EUR/USD: Reversal Signs as Chinese Markets and Technicals Take the Lead

2024.11.19 02:46

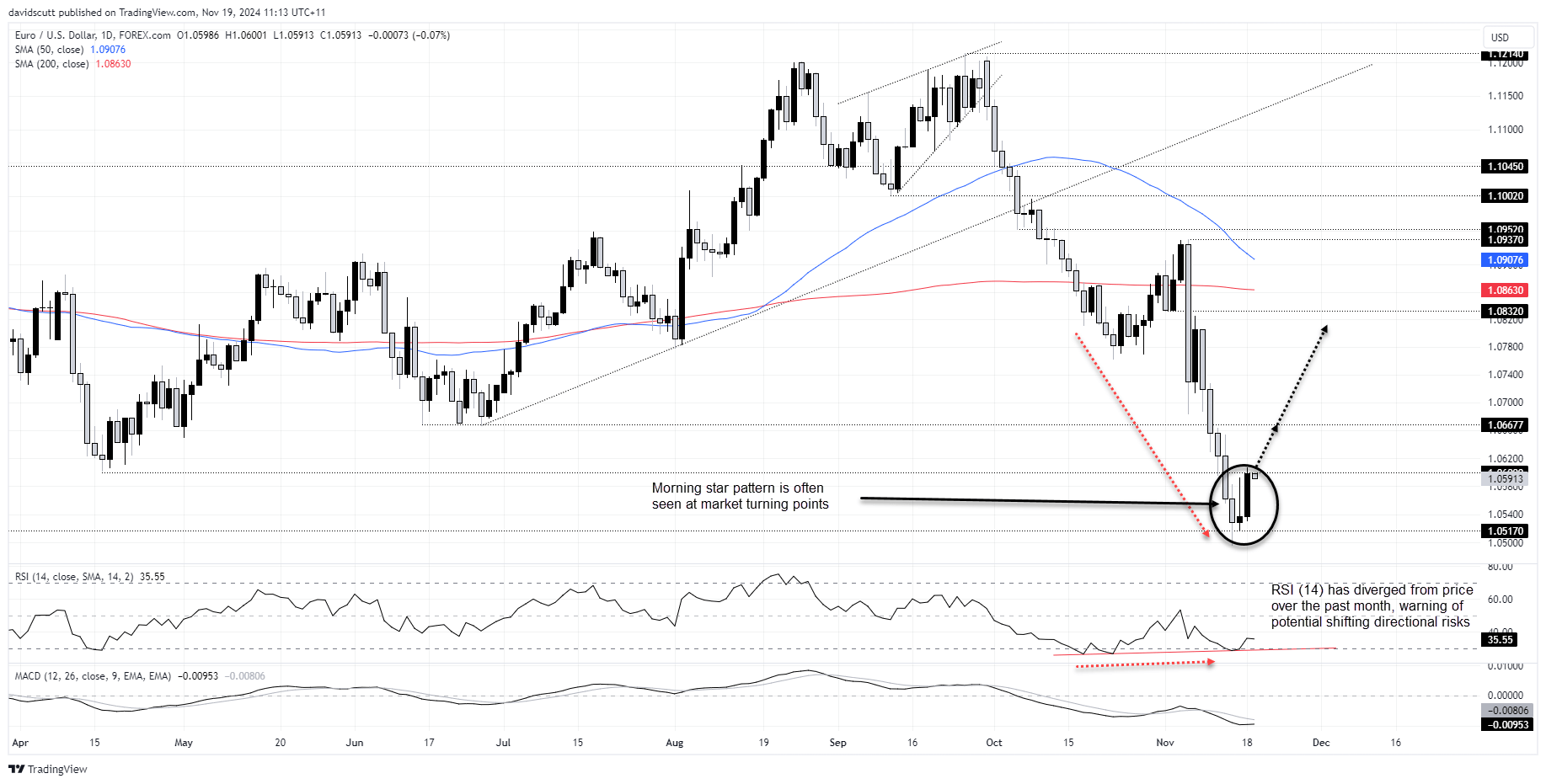

- Morning star pattern suggests EUR/USD may have bottomed

- EUR/USD correlates closely with copper and Hang Seng futures, along with US-German yield differentials

- Technicals and Chinese sentiment likely to drive short-term moves

Overview

may have found a near-term bottom after forming a bullish three-candle morning star pattern on Monday. With a subdued US economic calendar reducing the likelihood of another surge in US Treasury yields, the pair has room to extend higher, supported by both technical and fundamental factors. While eurozone inflation data, due Tuesday, could steer short-term market direction, don’t underestimate the influence of Chinese markets on the euro – it’s stronger than many expect.

