EUR/USD: Euro Steady as Spanish CPI Lower Than Expected

2023.12.29 10:13

- Spanish CPI lower than expected at 3.1%

- Chicago PMI expected to decelerate to 51.0

The euro is calm in Friday trade. In the European session, is trading at 1.1053, down 0.08%.

Spanish CPI Dips to 3.1%

Spain released the December inflation report today, with CPI dipping to 3.1% y/y, down from 3.2% in November. This was better than expected as the consensus estimate stood at 3.4%. The reading was the lowest rate since August, with the drop attributed to lower prices for fuel, food and electricity. Monthly, CPI rose from -0.3% to 0.0%, but this was lower than the consensus estimate of 0.3%. Core CPI dropped to 3.8% y/y, down from 4.5% in November.

Germany, France and the eurozone will follow with their inflation releases next week. If the data shows that inflation eased in December, it will put pressure on the European Central Bank to cut rates in the first half of 2024. The ECB has not followed the Federal Reserve and continues to push back against rate-cut expectations. The markets have priced in 150 basis points from the ECB next year, with an initial cut expected in April.

ECB President Lagarde has poured cold water over rate-cut fever, saying that the ECB should “absolutely not lower its guard”. Lagarde may have to shift her hawkish stance or risk tipping the weak eurozone economy into a recession. If next week’s inflation report indicates that inflation is falling, we can expect the voices in the ECB calling for looser policy to get louder.

The US releases Chicago PMI, an important business barometer, later today. The PMI shocked in November with a reading of 55.8, which marked the first expansion after fourteen straight months of contraction. The upward spike may have been a one-time blip due to the end of the United Auto Workers strike as activity rose in the auto manufacturing industry. The consensus estimate for December stands at 51.0, which would point to weak expansion.

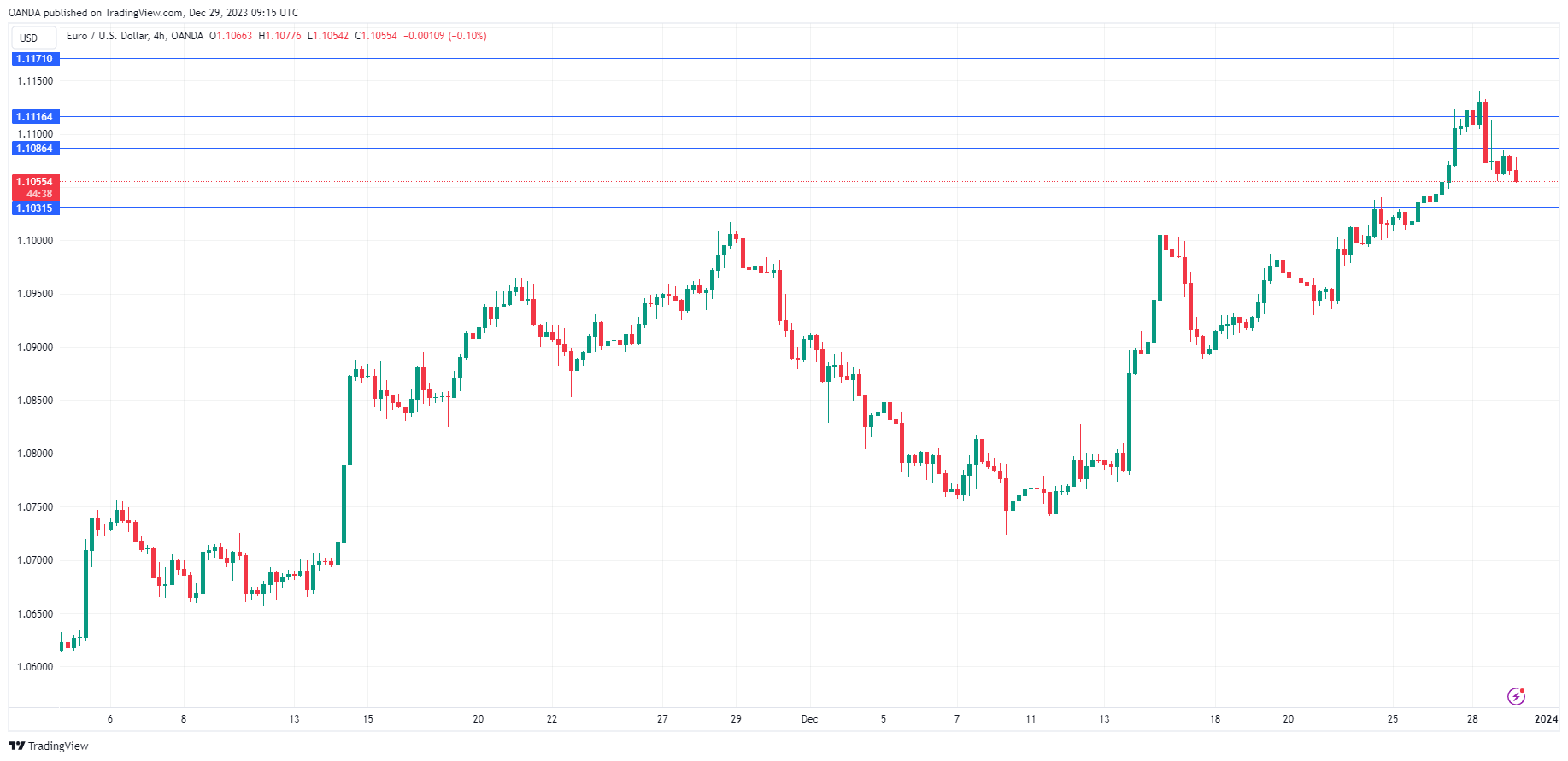

EUR/USD Technical

- EUR/USD continues to put pressure on resistance at 1.1086. Above, there is resistance at 1.1171

- 1.1116 and 1.1031 are providing support

Original Post