EUR/USD Hits a 6-Week Low, 1.08 in Sight?

2023.05.18 04:10

- The US dollar is rising against all of her major rivals today despite a lack of US economic data.

- EUR/USD broke down from its 1.09-1.11 sideways range last week, marking a top.

- The next level of support to watch comes around 1.0800, and a break below there could expose the 200-day EMA near 1.0700 next.

EUR/USD fundamental analysis

It’s another “buy dollars, wear diamonds” day, with the US dollar rising against all of her major rivals midway through the US session. With no major news out of the US, the moves are being driven more by technical factors than outright fundamental data, though we did see a slight negative revision to the Eurozone’s April CPI (0.6% m/m vs. 0.7% initially) that could be weighing on the single currency.

Meanwhile, the US debt ceiling debate continues to linger, with President Biden announcing that he would cut next week’s trip through Asia short to focus on coming to an agreement. Yesterday’s confab between the President and Speaker Kevin McCarthy was characterized as “productive and direct,” though there is little evidence of an imminent agreement between the two sides.

For traders, it’s worth remembering that as the world’s reserve currency, the US dollar may actually be a short-term beneficiary of any market panic if there is still no deal as the end of the month approaches; we saw a similar dynamic play out back in 2011 when the US credit rating was downgraded as a result of a failure to raise the debt ceiling promptly.

Euro technical analysis – EUR/USD daily chart

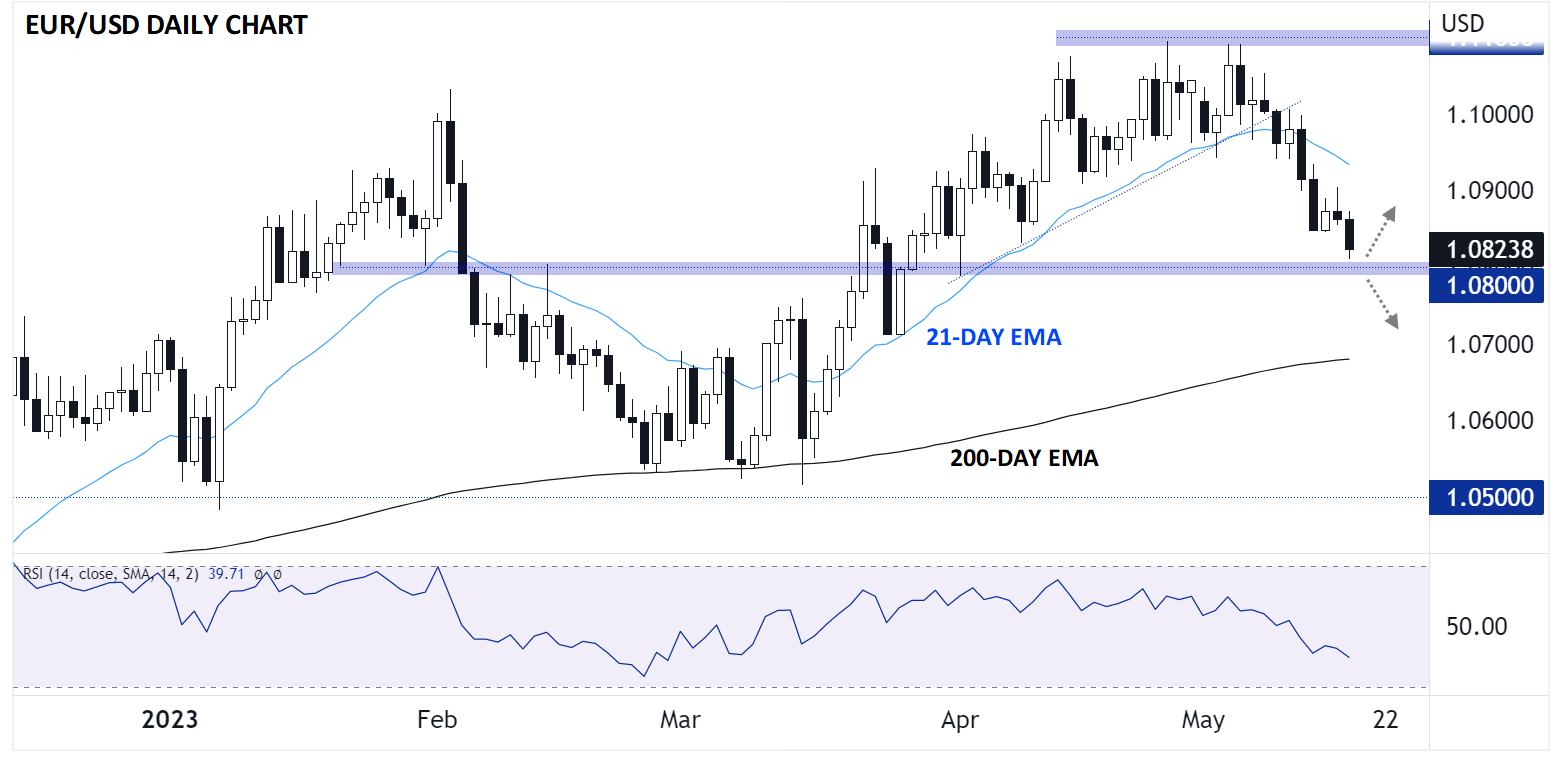

Looking at the chart, the price action over the last week looks particularly significant. After spending the latter half of April and the start of May in a sideways range below 1.1100, the world’s most widely-traded currency pair broke down below a near-term bullish trend line and its rising 21-day EMA, marking a near-term top.

After a small bounce back toward 1.0900 to start this week, the pair has again lost its bullish momentum and fallen to a 6-week low under 1.0830:

Source: Tradingview, StoneX

Looking ahead, EUR/USD is nearing a key level of previous-resistance-turned-support at 1.0800, where bulls may try to stem the bleeding later this week. If that level gives way, the probability of a continuation down toward the 200-day EMA near 1.0700 would increase markedly.

Original Post