EUR/USD: Key Drivers to Watch

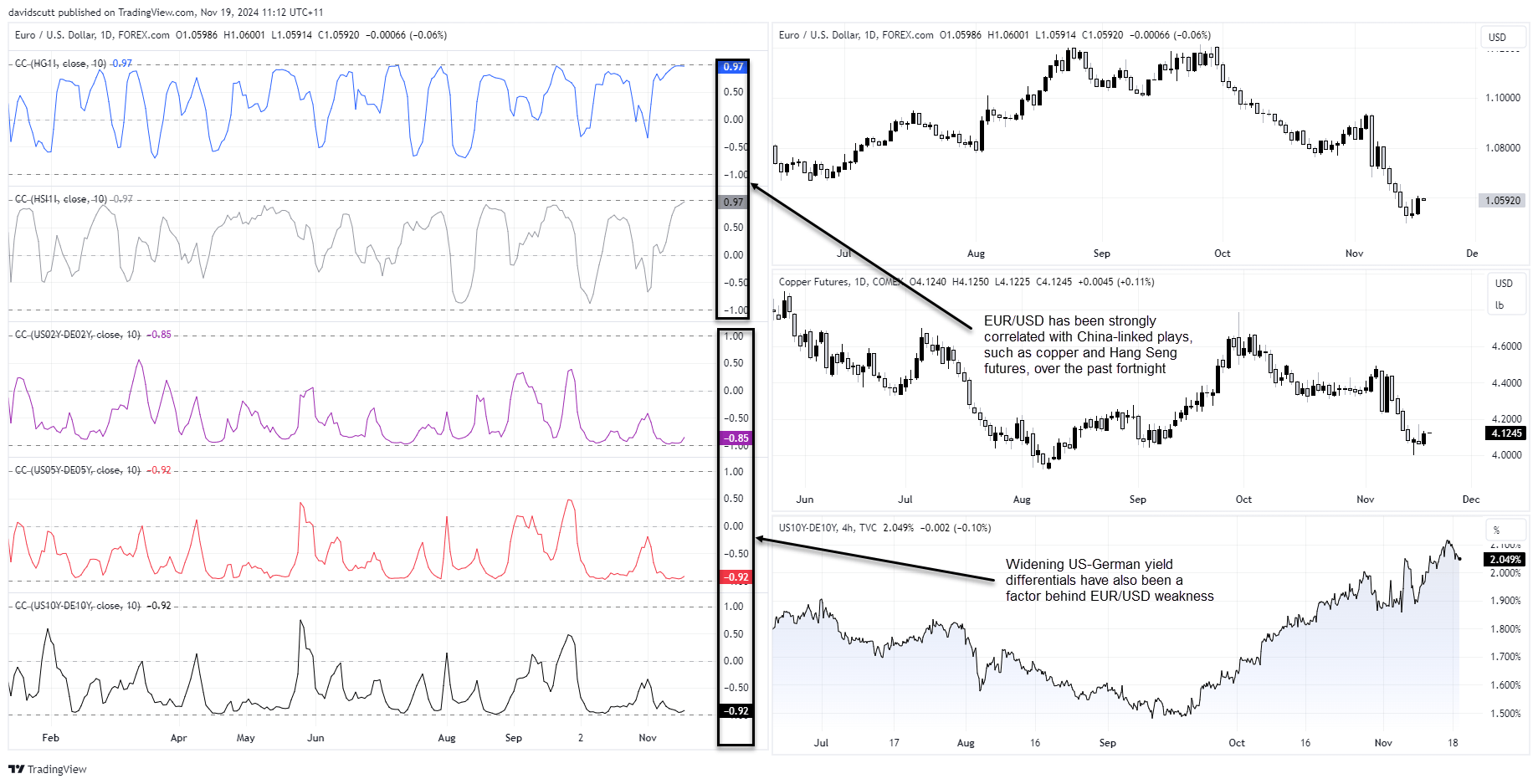

Considering the attention Europe’s political situation receives, EUR/USD movements recently have been more influenced by interest rate differentials and Chinese economic sentiment. , reflecting shared sensitivity to China’s economic performance.

China is the largest trading partner for both the euro area and Australia and is likely to take the hardest hit from proposed import tariffs by Donald Trump. Over the past two weeks, EUR/USD has shown a near-perfect correlation with prices and (0.97), highlighting its responsiveness to Chinese market trends.

Source: TradingView

Interest Rate Differentials in Focus

Rate differentials between the US and Europe have also been influential with correlation coefficient scores of -0.86 to -0.92 across , and tenors. As yield spreads have widened in favour of the United States, the euro has tended to decline.

With a quiet US calendar and ECB rate expectations unlikely to deviate significantly without an unusually large revision to the October inflation data due later Tuesday, it points to a backdrop where Chinese markets and technicals may play a greater role in influencing near-term movements.

EUR/USD May Have Bottomed Near-Term

Source: TradingView

EUR/USD looks like it may have seen a near-term bottom with the price bouncing strongly on Monday, completing a morning star. Coming after an extended bearish move, this common bottoming pattern may be enough to bring buyers off the sidelines.

Momentum may also be starting to turn with RSI (14) diverging from price over the past month, adding to the sense that directional risks may be skewing higher. While MACD continues to generate a bearish signal, it looks like it may soon flick higher, potentially bolstering the view.

Those considering longs should watch the action around 1.0600 near-term. The price has been respectful of the April low recently, testing it from both sides over the past week.

If the price were push and hold above 1.0600, longs could be established with a tight stop below for protection. 1.06677 would be the first target, the triple bottom set in June. If the price were to clear this level, it could open the path for an extended run higher.

If EUR/USD were unable to break above 1.0600, another option would be to establish shorts with a tight stop above the level for protection. 1.0500, the low set last week, would be the obvious target.

Original Post