EUR/USD: Continues Its Downward Momentum

2024.05.08 06:41

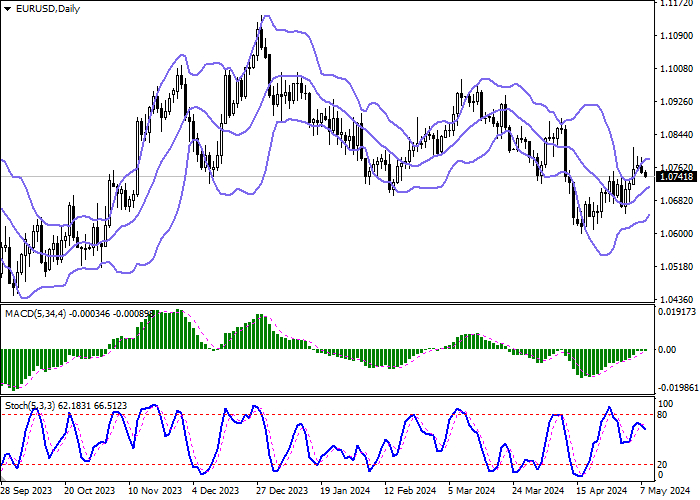

The pair is in moderate decline, continuing a previously established downward momentum. The currency is testing the 1.0740 level to the downside as investors wait for new catalysts to move the price.

Market participants are assessing Germany’s industrial production statistics for March. Monthly, there was a decline of 0.4% after a 1.7% increase in the previous month, better than the expected -0.6%. Annually, the reduction slowed from -5.3% to -3.3%. However, there was a decline of 0.4% in monthly industrial orders and 1.9% annually. The German economy seems to be recovering more slowly than expected.

On the other hand, exports increased by 0.9% (exceeding the 0.4% forecast), and imports accelerated from -3.0% to 0.3%, resulting in a trade surplus of 22.3 billion euros. Additionally, retail sales in the Eurozone showed a 0.8% monthly increase and a 0.7% annual increase, surpassing previous figures.

Support and Resistance Levels:

In the daily chart, the Bollinger Bands are moderately ascending. The MACD is trying to settle above the zero line, providing a weak buy signal. The Stochastic, near the 80 level, reversed downward due to the bearish momentum at the start of the week.

Resistance: 1.0765, 1.0800, 1.0820, 1.0842

Support: 1.0730, 1.0700, 1.0660, 1.0630

Trading Scenarios:

Recommendation: SELL STOP

Entry Point: 1.0730

Take Profit: 1.0660

Stop Loss: 1.0765

Time Frame: 2-3 days

Alternative Scenario:

Recommendation: BUY STOP

Entry Point: 1.0765

Take Profit: 1.0820

Stop Loss: 1.0730

Both scenarios provide a balanced approach to capture the current EUR/USD trend while mitigating risks associated with the market.