EUR/USD Keeps Downside Momentum

2024.12.02 07:37

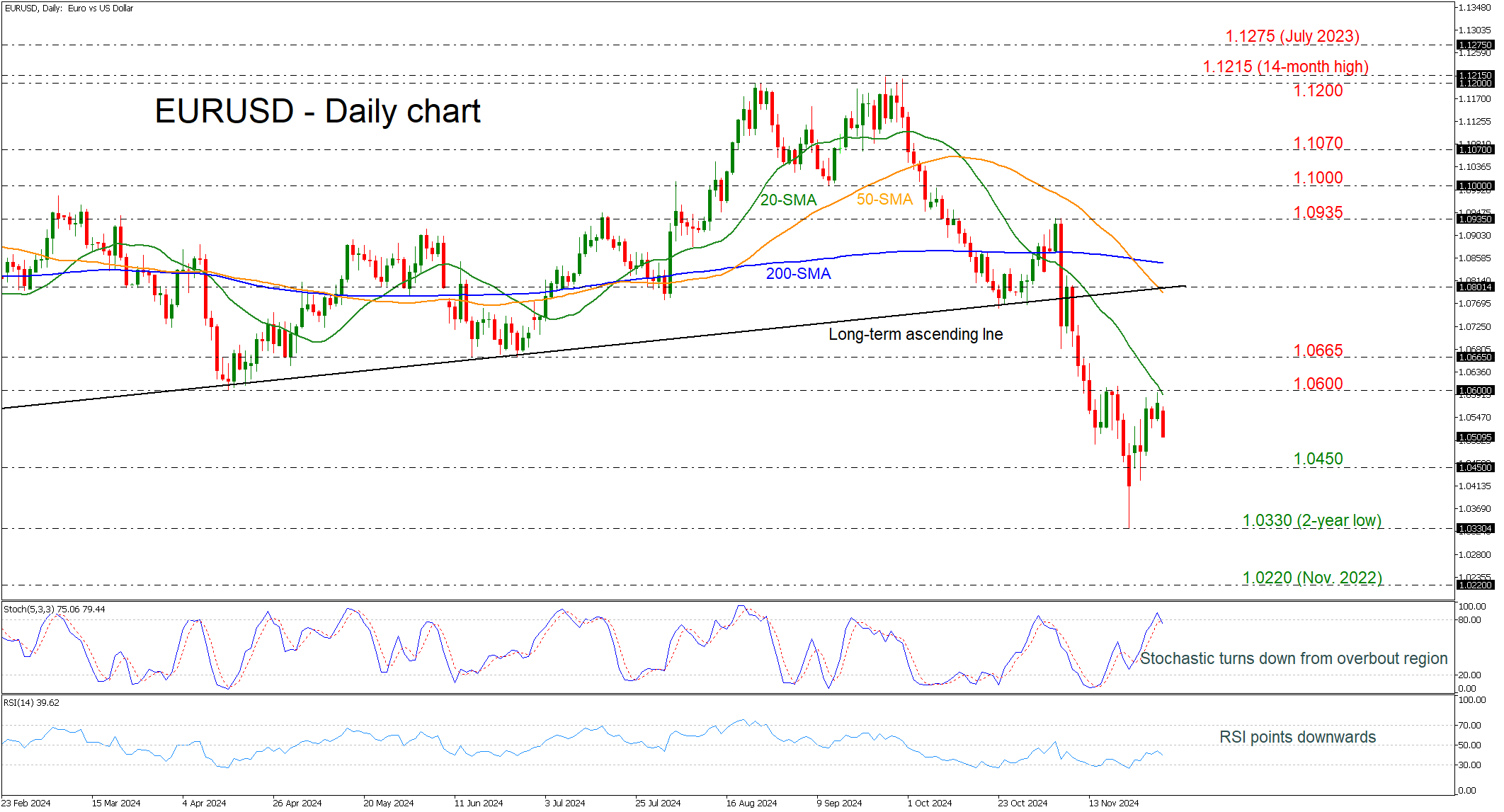

- EUR/USD meets 1.0500 again

- Stochastic and RSI continue bearish moves

failed to extend its bullish movement above the 1.0600 round number, which overlaps with the 20-day simple moving average (SMA), raising the likelihood for further downside movements.

According to technical oscillators the upside momentum of the last ten days may come to an end. The stochastic oscillator posted a bearish crossover within its %K and %D lines in the overbought territory, while the RSI is sloping south below the neutral threshold of 50.

If the price continues the selling interest, then the first support for traders to look for is the 1.0450 barricade. Even lower, the two-year low of 1.0330 may pause the bearish move; but if a lower low takes place, then the market may visit November 2022 trough at 1.0220.

In the positive scenario, a climb above the 1.0600 obstacle could add some optimism for more bullish actions heading towards the 1.0665 bar and the 1.0800 round number, which coincides with the 50-day SMA.

To conclude, EUR/USD has been in a bearish tendency since September 25, losing around 8%. The signs for upside correction are fading, especially as long as the price remains below 1.0600.