Equal-Weight S&P 500 ETF Has Outperformed In 2022, So Should You Climb Aboard?

2022.11.01 08:22

[ad_1]

- Seven stocks comprised more than a quarter of the S&P 500 to start the year

- Less growth-heavy S&P 500 equal-weight index has produced alpha

- Investors should consider one intriguing ETF

In a year that seems to lean more in favor of small caps and value stocks, investors might start to reconsider their allocations to mega-cap names that led the previous bull market. It’s rare to see one group of stocks keep up a torrid bullish pace for two decades in a row.

Recall how the 1960s was led by the so-called “nifty 50,” then the ’70s was a time to be long commodity-related shares and emerging markets, with the ’80s came an epic bull market in Japanese shares, the ’90s was of course the U.S. dot-com boom, the 2000s featured China’s bullish impact on commodities and EM once again, and then came the U.S. mega-cap growth dominance in the 2010s.

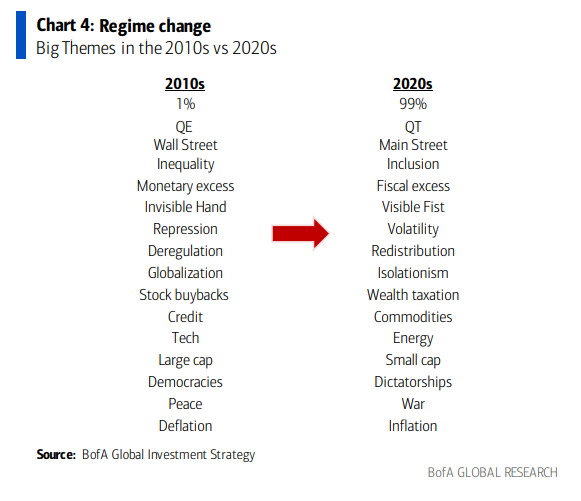

Many are already quick to call for a 180 in some of the secular themes of the past decade. This chart from Bank of America Global Research, at the very least, is thought-provoking:

Big Changes Already Underway?

Major Market Themes

Source: Bank of America Global Research

The ground is already shifting under our feet. Quantitative tightening is here, volatility is above normal, re-shoring is a real thing, the Energy sector leads the way, and inflation is hard to squash. It makes a good narrative, and price action, thus far, is following what BofA’s narrative suggests.

One way to play the trend (that isn’t so dramatic) is to own the in an unusual way. Rather than having a chunk of your equity exposure in, say, the SPDR S&P 500 ETF Trust (ASX:), which weights stocks by market cap, you can own the Invesco S&P 500 Equal Weight ETF (NYSE:) which employs an equal-weight scheme.

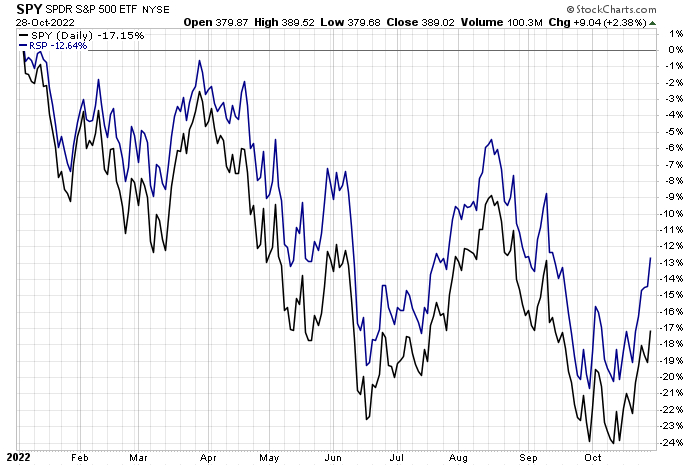

So far this year, RSP is down just 12.6% compared to SPY’s 17% drop. Naturally, RSP is less dominated by a handful of mega-caps. Back on Dec. 31, 2021, Apple (NASDAQ:), Microsoft (NASDAQ:), Amazon (NASDAQ:), Alphabet (NASDAQ:), Tesla (NASDAQ:), Meta Platforms (NASDAQ:), and NVIDIA (NASDAQ:) comprised a stunning 26.7% of SPY. It doesn’t take a finance whiz to tabulate how much those seven made up RSP—just 7%.

YTD Performances: SPY Down Sharply vs. RSP

Source: Stockcharts.com

Even today, the sector exposure differences tell the tale. SPY is 26% invested in the sector, 11% (AMZN and TSLA being monster components), and 7.5% Communications Services. Those “TMT” sectors are a mere 15%, 11%, and 4%, respectively, of RSP.

The S&P 500 equal-weight index has much more cyclical and value positions. and are 28% of RSP. Those two blue-chip parts of the market compose under 20% of SPY. I assert that RSP is a strong way to play some of the seismic shifts many, including BofA, predict will take place in markets over the coming year.

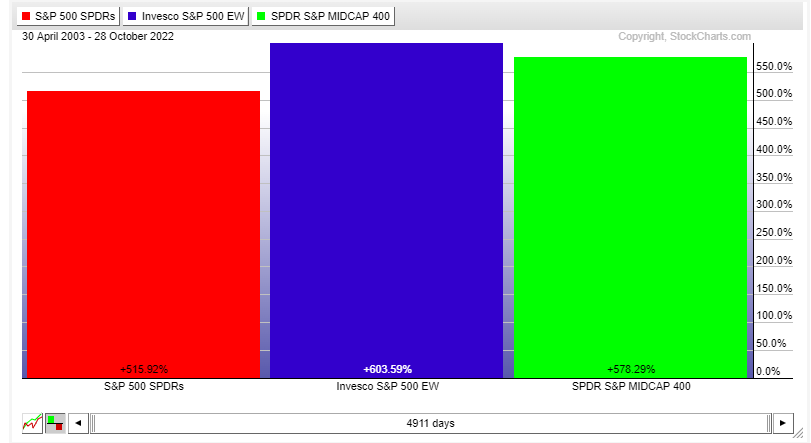

Another strategy to get similar exposure is to simply have a higher weight to mid-caps. RSP carries with it a modest 0.20% annual expense ratio, and you can snatch up shares of a mid-cap index fund for just a few basis points annually. Long-run returns suggest that the S&P 500 equal-weight product performs about on par with domestic mid-caps.

Owning Mid-Caps Works Almost As Well Over The Long Haul

Source: Stockcharts.com

The Bottom Line

Investors seeking diversification from the top-heavy S&P 500 market-cap-weighted index can use RSP as a way to level out their portfolio without paying too high of a fee. Momentum appears with the equal-weight ETF’s value bent and smaller average market cap size.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.

[ad_2]

Source link