EUR/USD Eyes 1.10 as Path of Least Resistance Remains to the Upside Ahead of ECB

2024.07.17 08:58

The poked its head above the June high to approach 1.0950, reaching its best level since March. The has weakened further despite the release of mixed-bag US data this week, with coming in a little higher than expected and the Index weaker.

However, the tide may have turned on the US dollar following the recent weaker data releases and raised over the Fed cutting rates in September following last week’s weaker-than-expected US data. Already cutting rates in June, the European Central Bank will be in focus again this week.

This time, no rate cuts are expected from the ECB, which, together with reduced political uncertainty in Europe and weakness in US data, should all help to keep the euro supported against the US dollar.

Key macro highlights this week for EUR/USD pair

Apart from industrial production and a handful of other macro pointers, the US economic calendar is quiet for the rest of this week. The same could be said about Europe’s data calendar had it not been for the ECB policy on Thursday. Here are this week’s key macro highlights, relevant to the EUR/USD pair:

|

Date |

Time |

Currency |

Actual |

Forecast |

Previous |

|

|

Mon Jul 15 |

3:00am |

CNY |

GDP q/y |

4.7% |

5.1% |

5.3% |

|

CNY |

Industrial Production y/y |

5.3% |

4.9% |

5.6% |

||

|

1:30pm |

USD |

Empire State Manufacturing Index |

-6.6 |

-5.5 |

-6.0 |

|

|

5:00pm |

USD |

Fed Chair Powell Speaks |

||||

|

Tue Jul 16 |

1:30pm |

USD |

Core Retail Sales m/m |

0.4% |

0.1% |

-0.1% |

|

USD |

Retail Sales m/m |

0.0% |

-0.2% |

0.1% |

||

|

Wed Jul 17 |

1:30pm |

USD |

Building Permits |

1.40M |

1.40M |

|

|

2:15pm |

USD |

Industrial Production m/m |

0.4% |

0.9% |

||

|

2:35pm |

USD |

FOMC Member Waller Speaks |

||||

|

Thu Jul 18 |

1:15pm |

EUR |

Main Refinancing Rate |

4.25% |

4.25% |

|

|

EUR |

Monetary Policy Statement |

|||||

|

1:30pm |

USD |

Unemployment Claims |

229K |

222K |

||

|

USD |

Philly Fed Manufacturing Index |

2.7 |

1.3 |

|||

|

1:45pm |

EUR |

ECB Press Conference |

Already, we have seen the Index print a below-expected -6.6 reading this week, which helped to keep the pressure on the US dollar, even if were stronger. Up next, we will have and data, before the focus turns to the ECB meeting on Thursday when US and Philly Index will be published too.

ECB not expected to cut again, but watch for clues

The European Central Bank’s next rate decision is on Thursday, July 18 at 13:15 BST. Don’t expect any fireworks this time, after it delivered its first rate cut in June. That decision was built up so much by the ECB that they simply had to cut even if policymakers were unsure about the path of inflation.

Indeed, the minutes of that meeting have since revealed greater uncertainty in ECB staffs’ outlook for inflation, while private consumption showed no convincing evidence of picking up either. The ECB will remain data-dependent, something which Christine Lagarde highlighted at the last press conference in June and said there will be no pre-commitment to a particular rate path. So, don’t expect another rate cut at this meeting, but watch out for clues about the next move.

Indeed, Eurozone headline was today confirmed at 2.5% in the final release, while measure remained unchanged at 2.9% in June. Inflation remains above the ECB’s target due to the sticky services component, which the ECB may interpret as warranting a cautious approach and therefore provide no compelling reason to make any further policy changes at July meeting. CPI is likely to fall towards the ECB’s 2% goal in the third quarter, potentially paving the way for at least two more rate cuts before the year is out.

