EUR/USD Rebounds After Sharp Losses

2023.07.28 11:26

- EUR/USD rebounds after 1% fall on Thursday

- US GDP for Q1 beats expectations

The bounced back on Friday after sliding 0.99% a day earlier. In the European session, EUR/USD is trading at 1.1018, up 0.38%. On the economic calendar, the US PCE Price Index, the Fed’s preferred inflation gauge, fell to 3.0% in June, down from 3.8% in May.

ECB, US GDP Send Euro Sharply Lower

The European Central Bank raised interest rates by 0.25% on Thursday, bringing the main rate to 3.75%. The ECB statement warned that inflation, although on the decline, “is expected to remain too high for too long”. The ECB did not provide any forward guidance, as the statement said the Governing Council would base its decisions on the data. ECB President Lagarde didn’t add much to this stance, saying that ECB members were “open-minded” about rate decisions at upcoming meetings and wouldn’t commit to whether the ECB would raise or pause in September.

The rate increase can be described as a ‘hawkish hike’, as the statement kept the door open for further hikes. Nevertheless, the euro lost ground following the decision, which could reflect expectations that the ECB is close to its peak rate, despite the hawkish rhetoric.

The eurozone economy is struggling, and this week’s Services PMIs pointed to weakness in Germany and France, the biggest economies in the bloc. The eurozone could slip into recession this year, which means that the ECB will have to think carefully before it raises rates. On the other side of the coin, inflation, which is the ECB’s number one priority, is at 5.5%, well above the target of 2%. The eurozone releases the July inflation report on Monday and the reading could be a key factor in the ECB’s rate decision at the September meeting.

The euro lost further ground on Thursday after better-than-expected US data. In the second quarter, GDP rose 2.4% q/q, above the Q1 reading of 2.0% and the consensus estimate of 1.8%. US Durable Goods Orders and unemployment claims were better than expected, a further indication that the Fed may be able to guide the economy to a soft landing even with interest rates at their highest levels in 22 years.

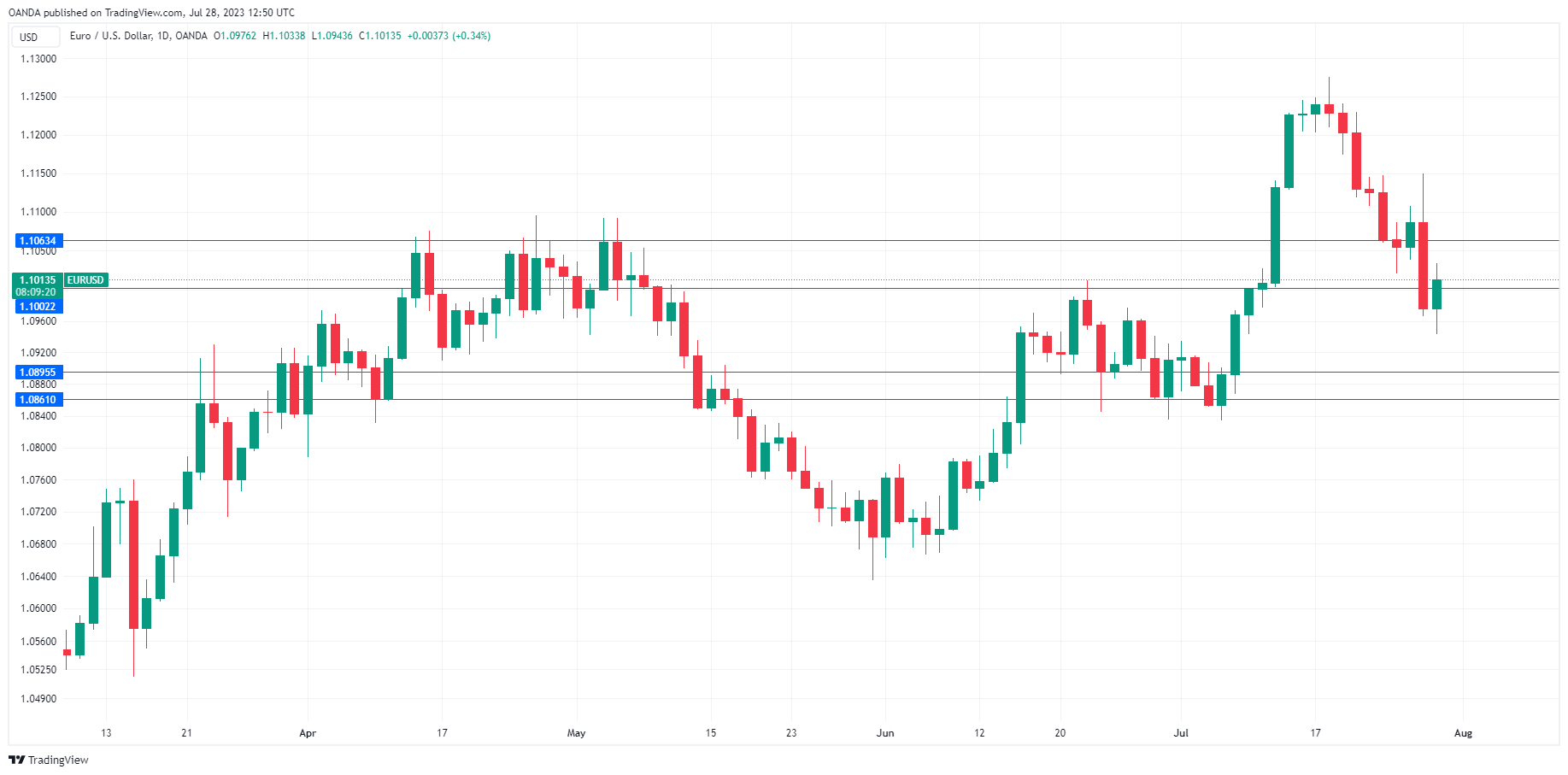

EUR/USD Technical

- EUR/USD is testing resistance at 1.1002. The next resistance line is 1.1063

- There is support at 1.0895 and close by at 1.0861

Original Post