EUR/USD Edges Higher as CPI Falls

2022.11.30 11:08

[ad_1]

It continues to be a quiet week for the euro. In the European session, is trading at 1.0363.

Eurozone Inflation Falls to 10%

The ECB’s number one priority has been bringing down inflation, which has hit double-digits. ECB policy makers are no doubt pleased that November fell sharply to 10.0%, down from 10.6% a month earlier. This beat the consensus of 10.4%, and the euro has responded with slight gains.

The drop in eurozone inflation was the first since June 2021, and investors will be hoping that this indicates that inflation is finally peaking. On Tuesday, showed a similar trend, falling to 10.0%, down from 10.4% (10.3% est). Still, eurozone remained unchanged at 5.0%, matching the forecast. One inflation report is not sufficient to indicate a trend, and with inflation still in double digits, nobody is declaring victory in the battle against inflation. Still, the drop in German and eurozone inflation increases the likelihood of a 50 basis-point increase at the December 12th meeting, following two straight hikes of 75 basis points.

With market direction very much connected to US interest rate movement, a speech from Fed Chair Jerome Powell later today could be a market-mover. Powell is expected to discuss inflation and the labor market, and his remarks could echo the hawkish stance that Fed members have been signaling to the markets over the past several weeks. The market pricing for the December meeting is 65% for a 50-bp move and 35% for a 75-bp hike, which means that the markets aren’t all on the Fed easing rates. Even if the Fed does slow to 50 bp in December, it will still be a record year of tightening, at 425 basis points.

EUR/USD Technical

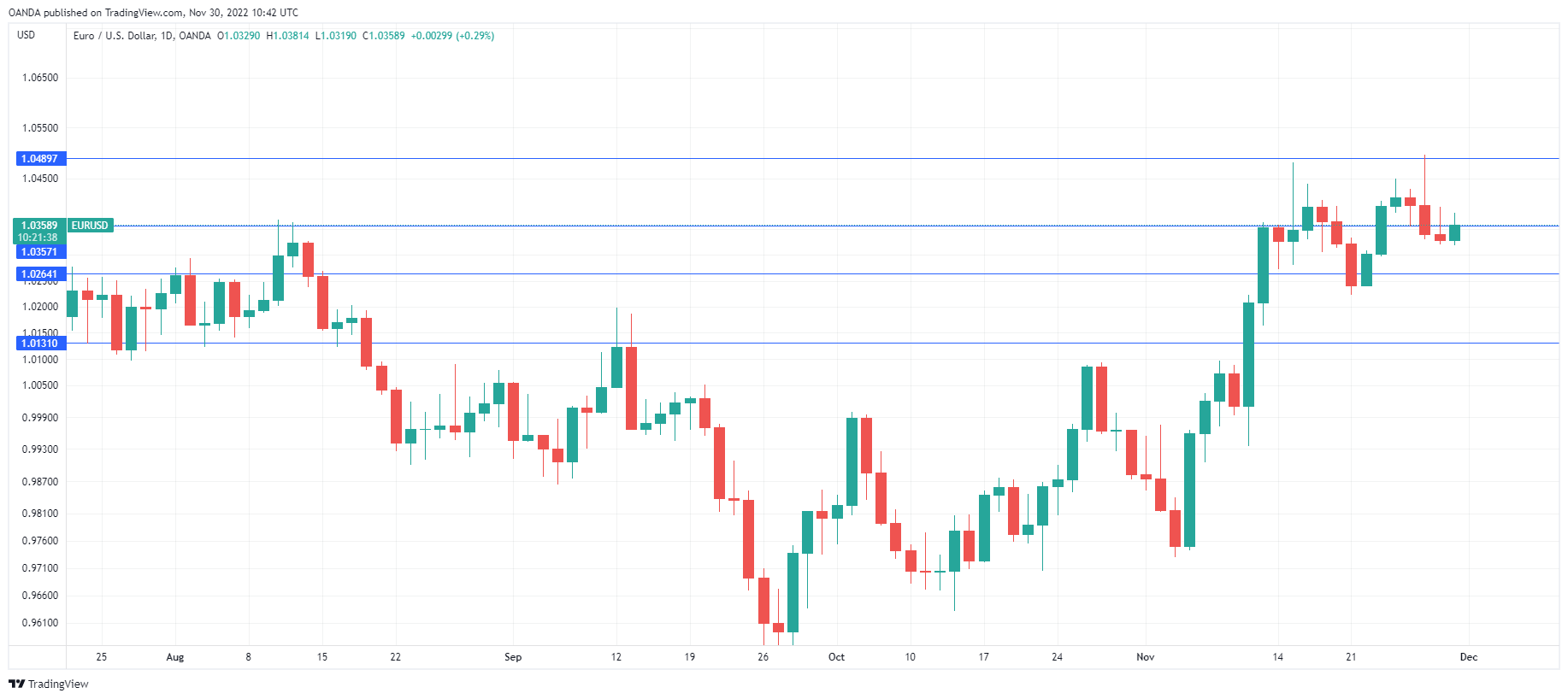

- EUR/USD is testing resistance at 1.0359. Above, there is resistance at 1.0490

- There is support at 1.0264 and 1.0131

[ad_2]