EUR/USD edges higher, all eyes on the Fed meeting

2023.09.20 05:07

- continues to exhibit low volatility ahead of today’s Fed meeting

- It tested the May 31 low and bounced higher but remains below the 1.0720 level

- Bearish sentiment lingers but the SMAs’ convergence points to an imminent strong move

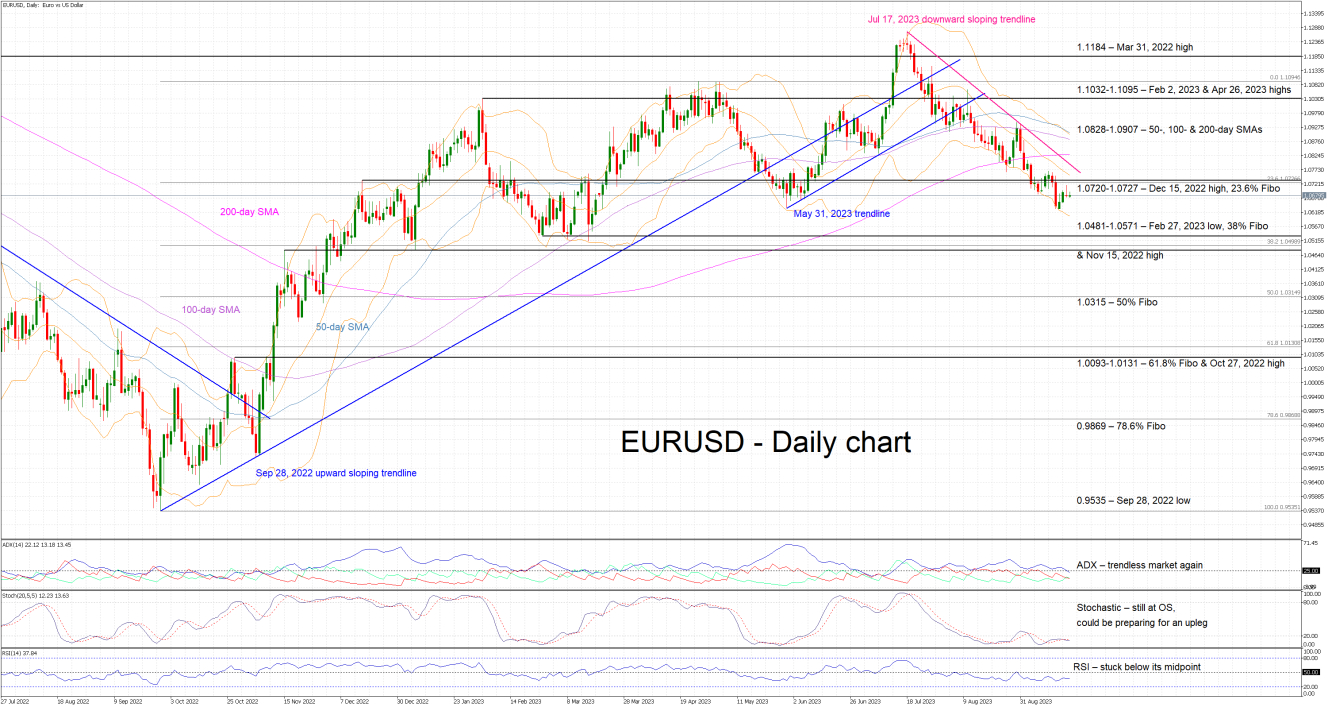

EURUSD is hovering below the 1.0720-1.0727 area as market participants are preparing for today’s significant Fed meeting. Its outcome and the overall tone of the accompanying press conference could determine the next leg in EURUSD. The bears are still in control since the July 17, 2023 trendline remains intact, supported also by the RSI trading below its 50-midpoint for a considerable amount of time.

However, the bulls are ready to jump the gun if they get the appropriate signal from the remaining momentum indicators. More specifically, the stochastic oscillator is trading in its oversold territory and hovering around moving average. A move above its 20 threshold and towards the August 31 local peak could be seen as a strong bullish signal. In the meantime, the Average Directional Movement Index (ADX) has dropped below its 25-threshold, pointing to a trendless EURUSD market and potentially preparing to signal the next trend.

Should the bulls feel energized to stage a short-term rally, they could try to overcome the busy 1.0720-1.0727 area and then test the resistance set by July 17, 2023 downward sloping trendline. Even higher, the 50-, 100- & 200-day simple moving averages (SMAs) in the 1.0828-1.0907 area could prove tougher to crack than currently envisaged.

On the flip side, the bears could take advantage of any short-term upleg and try to engineer a push towards the important 1.0481-1.0571 region, which is populated by the February 27, 2023 low, the November 15, 2022 high and the 38% Fibonacci retracement of the September 28, 2022 – April 26, 2023 uptrend. They could then have the chance of making a new 2023 low and potentially set their eyes on a bigger prize at the 1.0315 area.

To sum up, market participants are gearing up for today’s events with the SMAs’ convergence potentially pointing to a sizeable market reaction.