EUR/USD Retraces Lower as 200-Day SMA Rejects Advance

2022.11.21 07:36

[ad_1]

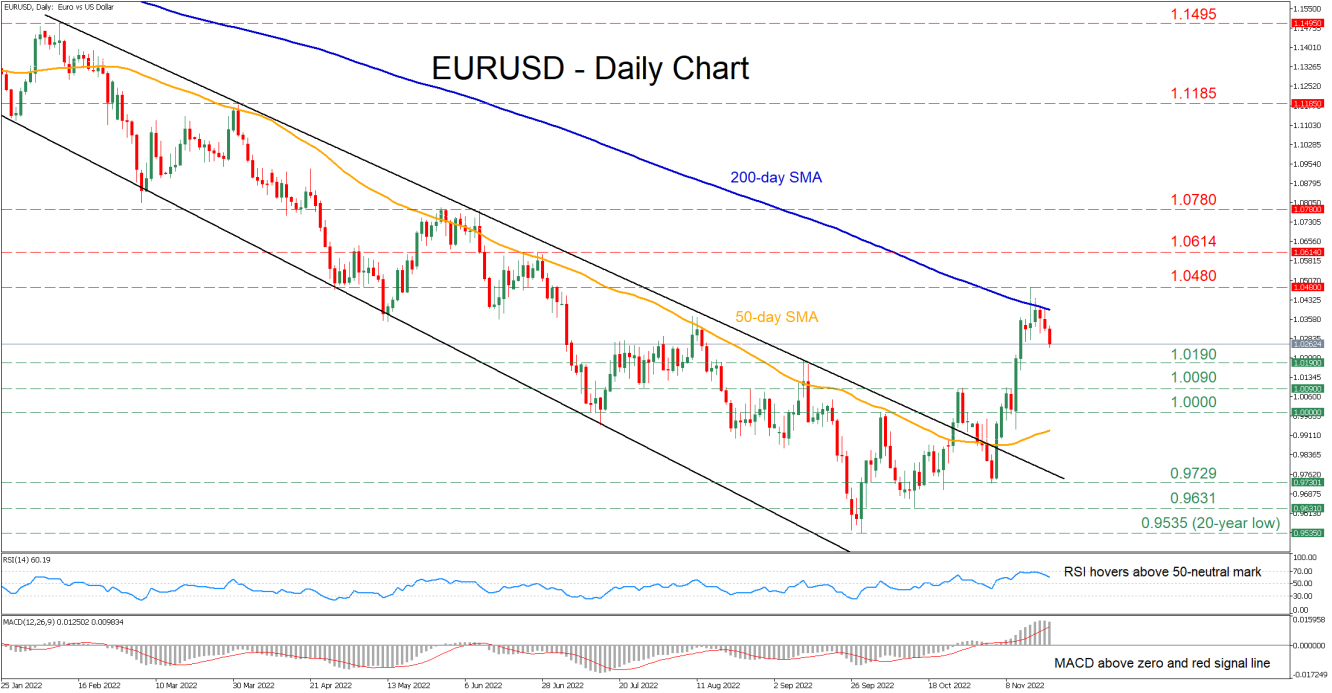

has been attempting a rebound in the short term after escaping its descending channel to the upside. However, in the past few daily sessions, the advance has paused as the price has been constantly held down by the 200-day simple moving average (SMA).

The short-term oscillators currently suggest that bullish forces are waning but remain in control. Specifically, the RSI is pointing downwards above its 50-neutral mark, while the MACD histogram is softening above both zero and its red signal line.

Should selling pressures intensify further, the September high of 1.0190 could act as the first line of defence. Sliding beneath that floor, the spotlight could turn to 1.0090 before the crucial parity region comes under examination. Failing to halt there, the price may then test the November low of 0.9729.

To the upside, if bullish forces re-emerge and push the price above the 200-day SMA, initial resistance might be encountered at the recent high of 1.048. Conquering this barricade, the bulls could then aim at the June resistance of 1.0614. Even higher, the 1.0780 hurdle could prove a tough one for the price to overcome.

Overall, EURUSD appears to be experiencing a minor pullback after the 200-day SMA capped its upside. Therefore, breaking above the latter could signal the resumption of the pair’s short-term uptrend.

[ad_2]

Source link