EUR/USD Targets 1.08 as Bleak Eurozone Outlook Leaves Room for Dovish ECB Surprise

2024.10.15 04:48

- EUR/USD traders await the ECB meeting as the pair hovers near key support levels.

- Shifting Fed and ECB rate cut expectations continue to drive volatility in the pair.

- Upcoming U.S. economic data and Eurozone inflation will play a pivotal role in EUR/USD’s next move.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

has been under pressure since late September, as market participants adjusted their for Federal Reserve rate cuts.

Stronger-than-expected U.S. economic data has sparked doubt over a larger 50-basis-point cut in November, with a more modest 25-basis-point reduction now seen as the baseline.

Meanwhile, in the eurozone, the European Central Bank (ECB) looks set to a 25-basis-point cut, though the region’s deteriorating economic outlook leaves room for a more dovish surprise.

This shift in expectations has driven EUR/USD lower, with the pair testing the 1.09 level.

U.S. Dollar Strengthens Amid Shifting Rate Cut Expectations

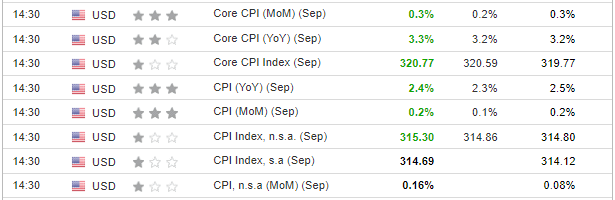

The has gained strength as market expectations realign, thanks in part to last week’s data, which showed a slight year-over-year decrease but missed forecasts.

Although inflation is trending downward, it hasn’t yet hit the Fed’s target. Minneapolis Fed President Neel Kashkari recently indicated that moderate rate cuts should continue, aligning with the market’s current outlook.

All eyes will now be on key U.S. data and labor market reports, set for release in late October. These figures will heavily influence the Fed’s decision at its upcoming November 6-7 meeting.

Eurozone Faces ‘Super Thursday’ – What’s Next for EUR/USD?

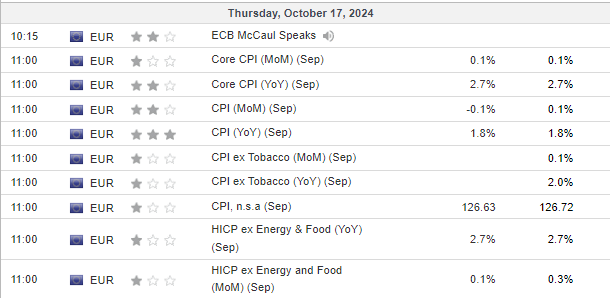

This week’s key event will be Thursday’s ECB meeting, where the market expects another rate cut alongside fresh inflation data.

The consensus points to a continued drop in , confirming preliminary figures that brought inflation down to 1.8% year-over-year.

However, weakening readings in the eurozone signal that the region’s economy is slowing, which could push the ECB toward a bolder 50-basis-point cut—though that remains an outside bet.

EUR/USD Eyes 1.08 Support

Technically, EUR/USD broke through its 1.10 support, signaling further downside potential. The next key level lies near the 1.08 mark, where buyers may step in.

A reversal above 1.10 would shift the focus back to the 1.12 resistance area, but for now, all eyes are on Thursday’s data releases and ECB decisions, which will set the tone for the pair’s next move.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.