the 6-week sideways trend—and I am forced to wait for a breakout because I cannot find low-risk trade opportunities.

Has a lot of support at the lower end of the range, between 8120 and 8100. Stops must be below 8070 for longs. A sell signal is a break lower that initially targets 7960/40 and possibly even 7880/60.

In the broad sideways trend, it is difficult to locate levels that can be traded. At 8460/80, we once more face significant resistance. Stop below 8520. This is a buy signal, which could target 8590 and then 8630.

Made a weekly high precisely at the 1.1010/20 rising trend line resistance level. On the weekly chart, a large bearish engulfing candle suggests that the US dollar’s longer-term bull trend has resumed. Today’s support at 1.0690/70 could be reached if the price stays below 1.0820/30. Stops must be below 1.0650 for longs. A sell signal is a lower low that initially targets 1.0600 and eventually strong support at 1.0470/50. Stops must be below 1.0430 for longs.

After the significant sell signal on the weekly chart, gains are likely to be limited. Shorts need stops above 1.0890 because there is strong resistance at 1.0840/60 on any bounce today.

Shot higher, resulting in a bearish engulfing candle on the weekly chart. Shorts may be too risky, but we reach the first resistance at 1.3430/50. A buy signal is a break above 1.3460, which targets 1.3495/1.3305 and then 1.3530/40.

At 1.3370/50, support. Stops must be below 1.3335 for longs.

I must wait for the pattern to become more clear in order to establish a wild sideways consolidation, possibly a bull flag. At 1.4630/40, the January high, there is resistance. A buy signal is a break higher this week.

A break below 1.4425 is a sell signal with a target of 1.4390/80 and possibly as far as 1.4320/10. Support is located at the end of the 2-week range at 1.4455/35.

A buy signal for 1.7140/50 is held above 1.7035/25. Stops must be below 1.7000 for longs.

Broke below the lower end of the recent range at 1.2280/60 for a sell signal with a target of 1.2145/25. On Friday, we hit 1.2047 for the next sell signal. As we look for a test of support at 1.1960/40, the outlook remains negative. Longs must have stops below 1.1920 in order to prevent a daytime low.