EUR/GBP Lacks Clear Direction, Remains Below 0.8900

2023.01.17 08:20

[ad_1]

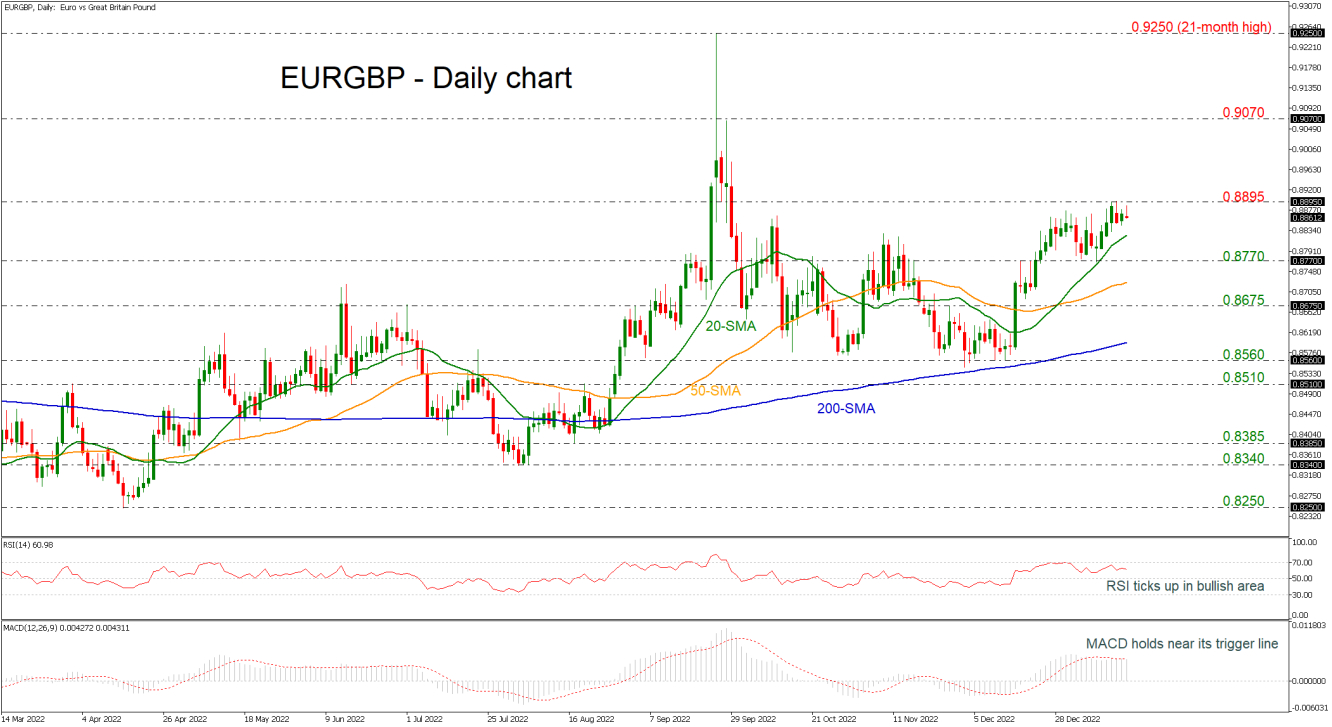

EUR/GBP is testing the 0.8895 resistance level, remaining well above the short-term simple moving averages (SMAs).

Moreover, the price rebounded after it found support near the 0.8830 barrier, enhancing the argument that the picture may turn positive.

Looking at momentum oscillators on the daily chart, though, they suggest some declines may be on the cards in the short-term. The RSI is above its neutral 50 line but is pointing down, detecting negative momentum. The MACD is trying to overcome its trigger line in the positive territory, indicating some more positive action, but the momentum is too weak.

If the bulls retake control, price advances may stall initially near the latest highs at 0.8895, and subsequently near the 0.9070 bullish spike, registered on September 28. In such a case, the 21-month high of 0.9250 would raise the likelihood for more advances.

On the other hand, immediate support could come from the 20-day SMA at 0.8820 ahead of the 0.8770 support level. A significant leg below this area could send prices towards the 50-day SMA at 0.8730 before the market retests the 0.8675 barrier. Then, if the market fails to hold above this level, the next stop could be at the 200-day SMA near 0.8600.

In the bigger picture, the pair is neutral as long as it is holding beneath the 0.8900 round number and above the 0.8560 support. In case it violates 0.8895, the bulls could take the upper hand.

[ad_2]