‘Economic state of shock’ to persist in Germany in 2024 -survey

2023.12.04 07:04

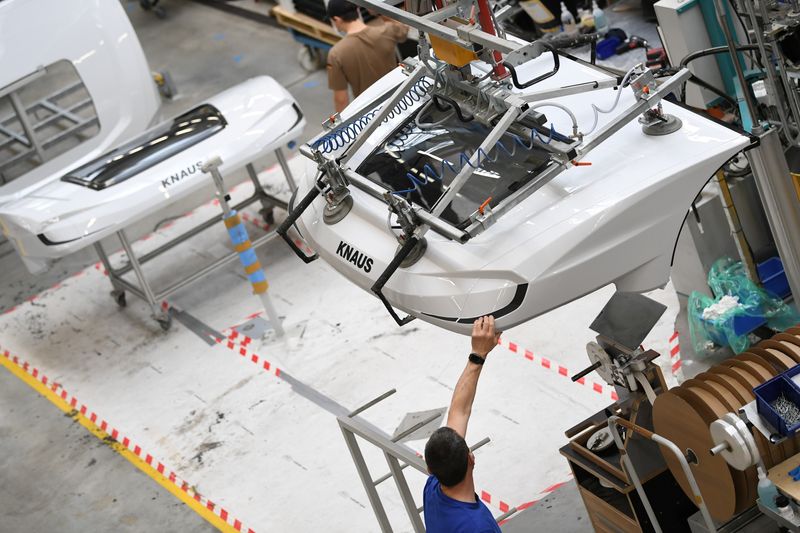

© Reuters. Workers assemble campers at Knaus-Tabbert AG factory in Jandelsbrunn near Passau, Germany, March 16, 2021. Picture taken March 16, 2021. REUTERS/Andreas Gebert/File Photo

(Reuters) – German businesses, which have been struggling with high inflation, energy price fluctuations and geopolitical instabilities for months, are rather pessimistic for 2024 and do not expect a recovery, a study seen by Reuters showed on Monday.

Only 23% of companies were optimistic about next year, while 35% had negative expectations, according to the survey of more than 2,200 firms by the Cologne-based German economic institute (IW). The situation had deteriorated in the construction and industrial sectors in particular, the institute found.

Germany’s long period of job creation had probably come to an end for the time being with only 20% of companies expecting to employ more people in the coming year compared with 35% expecting fewer, IW said. The survey signalled “a continuation of the economic state of shock in Germany,” with business expectations back to levels registered in autumn 2022.

“The sharp rise in energy prices on the back of the Russian invasion of Ukraine, the related overall increase in prices, the geopolitical uncertainties and the clearly weakening dynamic of the world economy explain the economic standstill in this country,” said Michael Groemling, researcher at the institute.

The survey also found consequences on investments: only 27% of the companies said they plan to invest more next year, while 36% plan to spend less.

The survey also highlighted the difficulties for Germany’s construction and industrial sectors. Only a quarter of industrial companies expected production to increase compared with 38% expecting a drop. Among construction firms, 13% expected an increase in output. By contrast, 54% saw a decline.