EUR/USD Under Pressure from Multiple Sources but Clings on to $1.05 for Now

2024.11.19 09:15

The pair has struggled to find footing, trading below the $1.06 and vulnerable to further losses. Tuesday has been hit by latest escalation in Russia’s war against Ukraine, something which has also weighed on European shares. Meanwhile, the has maintained its gains against most currencies except the safe-haven , which rose along with .

The greenback’s strength has been the more dominant theme in FX than geopolitics in recent weeks, apply downward pressure on all major FX pairs, thanks to rising inflation concerns after Trump’s victory and the Federal Reserve signaling it will slow down its rate cutting. Meanwhile, the euro faces hurdles from European political instability and weakening economic indicators from the Eurozone, and any escalation in the Russia-Ukraine situation. This week, there is not much in the way of US data, but global PMIs on should cause some volatility on Friday. The EUR/USD remains on a bearish path, and I continue to expect an eventual breakdown below the $1.05 handle, even if a short-term dollar correction or consolidation is now a good possibility given the big dollar rally heading into December, which has not been a great one for the greenback in the last decade or so.

Euro and Stocks Drop as Ukraine hits Russia with Western-made Missiles

The big news this morning was from Russia. Investors were shaken by reports of Ukrainian forces conducting their first strike on a Russian border region – a military facility in the western Bryansk region – using Western-supplied missiles. This follows President Vladimir Putin’s approval of an updated nuclear doctrine, broadening the conditions under which Russia might deploy atomic weapons, including in response to a large-scale conventional attack on its territory.

Dollar Remains Largely Bid

Even if you ignore the raised geopolitical risks, the US dollar continues to dominate the currency markets, buoyed by Trump’s recent election victory and a surprisingly resilient economy, as highlighted by Friday’s stronger retail sales figures, and sticky inflation data. Expectations of a loose fiscal policy outlook, including spending and tax measures in 2025 and beyond, is keeping the dollar rally alive. The Federal Reserve’s hawkish tone last week gave the dollar another shot in the arm. Chairman Powell warned that the Fed was in no rush to cut interest rates. This resulted in a hawkish repricing of expectations for a December rate cut down to 60/40 odds from over 80% not so long ago. We also had slightly hotter than expected inflation data last week, which helped to keep the greenback on the front foot. The lack of any major data releases this week from the US will keep the Fed speakers in focus.

Eurozone Woes Undermine Single Currency

The greenback may be vulnerable to some profit-taking, but ultimately it remains in a strong bullish trend, especially against currencies where the central bank is comparatively less hawkish or more dovish than the Fed. Among these currencies is the euro, which is also undermined because of concerns over the impact of the looming tariffs when Trump takes office in January.

Meanwhile, the eurozone is grappling with political uncertainty and economic challenges. Germany, the eurozone’s largest economy, last week reported disappointing sentiment data, with its ZEW economic sentiment index declining sharply. Adding to the uncertainty, German Chancellor Olaf faces a no-confidence motion on December 16, which Scholz looks certain to lose without backing from the FDP. As a result, Scholz has agreed to hold snap elections on February 23, 2025, moving up the originally scheduled election from September 2025.

Adding to the euro’s challenges is its heavy dependence on external trade. China’s economic struggles, driven by a property crisis and trade tariffs, are weighing heavily on European exports. Among the eurozone countries, Germany is particularly exposed due to its close trade links with China. With weak Chinese demand, the eurozone’s growth outlook appears grim, reinforcing a bearish sentiment behind our EUR/USD forecast.

Key Macro (BCBA:) Events to Watch this Week that Could Impact EUR/USD

The economic calendar for the week offers fewer major events, but two key developments could still drive volatility:

- PBOC Rate Decision (Wednesday): The People’s Bank of China may surprise markets with a rate cut, adding to the pressure on the euro through its trade linkages with the Chinese economy. W weaker yuan means lower Chinese demand for eurozone goods and services.

- Global Flash PMIs (Friday): Friday’s PMI data for manufacturing and services sectors will provide fresh insights into economic health across major regions, including the eurozone. Given the eurozone’s recent struggles, a weak PMI print could fuel further selling pressure on EUR/USD, while stronger data could result in a short-squeeze rally.

Concerns over slowing demand, compounded by trade tensions and potential tariffs, weigh heavily on sentiment. Unless the eurozone shows an unexpected improvement in its data, the bearish dynamics for EUR/USD are unlikely to shift meaningfully.

