EUR/USD Faces Test at 1.06 – Breakthrough Here Could Lead to Strong Rally

2024.12.10 05:07

- EUR/USD traders eye critical resistance at 1.06, with central bank decisions looming.

- A deeper ECB rate cut could trigger a sharp decline, testing this year’s lows near 1.0350.

- Watch for surprises from U.S. inflation data and ECB policy to shape the pair’s year-end trajectory.

- Discover the top stocks poised to benefit amid stock market’s surge using InvestingPro’s powerful tools – now up to 55% off amid the Extended Cyber Monday offer!

traders find themselves at a crossroads, with the 1.06 resistance level again proving a formidable barrier.

As the year winds down, all eyes are on two key events: the European Central Bank () meeting and U.S. data.

Both could shape the pair’s trajectory, but unless surprises emerge, EUR/USD may remain stuck in a sideways range through December.

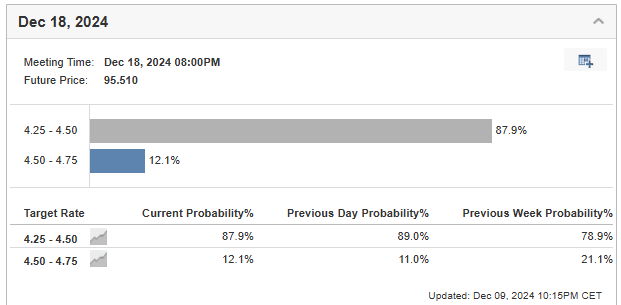

Market consensus currently suggests minimal shocks, with the ECB and Federal Reserve likely to stick to their expected 25 basis point (bps) rate cuts.

However, weak industrial data from the Eurozone and stabilizing inflation may prompt the ECB to adopt a bolder approach. A larger-than-expected 50 bps cut could send EUR/USD back into a downward spiral, testing the year’s lows near 1.0350.

Will Central Banks Close the Year with a Twist?

The ECB’s decision this week, followed by the Fed’s next week, marks the final monetary policy moves of 2024. While both institutions are expected to deliver modest rate cuts, the ECB faces mounting pressure.

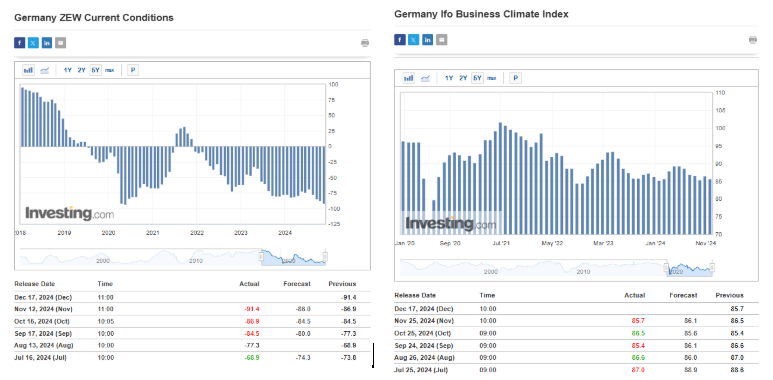

Economic sentiment indicators from Germany, including the and indices, continue to paint a bleak picture, reinforcing the possibility of deeper easing.

The challenges aren’t confined to Germany; similar trends in France and Italy signal a broader Eurozone slowdown.

Adding to the ECB’s headaches is the potential for renewed trade tensions. If the U.S. imposes further tariffs on Europe, the Old Continent’s fragile economy could face another blow.

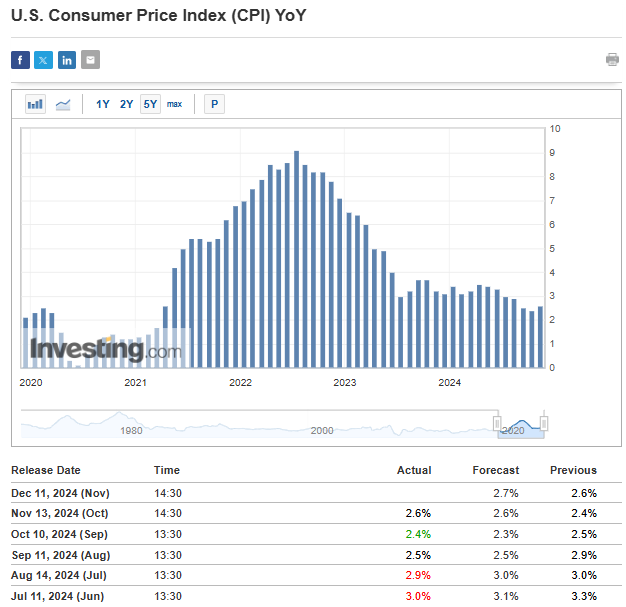

Meanwhile, in the U.S., a 25 bps Fed cut appears all but certain, as markets have already priced it in. However, sticky inflation and political headwinds limit the ‘s ability to pursue aggressive rate cuts next year.

While the U.S. economy and labor market remain relatively resilient, inflationary pressures and trade uncertainties keep the Fed on a cautious path.

Technical Outlook: The Battle for 1.06

From a technical perspective, EUR/USD faces an uphill battle to break above the 1.06 resistance level. The zone represents a key neckline for a potential inverted head-and-shoulders pattern, which could open the door to higher levels if breached.

Conversely, if the ECB surprises with a deeper rate cut, sellers could regain control, aiming for this year’s lows near 1.0350. Traders should watch closely for signals of a breakout or reversal as the pair teeters at this critical juncture.

Bottom Line

This week’s ECB meeting and U.S. inflation data could either solidify EUR/USD’s range-bound behavior or trigger a decisive move.

With central banks wrapping up the year’s monetary policy, traders must prepare for potential surprises that could define the pair’s direction heading into 2025.

***

Subscribe now to InvestingPro to take advantage of the market’s top AI-powered stock-picker at a fraction of the cost. For a limited time only!

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.