EUR-USD bears control the market

2022.11.21 11:07

[ad_1]

EUR-USD bears control the market

Budrigannews.com – Toward the start of another seven day stretch of November, the market major is venturing back.is weighing in at 1.0280.The market is extremely wary of any comments or opinions regarding the Federal Reserve System’s upcoming actions.

The closest one, scheduled for December 14, is shrouded in mystery.Prior to the pressure decreasing and the possibility of a recession in the US economy, it was anticipated that the interest rate would rise by 50 basis points.

However, Fed politicians later suggested that the interest rate’s peak might be higher.This implies that the likelihood of the financing cost developing by 75 base focuses is expanding.This supports the dollar and effects different monetary forms.

The macroeconomic calendar is empty at the start of the week;Investors, on the other hand, are looking at data from the United States and the ECB’s previous meeting.

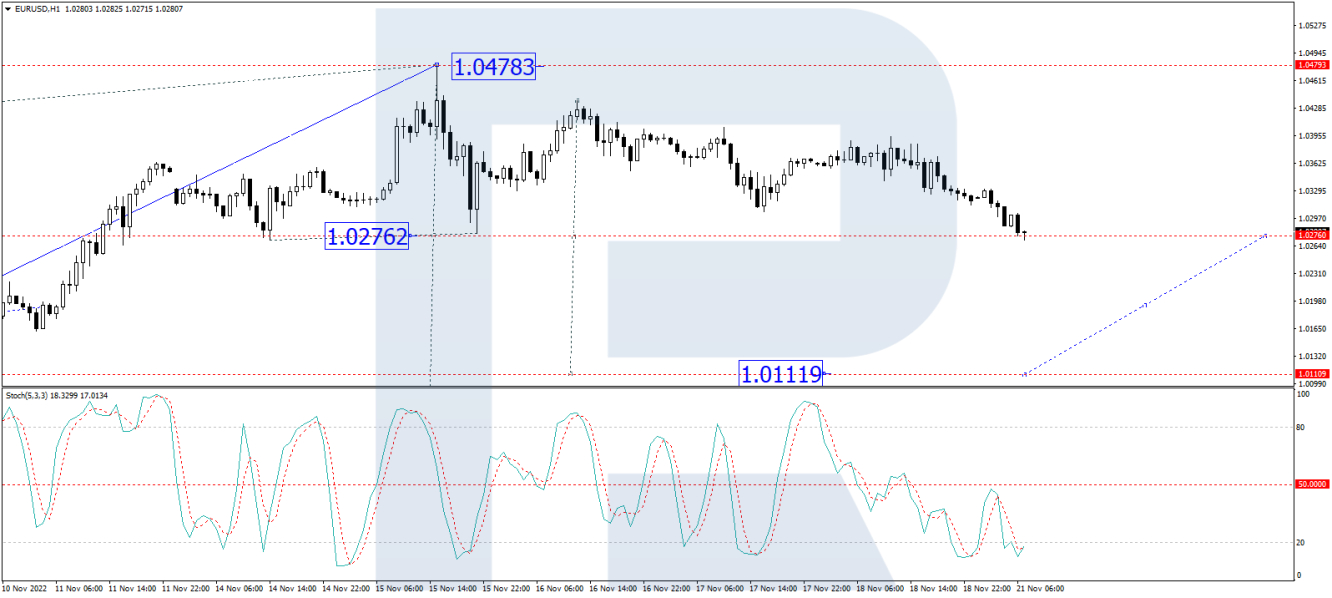

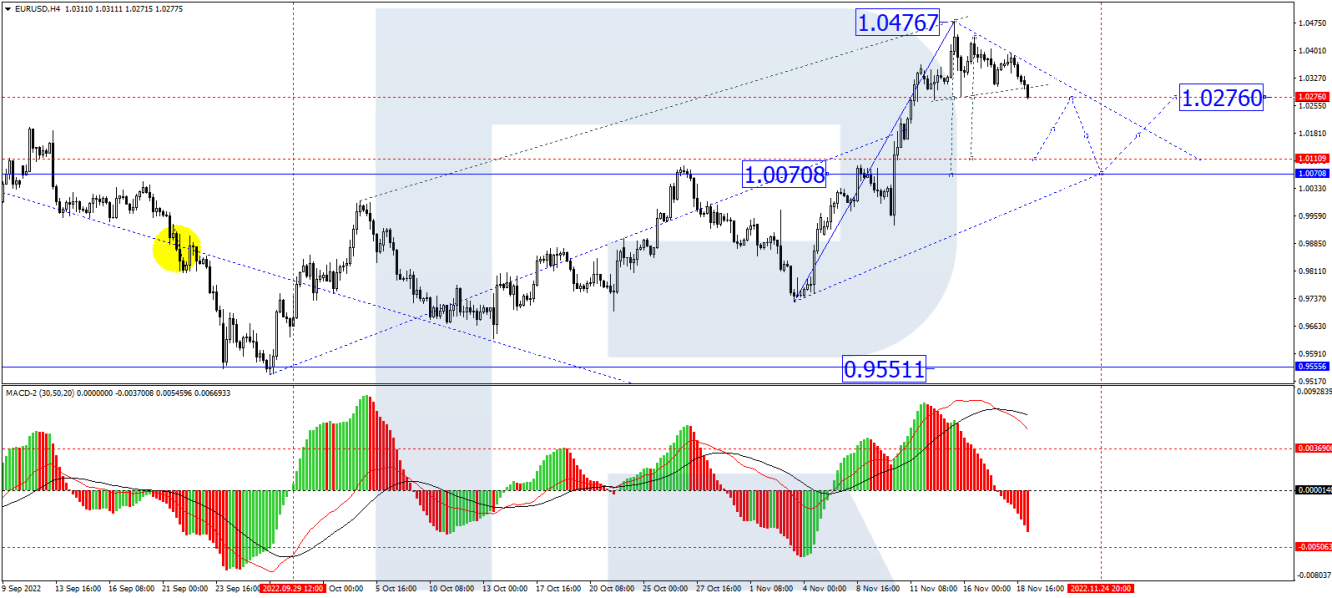

Technical View On H4, the EUR/USD pair has reached 1.0276.In practice, this only represents half of the anticipated wave of decline.Currently, the market is consolidating around this level.

The second half of this declining wave is anticipated to reach 1.0111 with a downward escape.A link of correctional growth to 1.0270 and a fall to 1.0070 are expected to occur after this level is reached.

The MACD backs up this scenario technically.It aims its signal line straight down to zero.

EUR/USD has reached 1.0276 on the first half of the year.A consolidation range is currently forming around it.There is no excluding an upward escape and a link of correction to 1.0350.

A link of decline to 1.0111 will occur once it is reached.Local is the goal.The stochastic oscillator backs up this scenario technically.Its signal line is close to 20 and is still falling.