EUR/USD Stabilizes as the Market Absorbs Fed Decision and Awaits ECB Meeting

2025.01.30 07:06

The pair is consolidating around 1.0426 on Thursday as investors digest the latest and shift their focus to the upcoming European Central Bank (ECB) meeting.

Key market influences

As widely expected, the Federal Reserve held its interest rate steady at 4.5% per annum. In its commentary, the central bank reaffirmed its commitment to reducing its balance sheet at a pace of 25 billion USD per month. Fed Chair Jerome Powell stated that does not necessarily need to fall to 2% before considering rate cuts. He also supported banks’ provision of crypto services, a move that signals openness to financial innovation.

Notably, Powell indicated that the Fed is in no rush to lower interest rates. The central bank monitors stock market valuations closely, expressing concerns that some assets may be significantly overvalued. Interestingly, Powell avoided commenting on US President Donald Trump’s repeated calls for immediate rate cuts.

Earlier reports suggested that Trump may push for a policy allowing US presidents to have a say in setting interest rates. While the Fed remains independent for now, the issue could resurface in political discussions.

Technical analysis of EUR/USD

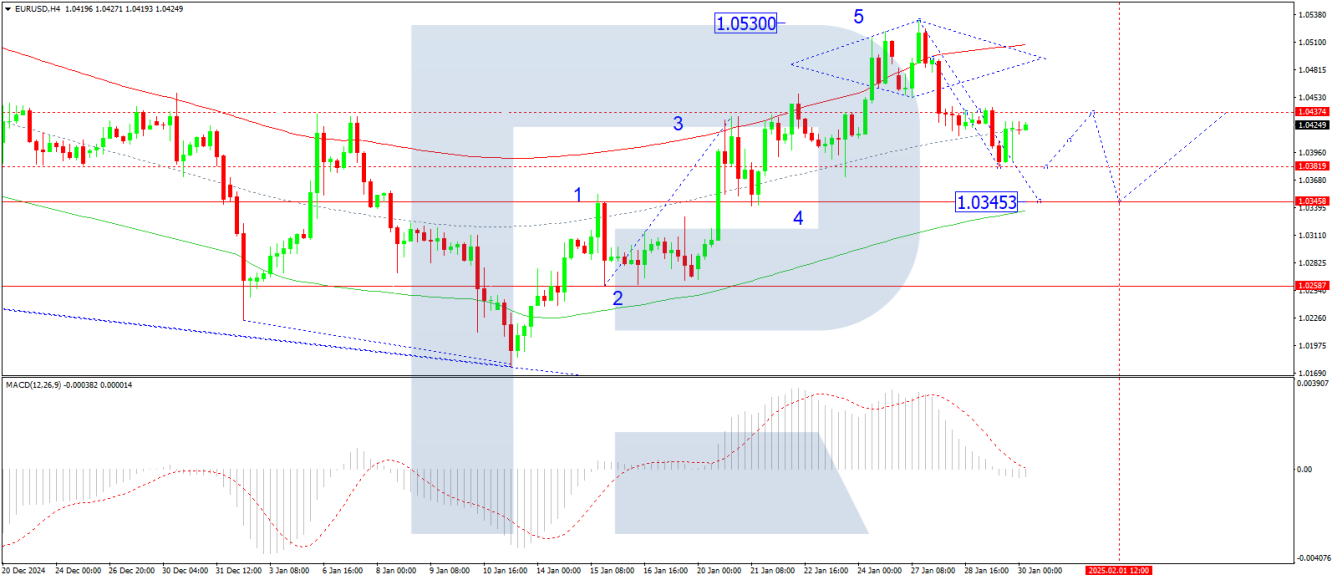

On the H4 chart, EUR/USD moved downward to 1.0382, forming a corrective wave towards 1.0437. After completing this correction, the pair is likely to resume its decline, with an initial target at 1.0345. A brief correction to 1.0437 may follow before the downtrend extends towards 1.0050. The MACD indicator supports this outlook, with its signal line positioned above zero but trending downwards, indicating bearish momentum.

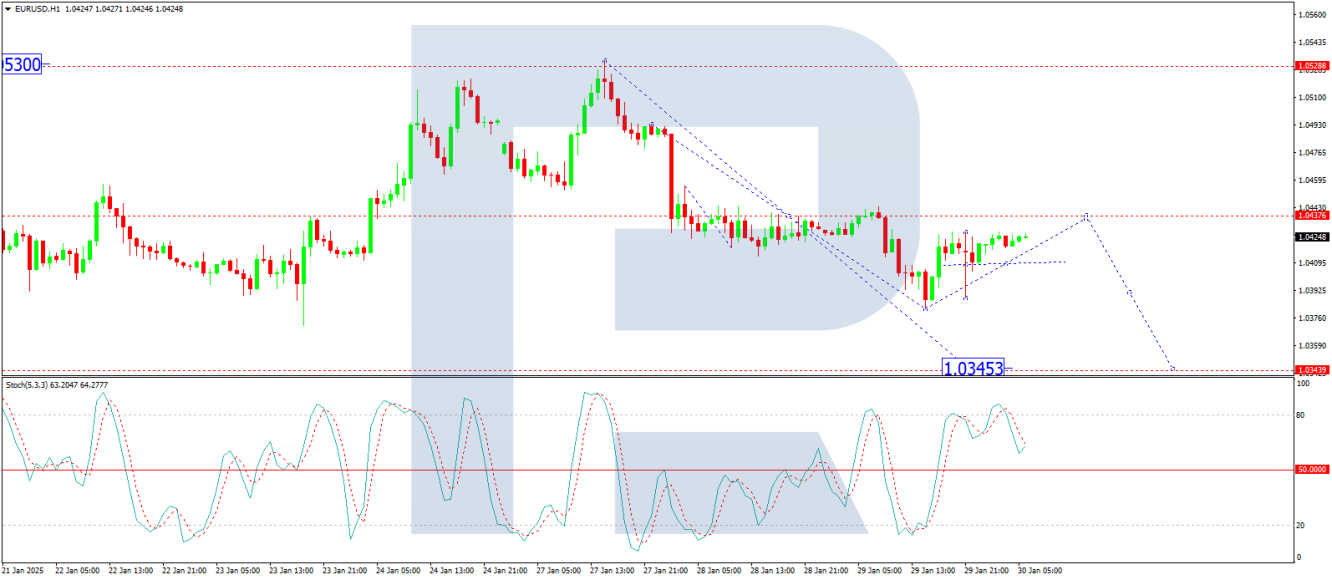

On the H1 chart, the pair consolidated around 1.0437 before breaking lower to reach a local target at 1.0382. A corrective move towards 1.0437 is now likely before the pair resumes its decline towards 1.0345, with a potential continuation to 1.0160. The Stochastic oscillator confirms this scenario, with its signal line above 80 but pointing downward towards 20, signalling the likelihood of further losses.

Conclusion

The EUR/USD pair remains stable following the Fed’s policy announcement, with attention shifting to the ECB’s upcoming meeting. The Fed’s cautious stance on rate cuts supports the USD, while uncertainty surrounding Trump’s potential influence over monetary policy adds another layer of complexity. Technical indicators point to further downside potential for EUR/USD, with key targets at 1.0345 and 1.0160. The next major moves depend on the ECB’s policy outlook and broader market sentiment.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.