EUR/USD Faces Crucial Test Below 1.05 – Can the Rebound Turn Into a Breakout?

2025.01.07 05:10

- EUR/USD shows signs of a mild rebound, but the broader downtrend remains intact.

- Inflation data and Trump’s tariff stance could shift market dynamics this week.

- Key resistance around 1.0460 will be a critical test for EUR/USD’s near-term direction.

- Kick off the new year with a portfolio built for volatility and undervalued gems – subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

As 2025 begins, shows signs of a mild rebound, but traders should not mistake this as the start of a reversal. The broader downtrend that has dominated since Q4 2024 remains firmly in place, and key economic events this week could provide fresh clues on whether the pair will continue its decline or shift course.

With President-Elect Donald Trump set to take office in just two weeks, his economic agenda—especially regarding tariffs—could intensify market pressure on the . Meanwhile, data from the eurozone and U.S. labor market reports this week will be pivotal in shaping the market’s outlook.

Trump’s Aggressive Tariffs and the Dollar’s Fate

Trump has already made it clear: he won’t back down from his stance on aggressive tariffs. This tough position, which the Republican camp largely supports, is poised to continue fueling inflationary pressures. The result? A potential drag on the U.S. dollar.

This week, the focus will be on data from the eurozone and U.S. labor statistics. However, Thursday will be marked by a day of mourning for the late former President Jimmy Carter, which could limit volatility on Wall Street.

Additionally, the market will digest the release of the Fed’s December . While the Federal Reserve previously signaled halving the number of rate cuts in 2025, Trump’s tariff policies could make the take a more aggressive approach.

If the central bank holds off on rate cuts entirely, the possibility of EUR/USD parity becomes more likely. Traders should keep an eye on the first quarter of 2025 for any hints that this scenario might unfold.

ECB’s Dovish Stance Adds Pressure to EUR/USD

Across the Atlantic, the European Central Bank (ECB) remains on track to maintain a dovish monetary policy. This stance is largely driven by weak economic performance, particularly in Germany.

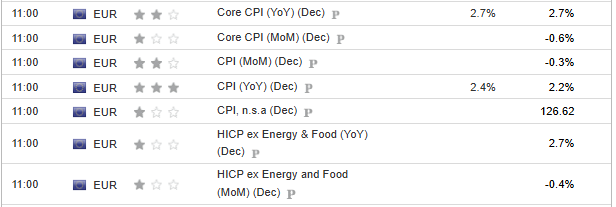

Today’s inflation data from the eurozone will provide critical insights into how the ECB plans to navigate these challenges in the coming quarters. If inflation continues its upward trajectory, as expected, this could support the ECB’s cautious approach to tightening.

Technical Picture: EUR/USD Faces Key Resistance

The early-year rebound in EUR/USD is best seen as a correction within a larger downtrend. Buyers will face their first real test as the pair approaches key resistance around 1.0460—where the downward trend line intersects.

Should the pair manage to break through this resistance, the next target could be 1.06. However, keep in mind that the broader downward trend remains intact, and any signs of escalation in Trump’s tariff rhetoric could send EUR/USD back toward recent lows.

Traders should watch these levels closely: they could provide the signal for either a continuation of the downtrend or a new phase in EUR/USD’s price action.

***

How are the world’s top investors positioning their portfolios for next year?

Don’t miss out on the New Year’s offer—your final chance to secure InvestingPro at a 50% discount.

Get exclusive access to elite investment strategies, over 100 AI-driven stock recommendations monthly, and the powerful Pro screener that helped identify these high-potential stocks.

Click here to discover more.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is the investor’s own. We also do not provide any investment advisory services.