EUR/USD technical analysis and trade ideas

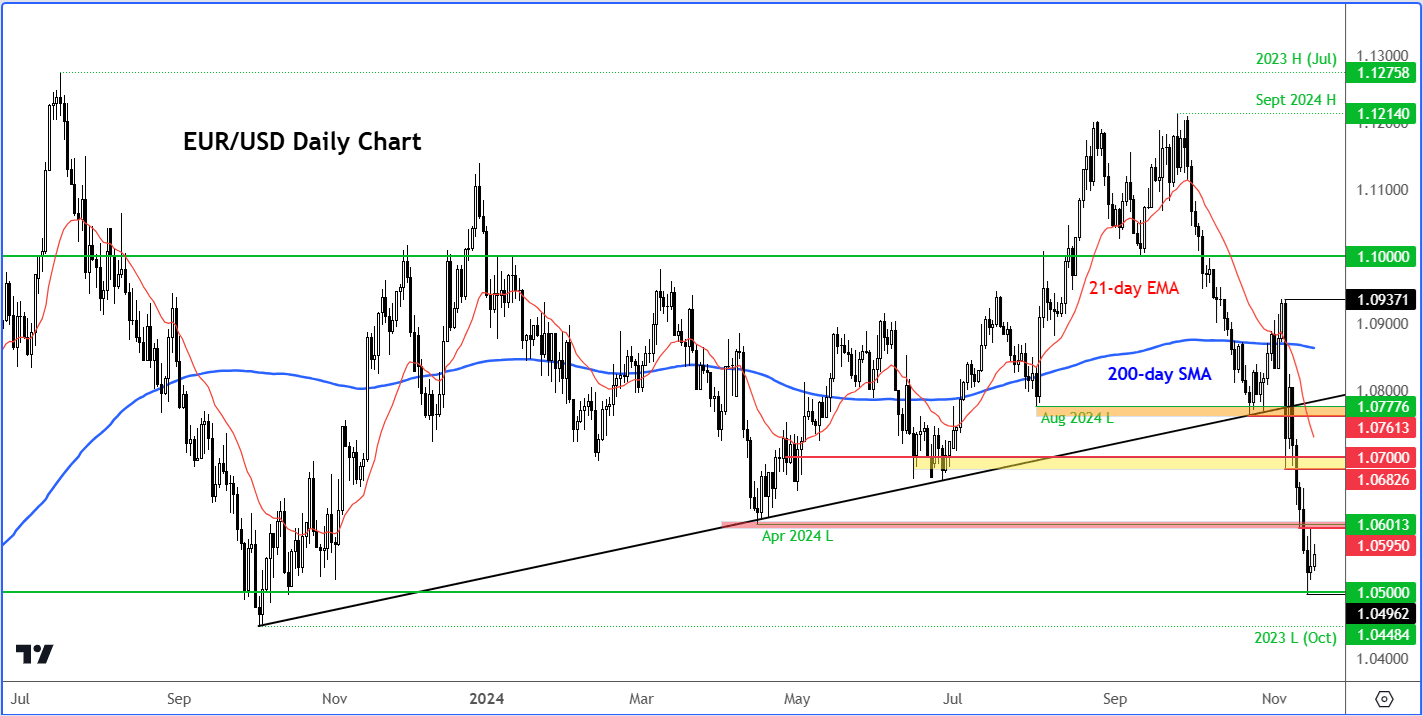

From a technical perspective, the EUR/USD continues its bearish trajectory, with lower highs and lower lows. The FX pair last week tested and briefly broke below the 1.0500 level before rebounding slightly. For now, short-term resistance around the 1.0590-1.0600 area has held firm.

Source: TradingView.com

So, immediate support lies at 1.0500, which could be tested again if the dollar-buying pressure continues. A break below this level could give rise to further technical selling, even without any fresh macro catalysts. The October 2023 low at 1.0448 is the next bearish target.

In terms of resistance levels to watch, as mentioned, the key short-term area to watch is now the old support zone of around 1.0590-1.0600. Above that area, 1.0650, 1.0700, and 1.0770 will come into focus.

Seasonality Factors May Come Into Play

My still bearish EUR/USD forecast reflects a challenging environment for the euro and a strong dollar, owing to European economic uncertainty, the situation between Ukraine and Russia, and Trump’s pro-growth policies. Unless significant bullish catalysts emerge, the path to sub $1.05 seems increasingly likely. The key risk to this bearish forecast is the fact that dollar may be hit by seasonality factors give that December has not been a great month for the greenback in the past several years. Out of the last 10 Decembers, the has fallen in 8 of those, and in the last 7 consecutive Decembers.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Read my articles at City Index