EUR/USD edges higher, tests key resistance area

2023.12.27 11:07

- edges higher again today, makes higher high

- It tests the resistance set by a key area, north of 1.1032

- Momentum indicators support the current bullish move

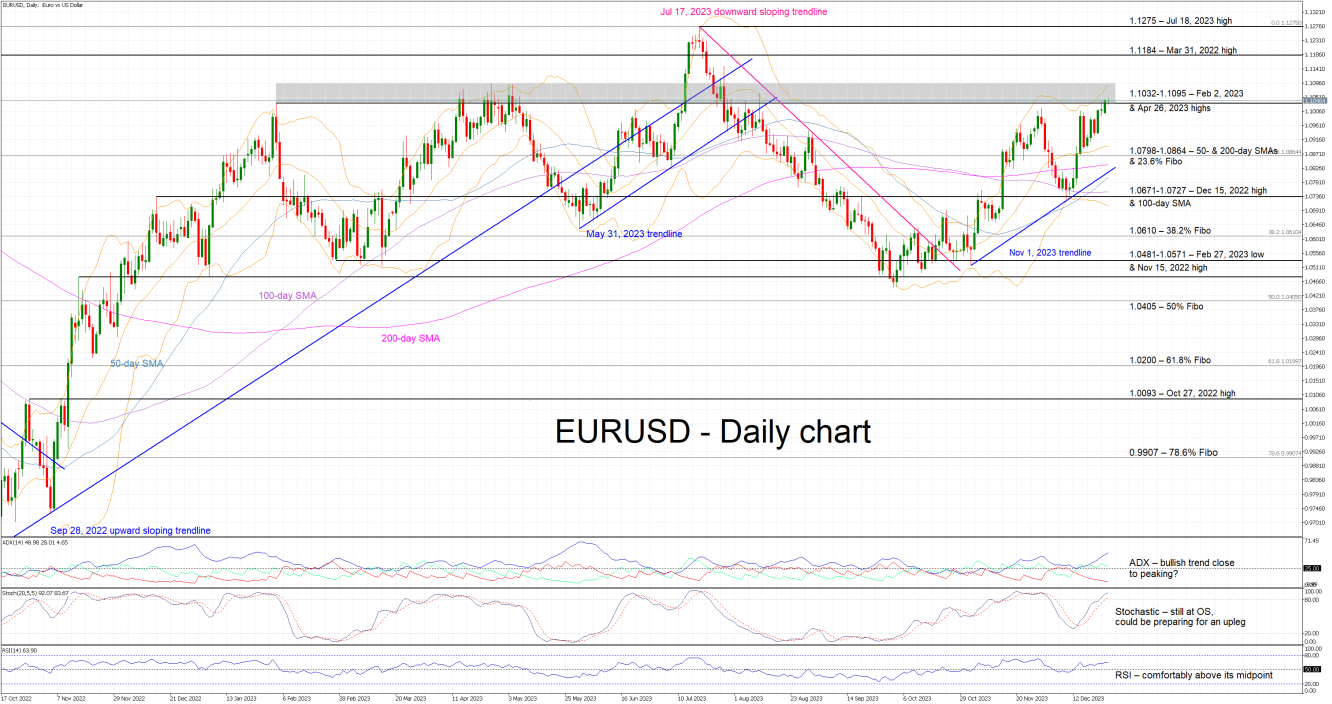

EURUSD is trying to record its fourth consecutive green candle as it has entered the 1.1032-1.1095 area. This is a key resistance area, which has been making the bulls’ lives difficult since February 2023 with a number of failed breakout attempts recorded. EURUSD has also recorded a higher high, above the recent local peak of 1.1016, thus keeping the bullish trend, which has been in place since the November 2023 lows, intact.

The bulls are probably feeling confident as the momentum indicators are yet to show strong rally-exhaustion signs. The RSI is hovering comfortably above its 50-threshold and the Average Directional Movement Index (ADX) is edging aggressively higher and thus pointing to a trending market. Similarly, the stochastic oscillator is trading in its overbought territory and trying to record a new higher high, matching EURUSD’s performance.

Should the bulls remain hungry, they could try to overcome the busy 1.1032-1.1095 area. If they are successful, they could then have a go at pushing EURUSD towards the March 31, 2022 and the July 18, 2023 highs at 1.1184 and 1.1275 respectively.

On the flip side, the bears are keen to defend the 1.1032-1.1095 range and then stage a move towards the 1.0798-1.086 area that is populated by the 50- & 200-day simple moving averages (SMAs) and the 23.6% Fibonacci retracement of the September 28, 2022 – July 18, 2023 uptrend. Even lower, the 1.0671-1.0727 region set by the December 15, 2022 high and the 100-day SMA could prove stronger to break than currently foreseen.

To sum up, EURUSD bulls are comfortably in control of the market, but they have now entered a key resistance area that could again lead to a sizeable correction.