EUR/JPY Fails to Rise Above 200-Day SMA

2023.03.21 07:49

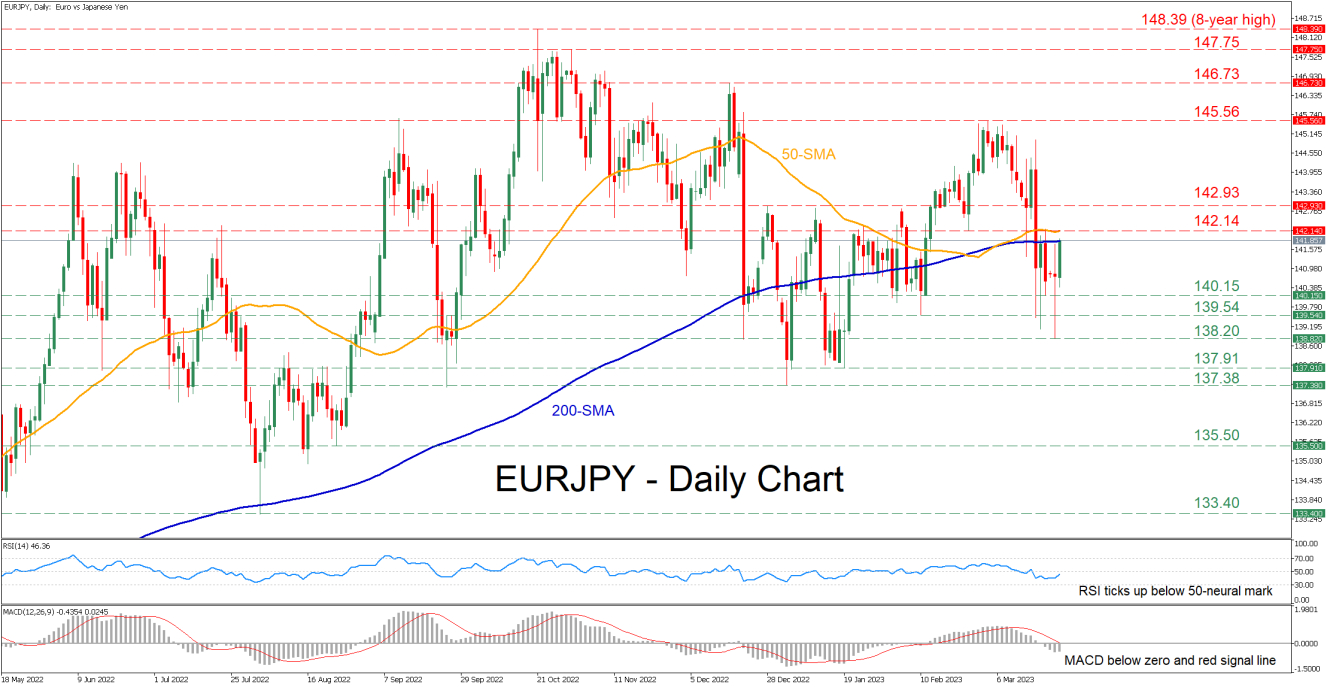

EURJPY has been under selling pressure after its latest advance got rejected at the 145.56 territory in early March. Even though the pair managed to halt its retreat and attempt a rebound, its 200-day simple moving average (SMA) has repeatedly curbed the upside.

The momentum indicators currently suggest that near-term risks are tilted to the downside. Specifically, the RSI is ticking upwards but remains below its 50-neutral mark, while the MACD histogram is below both zero and its red signal line.

If the pair extends its decline, the 140.15 support could act as the first line of defence. Sliding beneath that floor, the price could descend towards 139.54 before the March bottom of 138.20 appears on the radar. Even lower, further declines may cease at the 137.91 barrier.

Alternatively, should the bulls manage to propel the price above its 200-day SMA, initial resistance might be found at 142.14, which overlaps with the 50-day SMA. Violating that zone, the pair could challenge the 142.93 resistance territory. If that hurdle fails, the 2023 high of 145.56 may come under examination.

In brief, EURJPY seems unable to alter its short-term picture back to positive as the 200-day SMA continues to act as strong resistance. Therefore, the pair could experience more losses in case the price fails again to reclaim this barricade.