EUR/USD Bears Losing Steam? Move Above 1.08 Suggests Bulls May Be Ready to Step In

2024.10.29 05:42

With the U.S. presidential election just around the corner, traders are closely watching the for cues on how markets may react.

The pair has recently risen back above the crucial 1.08 level ahead of key events, suggesting bulls may be ready to retake control.

As odds of a Donald Trump victory have bolstered the , the Federal Reserve’s upcoming meeting looms large, bringing another 25-basis-point interest rate cut.

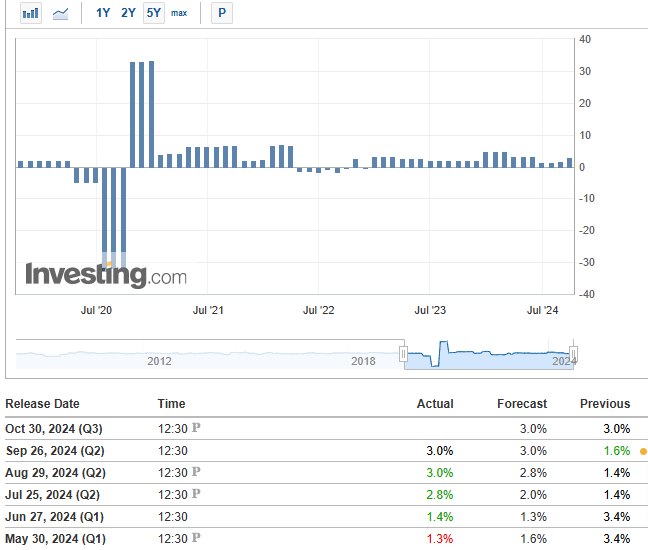

But before that, tomorrow’s growth data for both the and the U.S. could set the stage, with forecasts favoring the U.S. economy’s continued annualized growth of 3%.

What’s the Game Plan Before the Election?

Traders are keenly focused on the U.S. dollar, driven by the presidential race’s impending climax. No matter the outcome, the markets are poised for a shake-up, especially if Kamala Harris secures a win.

Currently, investors seem to be banking on a Republican win, so if the tables turn, expect the EUR/USD pair to see a significant move northward.

A Trump win could also strengthen the dollar but maybe not as dramatically, thanks to current market pricing. Here’s how it might unfold:

- If GDP and labor market data disappoint, there’s a rate cut, and Kamala Harris wins, the U.S. dollar could weaken.

- Conversely, robust U.S. economic indicators, hawkish Fed signals, and a Trump victory could keep the dollar strong.

Such perfect alignments are rare, so expect some mixed scenarios.

U.S. Economy Holding Its Ground

Despite some recession fears in the past, the U.S. economy has shown some resilience, despite Fed’s restrictive policy.

Tomorrow’s U.S. GDP data could confirm growth holding steady at 3%, providing little reason for the Fed to rush rate cuts.

Additionally, all eyes will be on ’s non-farm employment changes, forecasting a 101,000 increase after a previous 143,000.

EUR/USD Pauses—What’s Next?

October closed with EUR/USD sellers pushing the pair to new multi-month lows below 1.08. However, this downward momentum has paused, hinting at possible consolidation. A breakout from this point will likely determine the next steps for the currency pair.

Given the current trends, a dip below 1.08 with an eye on the 1.0660 lows seems plausible. However, key upcoming events could significantly sway financial markets, making it tricky to rely solely on technical signals.

Stay tuned as the week unfolds and markets react to both political and economic developments.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.