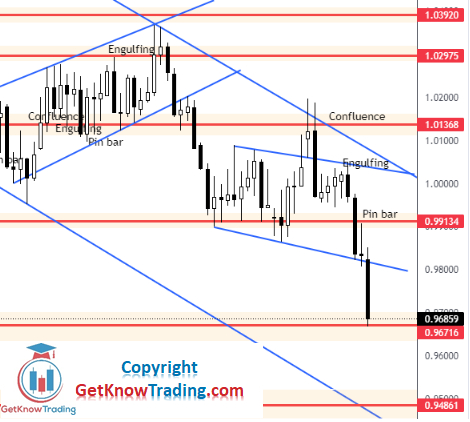

EUR/USD: Sellers Target $0.94861

2022.09.26 04:44

[ad_1]

Previous forecast mentioned possible higher levels if the price managed to break above the small downtrend resistance line.

On Monday, the price formed a bullish candle with a daily close above the previous day’s candle close. This indicated the price continued to move in the same direction as the previous week.

On Tuesday, the price managed to reach the resistance line of the downtrend channel, but it could not close above.

The price formed a bearish engulfing candle that encompassed the previous daily candle. It was a small signal the bears were holding the supply zone around the resistance line of the downtrend channel.

Wednesday was a day the price made a breakout to the downside, reaching lower levels than in the last breakout to the downside, which turned out to be false.

The price reached a downtrend support line and returned to $0.99134, which acted as a resistance level.

The price formed a bearish pin bar which was a sign the price had made a positive breakout. The price did not return inside indecision range but stopped on the resistance line and pushed down again.

From there, the price formed a strong bearish candle on Friday, where the price reached the $0.96716 support level.

We cannot see a bounce or strong retrace indicating sellers going out, representing a possible future move down.

EUR/USD price chart.

The pair did not retrace on Friday, indicating that the sellers did not get out from their trades to lock the profits.

This means there is still strong selling momentum in this move, so that we can expect a further price decline.

The first small support and demand zone that will hold the price is $0.96000, which acted as a support in the previous bearish attempt to reach lower levels.

From there, we can expect the price to return back up, and if the bulls are strong enough, the price could reach the first supply zone at $0.98300.

This is a confluence area where the price has formed a pin bar this week and where the price stalled for a while before breaking below the downtrend channel support line.

The market is bearish, so we expect the price to move lower and reach $0.94861, the weekly and monthly support level.

This is a crucial price level where sellers will try to get out and buyers to get in to change the price direction.

[ad_2]

Source link