EUR/USD Slices Through 50-Day SMA but Advance Pauses

2023.06.19 08:51

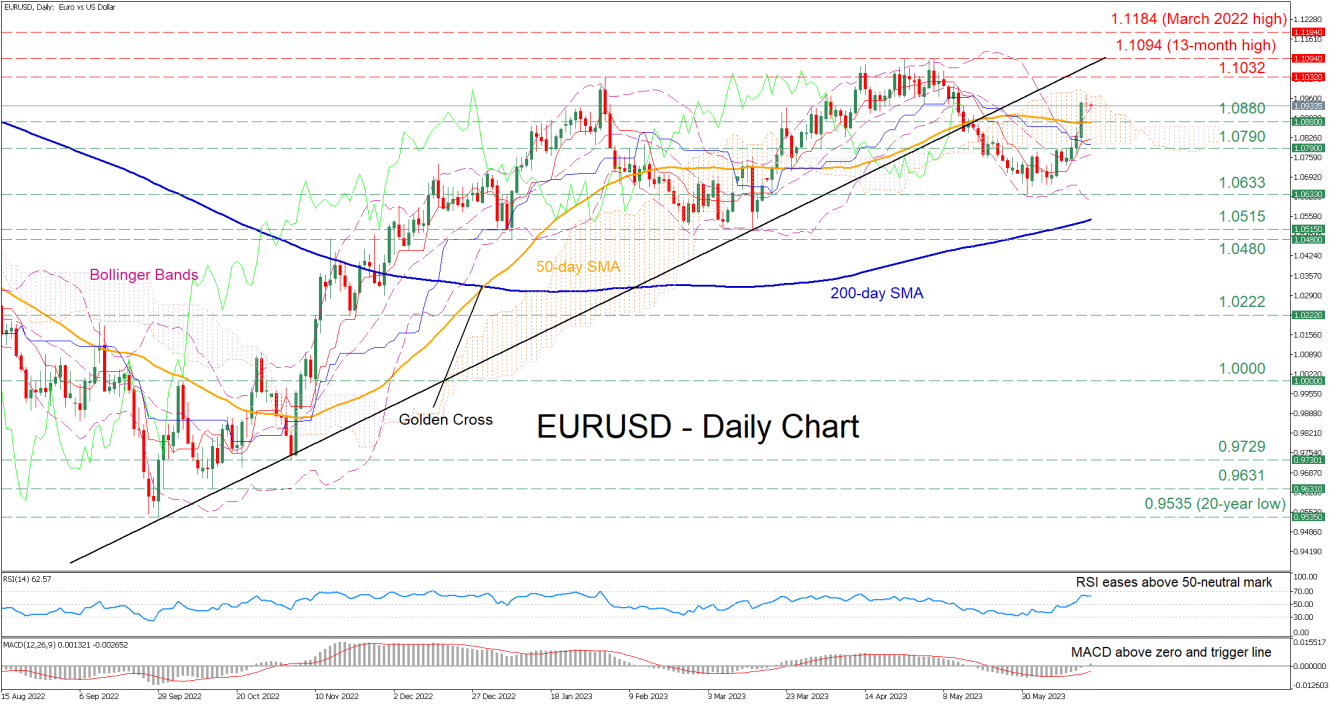

EURUSD had been experiencing a downside correction after peaking at the 13-month high of 1.1094. However, the pair has been regaining ground since it found its feet at the May low of 1.0633, crossing above its 50-day simple moving average (SMA) before its rebound stalled at the upper end of the Ichimoku cloud.

The momentum indicators currently suggest that near-term risks are tilted to the upside. Specifically, the RSI has flatlined above its 50-neutral mark, while the MACD histogram jumped above zero and its red signal line to its highest level since May 23.

If the positive momentum intensifies further, the February peak of 1.1032 could prove to be the first obstacle for buyers to clear. Surpassing that zone, the price could advance towards the 13-month high of 1.1094. A violation of that zone could send the price towards levels not seen in months, where the March 2022 high of 1.1184 might curb its upside.

Alternatively, should the price reverse downwards, initial support could be found at the 50-day SMA, currently at 1.0880. A dive beneath that region could turn the spotlight to 1.0790 before the May low of 1.0633 comes under examination. Failing to halt there, the pair could challenge the March double-bottom region of 1.0515.

In brief, EURUSD’s latest attempt for recovery has faltered after hitting the upper boundary of the Ichimoku cloud, but bullish forces have not surrendered yet. Therefore, the pair could enter a consolidation phase before buyers retry pushing the price higher.