EUR/USD Drops on Growing Risk Appetite

2024.07.19 07:22

The pair fell sharply to 1.0888, with investors speculating on the future of US interest rates and the potential implications of the upcoming presidential election, particularly as Donald Trump’s chances appear to be improving. These factors contribute to a heightened risk appetite, leading to a retreat in the USD.

As the Federal Reserve approaches its meeting at the end of the month, a quiet period will begin this Saturday, during which the Fed will make no further comments.

Concurrently, the European Central Bank (ECB) recently held its meeting, maintaining the current interest rates as anticipated. This decision aligns with recent economic indicators corroborating the ECB’s inflation forecasts, prompting a cautious approach.

The ECB emphasised that the prevailing high rates are instrumental in managing the consumer price index and reiterated the necessity to maintain these rates, given the expected inflation to remain above the 2% target into 2025.

This perspective is reinforced by sustained price pressures, particularly in the services sector, highlighting ongoing inflationary concerns.

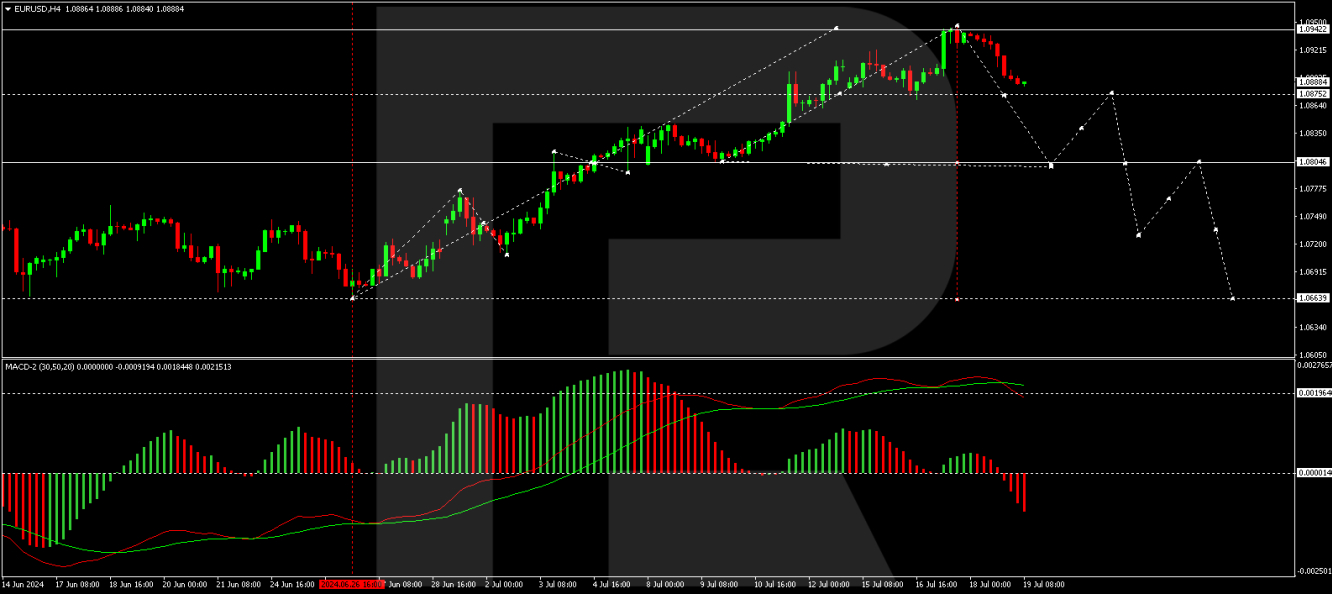

EUR/USD Technical Analysis

EUR/USD currency pair has developed a consolidation range around the 1.0806 level, with a breakout leading to achieving the target at 1.0946.

A correction towards 1.0806 is currently anticipated, with the initial correction wave targeting 1.0880. Subsequently, a potential rebound to 1.0910 may occur before another decline to 1.0840.

The MACD indicator supports this bearish outlook, indicating a downward trajectory from above zero.

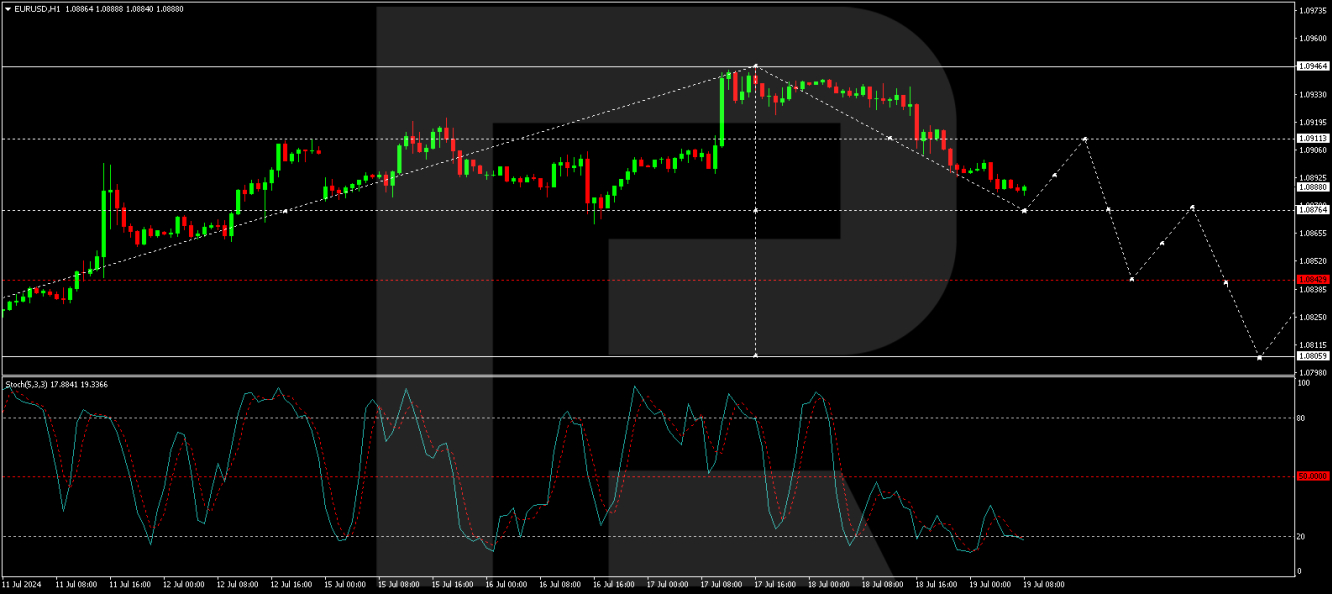

The pair is forming a downward wave to 1.0880. Upon reaching this level, a rise to 1.0910 may be considered.

This analysis is corroborated by the stochastic oscillator, positioned below 20 and poised for an upward movement, suggesting a short-term recovery in the pair.

Investors and traders should monitor these developments closely, particularly any shifts in market sentiment influenced by macroeconomic data and central bank activities, which are crucial in shaping the currency dynamics in the near term.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.