EUR/USD in Hold Mode Ahead of Fed, ECB: Longer-Term Correction Could Deepen

2024.05.14 04:52

The slowdown in disinflation lately has likely disrupted the Fed’s envisioned path towards a gradual series of interest rate cuts, initially projected at up to 5 starting from March. Furthermore, indications pointed towards executing this plan smoothly, avoiding a sharp economic downturn.

Recent releases of weaker data have heightened uncertainty, leaving Federal Reserve announcements ambiguous regarding future interest rate levels.

In this scenario, the forthcoming U.S. inflation data, scheduled for publication this Wednesday, will be pivotal. If forecasts materialize, inflation is expected to maintain similar levels to the previous month.

Fed Hawks Versus ECB Doves

While both the ECB and the Fed have maintained interest rate steady, the noticeable discrepancy in their rhetoric persists.

Recent statements from Federal Reserve board members Kashkari, Bowman, and Logan suggest that the hawkish faction within the Fed is gaining momentum, dispelling premature speculations of a hastened interest rate cut due to concerns about excessive economic slowdown.

Conversely, in the Eurozone, a decidedly more dovish stance is emerging from European Central Bank officials, with expectations mounting for an interest rate cut as early as June. This sentiment is underscored by a bold assertion from board member Frank Elderson, who asserts that June stands as a highly probable date for an ECB pivot.

Should such a scenario materialize, it would present a virtually unprecedented circumstance wherein the Fed trails the ECB’s lead, a dynamic with potential implications for the long-term trajectory of the currency pair.

Will US Inflation Stabilize Above 3%?

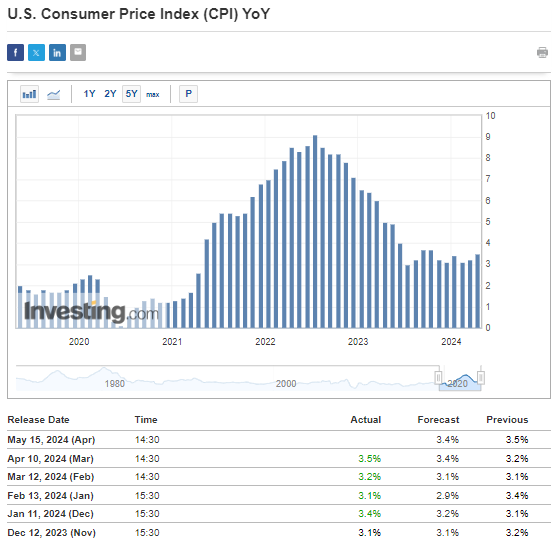

Upcoming from the US presents a potential challenge for the Federal Reserve. Forecasts indicate minimal deviation from last month’s figures, suggesting a continued stabilization above the 3 percent mark, well beyond the inflation target.

Figure 1. inflation data forecasts from the US

Potential deviations of at least 0.3 percentage points could induce heightened volatility in currency pairs involving the . Conversely, in the absence of any surprises, theory suggests we should only witness localized fluctuations.

EUR/USD Quotes Still Within Price Channel

For nearly a month, the main currency pair’s quotes have been confined within a price channel, constituting a correction within a broader downtrend.

An intriguing technical scenario will unfold once buyers breach the 1.0850 area, presenting an enticing opportunity to seek short positions given the presence of a robust supply zone within this price range.

Figure 2 Technical analysis of EURUSD

An early breakout of the lower boundary of the mentioned price channel could also create opportunities for sellers to initiate a downward trend, with the initial target set at 1.0730 and further down at 1.0670.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it’s crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Source link