EUR/JPY Jumps to a Fresh 15-Year High

2023.06.27 06:55

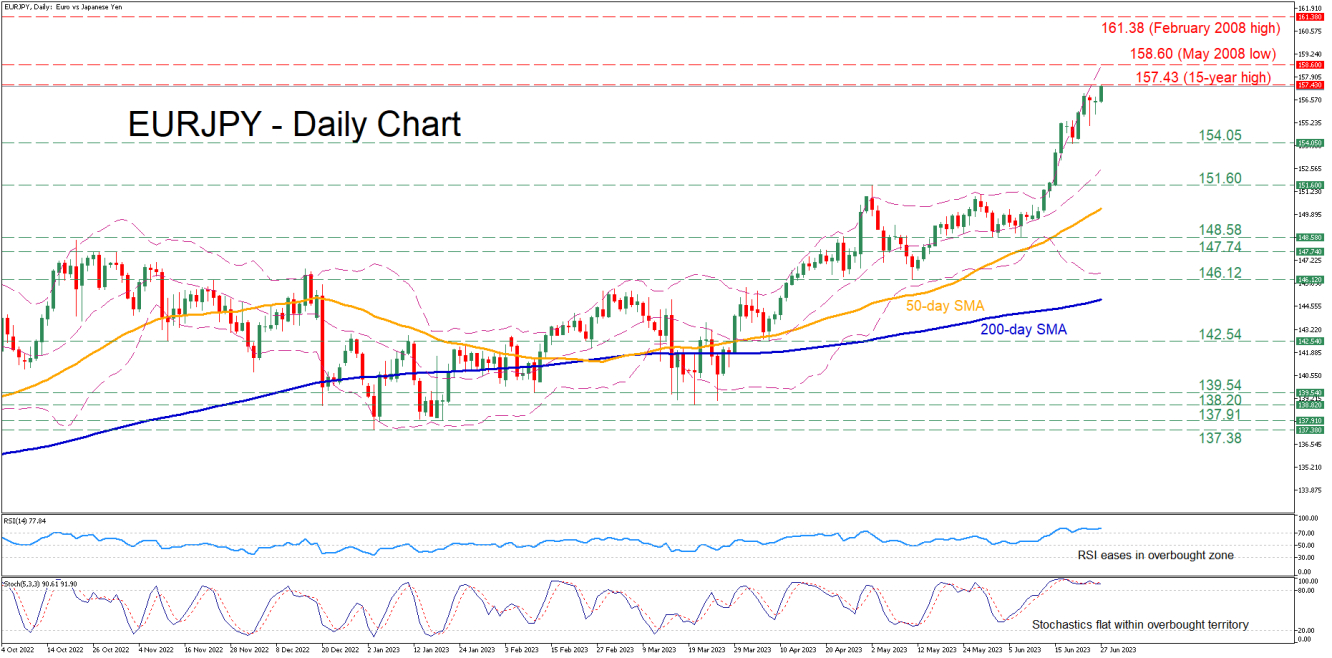

has been in a strong uptrend since the beginning of the year, posting a fresh 15-year high of 157.43 in today’s session. However, this rally appears to have reached overbought conditions, thus a potential downside correction might be on the cards.

The momentum indicators currently suggest that bullish forces could be running out of juice. Specifically, both the RSI and the stochastic oscillator are flat within their overbought territories, hinting towards a rally exhaustion.

Should bearish pressures emerge, the price could initially test the recent support of 154.05. Diving lower, the pair could descend towards the previous resistance of 151.60, which could serve as support in the future. Even lower, the June bottom of 148.58 may provide downside protection.

On the flipside, if the price attempts to extend its advance, the recent 15-year high of 157.43 could prove to be the first barrier for buyers to conquer. Piercing through that wall, the pair might ascend to form fresh multi-year highs, where the May 2008 low of 158.60 could curb any upside moves. A violation of the latter could open the door for the February 2008 peak of 161.38.

Overall, even though EURJPY recorded a fresh 15-year high in today’s session, its rally appears to be fading. Hence, traders should not rule out a pullback as the price has reached overbought conditions.