EUR/USD: European Rate Hike And U.S. CPI Were Just Catalysts

2022.09.15 07:26

[ad_1]

Europe was barely making its way out of the pandemic when Russia added war, inflation and energy extortion to the continent’s growing list of worries. Germany, the EU’s main economic engine, is almost certainly headed to a recession due to its immense reliance on Russian energy resources. As a result, the European currency fell to lows last seen more than 20 years ago. dropped below parity in July, 2022. By early September, the pair had breached the 0.9900 level, as well.

Then, the ECB finally decided it had to act more decisively to tame inflation. The EU’s central bank raised it benchmark interest rate by 75 basis points on September 8, sending EUR/USD up sharply. Four days later, the bulls were on the verge of exceeding the 1.0200 mark. Unfortunately for them, the August report came in worse-than-expected on September 13, sending the pair plunging again.

A Glimpse Beyond the Obvious in EUR/USD

On the surface, it may seem that EUR/USD is driven by entirely external news and events. The pair climbs after the ECB hikes rates. Then it drops following the news of higher US inflation. In reality, however, Ralph Elliott discovered some 90 years ago that “the habit of the market is to anticipate, not to follow.” It was his method of analysis, known as the Elliott Wave principle, which helped us stay ahead of EUR/USD ‘s reaction to both ECB and CPI.

EURUSD 1-Hr Chart, 7-Sep-2022

EURUSD 1-Hr Chart, 7-Sep-2022

The chart above demonstrates how, by correctly recognizing patterns, traders can stay ahead of more than one price swing or news item.

The most important part of this chart was the five-wave impulse to the downside between 1.0369 and 0.9901. According to the theory, every impulse is followed by a correction. So, this pattern meant the following choppy sideways development must be part of some sort of a corrective structure. The recovery to 1.0090 was clearly corrective. However, it was also too small and shallow in respect to the preceding impulse pattern. Furthermore, the decline to 0.9864 looked like a simple a-b-c zigzag with an ending diagonal in wave ‘c’.

Merely Catalysts

This led us to believe that EUR/USD was in the middle of an a)-b)-c) expanding flat correction, whose wave c) was yet to occur. On the other hand, once a correction is over the preceding trend resumes. With that in mind, we wrote that “wave c) up can now be expected to lift EUR/USD towards 1.0200, before the downtrend resumes.” The updated chart below shows EUR/USD ‘s path after one jumbo rate hike by the ECB and one disappointing US inflation report.

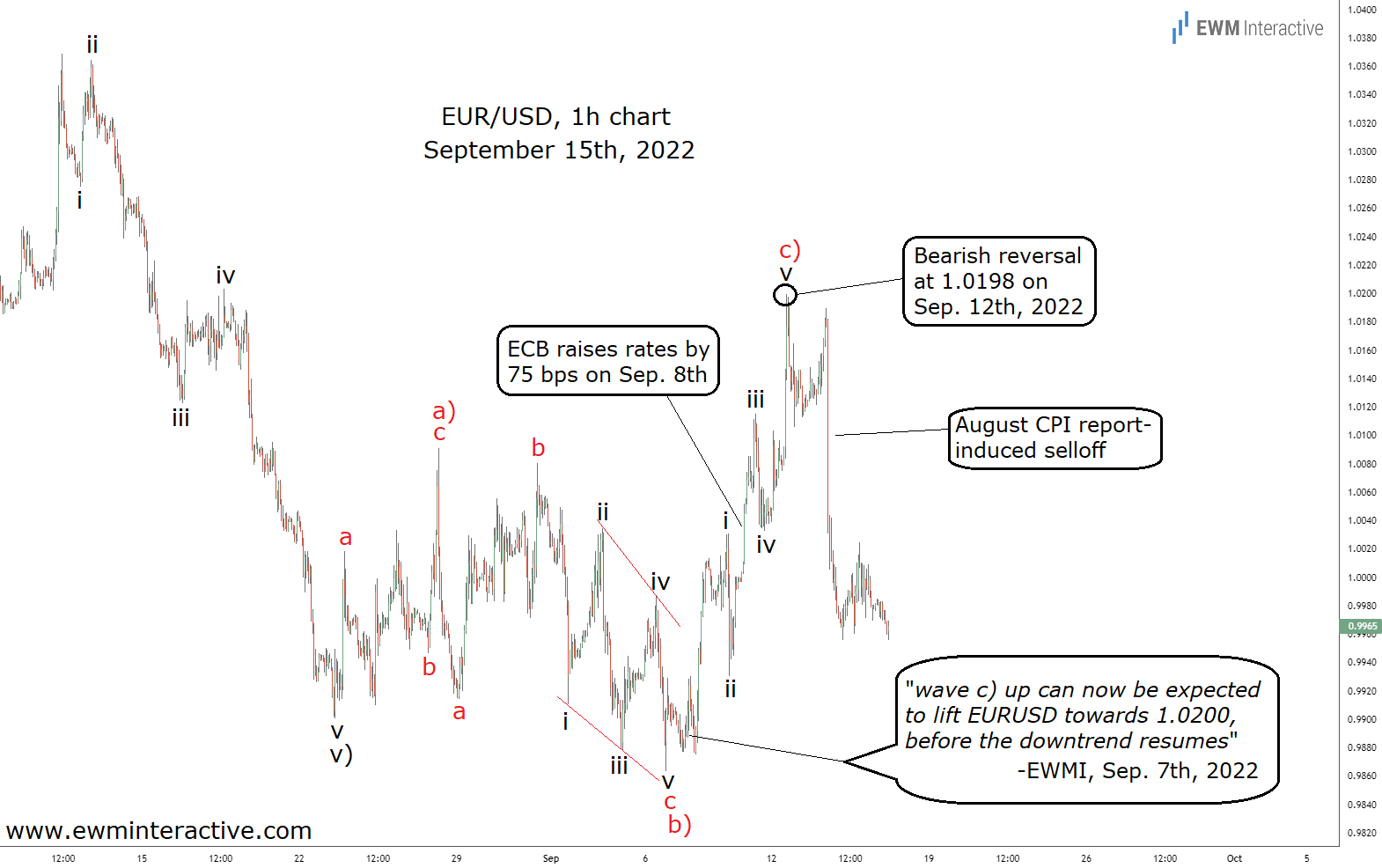

EURUSD 1-Hr Chart, 15-Sep-2022

EURUSD 1-Hr Chart, 15-Sep-2022

The pair was already surging when the ECB’s rate hike gave it another boost on September 8. Wave c) naturally took the shape of an impulse, marked i-ii-iii-iv-v. On September 12, wave ‘v’ reached 1.0198. As expected, a bearish reversal quickly followed. The next day, the August CPI report shattered the bulls’ hopes and dragged EUR/USD down by over 200 pips. As of this writing, it still hasn’t been able to recover.

In conclusion, the ECB’s interest rate decision and the CPI report are not the reasons why EUR/USD moved the way it did. They were merely catalysts of moves for which the stage was already set. Successful traders know that by the time the news is out, it is already too late. They’ve learned to stay ahead of it instead. That is where Elliott Wave analysis can help.

Original Post

[ad_2]

Source link