EUR/USD technical analysis and trade ideas

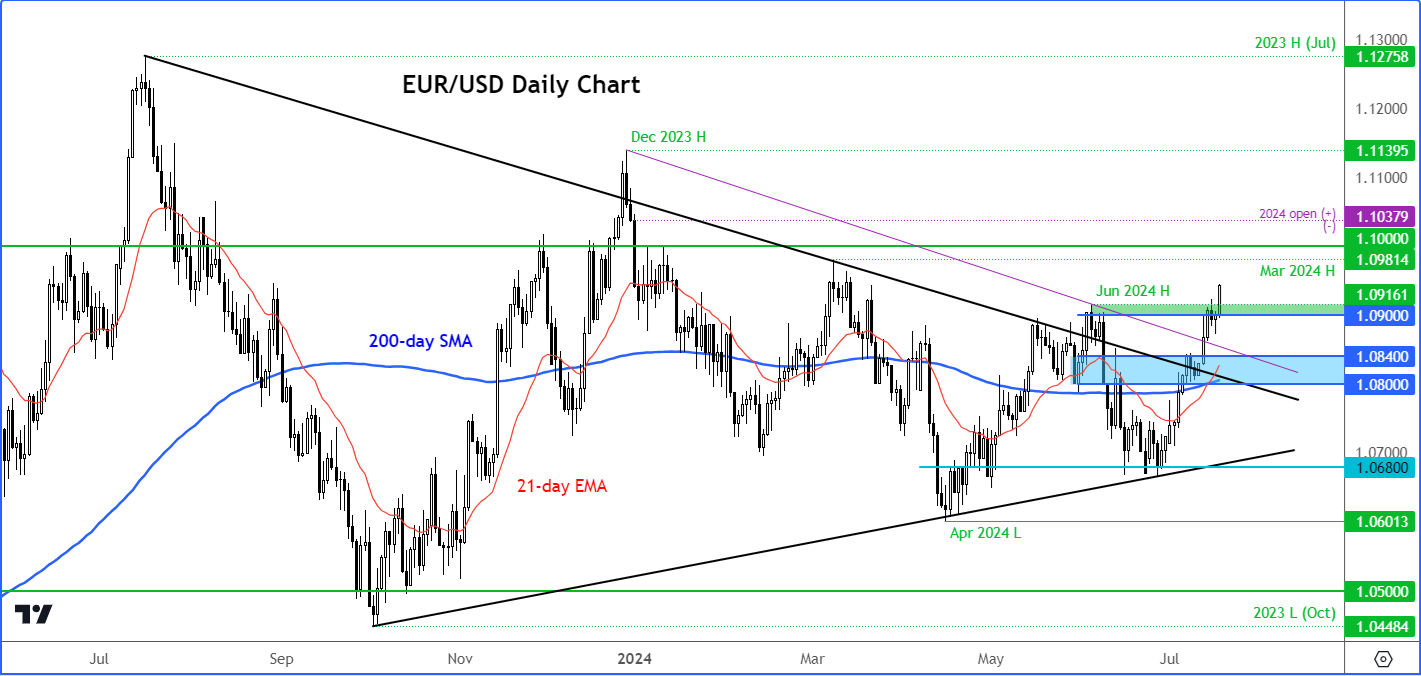

The EUR/USD has broken above a couple of bearish trend lines that were there from July and December of last year. Rates have also moved and stayed above their 21-day exponential and 200-day simple moving averages. The EUR/USD technical analysis is therefore bullish as things stand.

But given that it had struggled around the current levels near 1.0950 earlier this year, I wouldn’t be surprised if it hangs around here until the ECB rate decision is out of the way. Still, the short-term path of least resistance is clearly to the upside, so I wouldn’t necessarily look for bearish trades here unless the charts tell me otherwise.

Key short-term support is now seen at 1.0900-1.0915 area, followed by 1.0840 and then 1.0800, where the 200-day average now resides. On the upside, the 1.10 handle is now the next obvious target which comes in around 20 pips above the March high. This year’s opening level at 1.1038 will be in focus should we go above 1.1000.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Read my articles at City Index