EUR/CHF Bears Eye Lower Supports Amid Market Volatility and Political Uncertainty

2024.07.22 06:53

Monday Market Overview

Asian currencies fell on Monday following an unexpected interest rate cut in China, which failed to generate optimism. Simultaneously, the experienced a negative shock at the market open due to President Biden’s withdrawal from the election race, although it continued its third consecutive day of gains during European trading.

Biden endorsed Vice President Kamala Harris, who is now likely to face Republican frontrunner Donald Trump in the presidential race. The euro has notably weakened against various currencies.

Technical Analysis

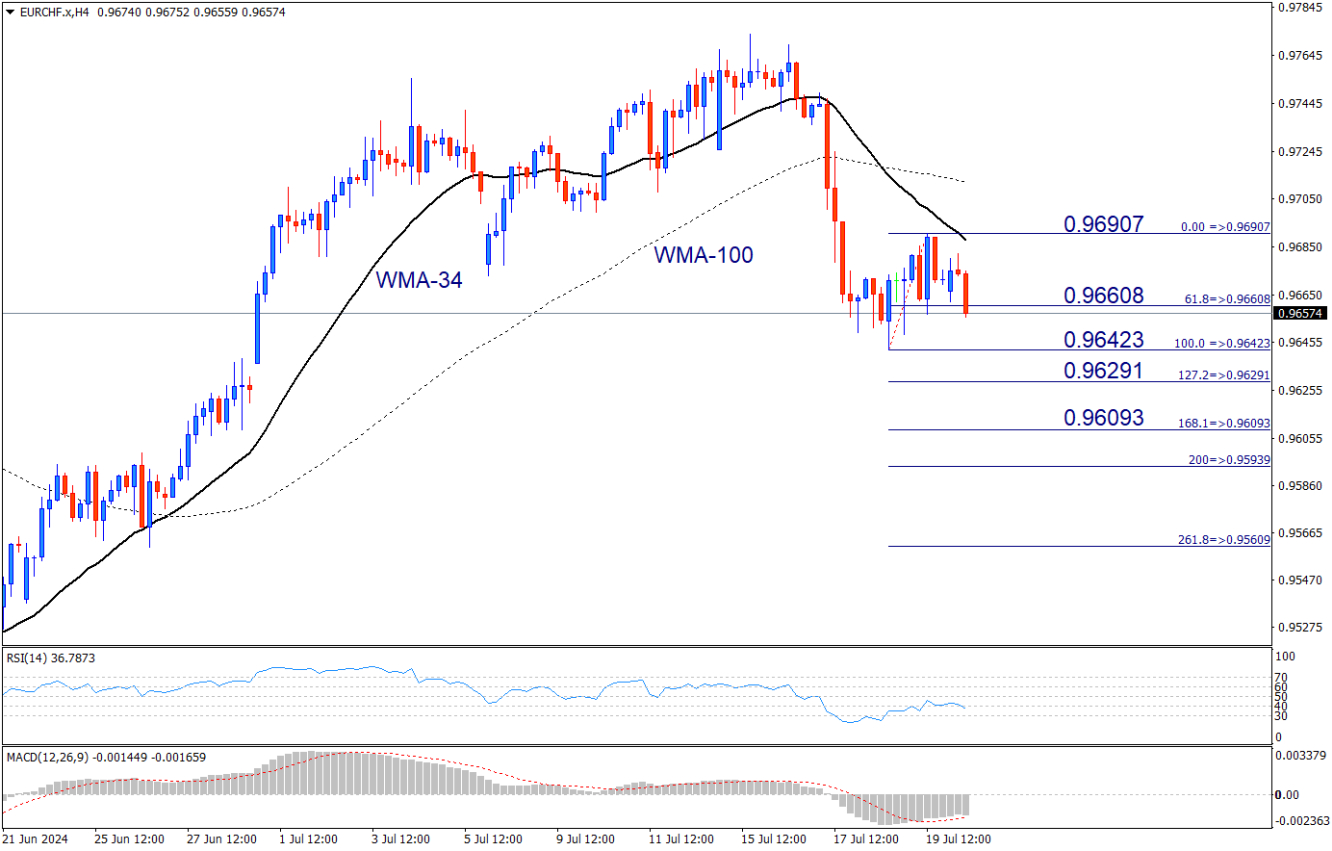

In the four-hour chart, displays a bearish trend, reversing from the 34-period moving average. After declining from the peak at 0.96907, sellers have pushed the price below the 0.96608 support, turning it into resistance.

Sustained bearish momentum positions the 0.96423 support as the next target. If sellers breach this level, lower supports at 0.96291 and 0.96093 will come into play.

Conversely, if buyers regain control and break above the 0.96608 resistance, they would need to target the 0.96907 peak to invalidate the bearish scenario.

Key Levels

Resistance Levels:

- Resistance 2: 0.96907

- Resistance 1: 0.96608

Current Price (at the time of analysis): 0.96574

Support Levels:

- Support 1: 0.96423

- Support 2: 0.96291

- Support 3: 0.96093

Impactful Events

Monday sees a quiet start to the financial markets. Following the unexpected interest rate cut in China, the main events to watch are the Eurogroup meetings and the short-term bond auctions in France and the United States.

Oscillators

RSI (Relative Strength Index): Bearish, indicating sustained selling pressure.

MACD (Moving Average Convergence Divergence): Bearish, reinforcing the downward trend.

Moving Averages: Bearish, reflecting the current negative price action.

Conclusion

EUR/CHF is under significant bearish pressure, having broken key support levels and confirming a downtrend. Further declines are likely towards 0.96423, 0.96291, and 0.96093 unless buyers can push the price back above the 0.96608 resistance.

A break above 0.96907 would be necessary to reverse the current bearish sentiment.