EUR/USD and EUR/JPY: Double Top Sell Signal

2023.05.01 07:35

broke support at the lower end of the channel at 6660/40 for a medium-term sell signal with a high for the day exactly at resistance at 6640/60 to try a short on Friday – the pair collapsed to 6571 (a pip away from my 6670 target), which did offer a 70 pip profit.

However, this market is very choppy & we saw a steep bounce back to 6619 by the close.

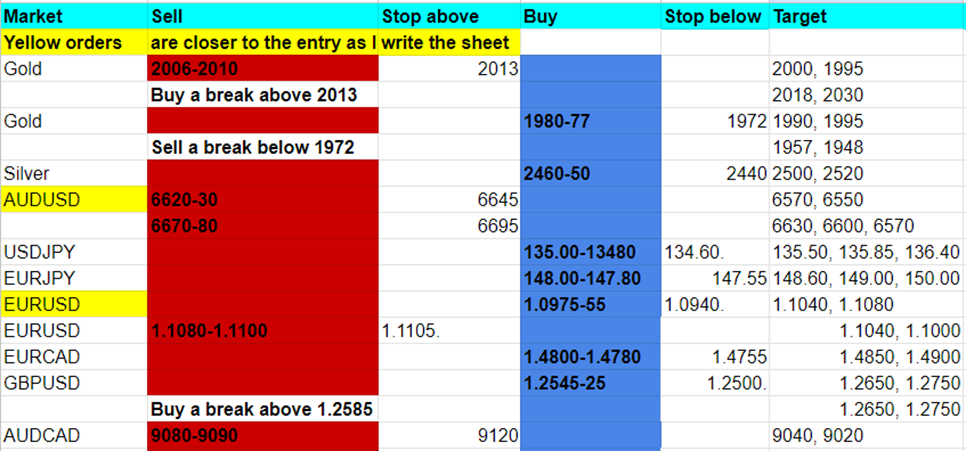

Strong resistance at 6620/30. Shorts need stops above 6645. Resistance again at 6670/80. Shorts need stops above 6695.

shot higher by 250 pips to retest strong resistance at 100.30/60. A high for the day here but the close at the high of the day is likely to lead to further gains on Monday.

Holding above 100.60/50 can target the March high at 100.88 then the December high at 101.30/40. Longs need stops below 100.25.

made a low for the day at strong support at 1.0975/55. Longs here again today need stops below 1.0940. A break lower is a sell signal which targeting 1.0880/70

Our longs were offered 80 pips on the bounce to 1.1044. Further gains meet resistance at 1.1080/1.1100. Shorts need stops above 1.1105. A break higher is a buy signal & resumes the 7-month bull trend.

collapsed & wiped out Tuesday’s strong gains. We are stuck in a 6-month, 300-pip range from 1.3320/1.3300 up to 1.3630/50.

wiped out Wednesday’s strong gains but we are still in an 8-month bull trend so for now I will attempt to buy at support levels. Minor support at 1.4910/00. Below 1.4885 risks a slide to 1.4850 & perhaps as far as strong support at 1.4800/1.4780. Longs need stops below 1.4755.

beat resistance at 1.2525/45. We have had a couple of failed breakouts in April, but there is a good chance this is the one that triggers a move towards 1.2750.

Support at 1.2545/25. Longs need stops below 1.2500. If you buy a break above Friday’s high of 1.2583 look for the first target of 1.2650/70.

break above 1.8715 was our buy signal – longs are working nicely as we hit my next target of 1.9030. Now I am looking for 1.9170, perhaps as far as 1.9220.

Longs need stops below 1.8930.

break above 1.6855/65 was our a buy signal targeting 1.7000/20, which was hit this week & outlook remains positive. We can target 1.7090 & 1.7135.

We should have support at 1.6960. Further support at 1.6935/25. A break below 1.6910 however risks a slide to strong support at 1.6865/45.

The should have strong resistance at 9080/9090. Shorts need stops above 9120. A break higher can target resistance at 9175/85.