Enel: Evaluating the Hype Behind Italy’s Most Popular Stock

2023.05.16 10:04

- Enel is popular stock in Italy with a market cap of $67B.

- The multinational energy company operates in electricity and gas sectors across Europe and Latin America.

- Mixed performance, high debt, and unattractive valuations make the stock a poor long-term investment.

Enel (OTC:) (ETR:), with a market capitalization exceeding $67 billion, is one of the most popular stocks in Italy. But what made this company such a prominent feature in the Italians’ portfolios?

Using InvestingPro tools, we are going to take a look at Enel’s fundamentals and try to identify the factors that make it a sought-after choice among Italian investors.

What Does the Company Do?

Enel is a multinational energy company that operates as a global integrated operator in the electricity and gas sectors, primarily focusing on Europe and Latin America. Its business segments encompass Italy, the Iberian Peninsula, Latin America, Eastern Europe, Renewable Energy, and Others.

Its divisions consist of Generation, Exchange, Infrastructure and Networks, Upstream Gas, and Renewable Energy. Enel’s extensive reach extends across approximately 30 countries, spanning Europe, North America, Latin America, Africa, and Asia. With a net installed capacity of about 90 gigawatts (GW), Enel is a major player in the energy industry.

Enel’s distribution companies facilitate the transportation of electricity through an extensive network encompassing over 1.9 million kilometers. The company operates diverse generating facilities across approximately 10 countries, serving cities like Rio de Janeiro, Bogota, Buenos Aires, Santiago de Chile, and Lima.

Using InvestingPro tools, we will try and analyze the company’s financials. Readers can do the same for virtually every company or fund in the market just by clicking this link.

Enel’s Fundamentals at a Glance

Let’s start with the historical financial statements, which provide several useful insights.

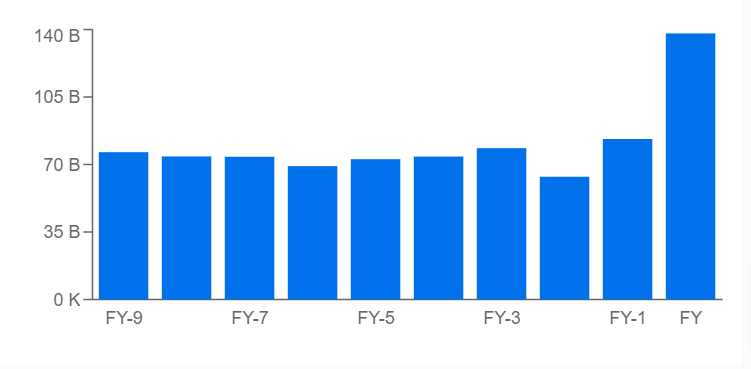

Inconsistent trends in turnover and profits and declining margins are apparent. But, the last year is insignificant in terms of turnover considering how margins and profits fared.

Source: InvestingPro

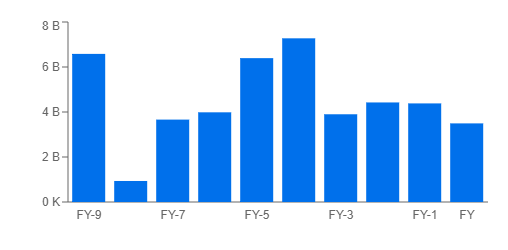

Net Income Trend

Source: InvestingPro

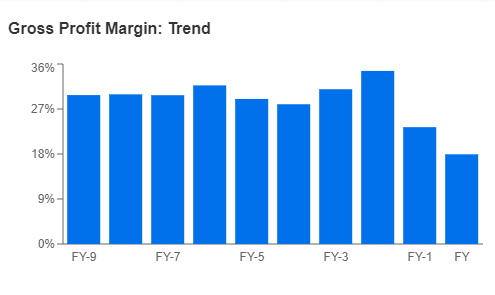

Gross Profit Margins Trend

Source: InvestingPro

Over the past 10 years, the growth rate of EPSd (diluted earnings per share) has been around 0.3 percent.

Balance Sheet and Cash Flows

Between cash and short-term investments, Enel has about $11.8 billion, for total current assets of around $70.7 billion. This, compared to current liabilities (about $81 billion), presents a very precarious short-term balance.

The Debt to Equity ratio isn’t great either, at 1.8 (typical for utility companies anyway).

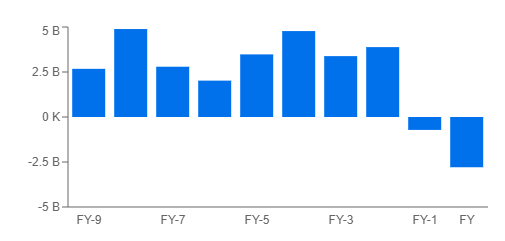

The operating cash flow has shown a significant decrease in the last two years, mirroring the net income trend. Before that, it was relatively stable.

Cash Flow Trend

Source: InvestingPro

The negative free cash flow indicates a lack of meaningful returns.

Valuations

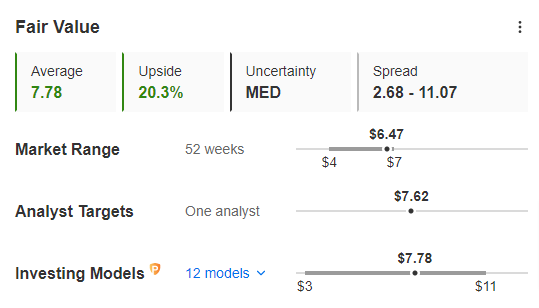

Currently, the stock is trading at a discount of approximately 13% to its fair value, which is estimated to be around $7.8 per share based on an average of 13 different models, according to InvestingPro.

On the other hand, analysts are more optimistic, setting a target price of $7.62 with a potential upside of around 20%.

Fair Value Estimate

Source: InvestingPro

Given the overall uncertain and weak performance of key metrics, excessive debt, and unattractive valuations, I have decided to exclude the stock from my watchlist.

While the dividend yield of 3.43% is positive, I prefer to invest in financially stronger companies that also offer dividends, potentially even higher ones.

One can simply look at the price chart, which reveals a lackluster performance in the past years.

Analysis was done using InvestingPro. Access the tool by clicking on this link.

Find All the Info you Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remain with the investor.