Earnings Frenzy: Will Tech Giants and Large-Caps Lift Market Sentiment This Week?

2024.11.04 13:54

-

Q3 S&P 500® EPS growth expected to come in at 5.1%, the fifth consecutive quarter of growth.

-

All eyes on earnings, the US presidential election and Federal Reserve rate decision this week.

- Large cap outlier earnings this week: Williams Company, APA Corp, Halliburton.

This week will bring more volatility-inducing events than we typically see in a given week. On top of this being the second peak week of earnings season with over 3,700 companies expected to report, Tuesday brings a U.S. presidential election, followed by a meeting on Thursday.

Earnings Update

marked the first peak week of the Q3 2024 earnings season, highlighted by mixed results from some very closely watched mega tech companies which had a high bar to clear.

The tech party kicked off with results from Alphabet (NASDAQ:) on Tuesday which reported better-than-expected results on the top and bottom line. The company confirmed that their bet on AI was “paying off,” while its cloud business saw a 35% increase YoY and Youtube ad revenues were up due to the impending US presidential election.

Things began to fizzle from there when Meta (NASDAQ:) and Microsoft (NASDAQ:) reported on Wednesday. While they both beat top and bottom-line expectations, it was slowing user growth that disappointed Meta investors while soft revenue guidance hurt Microsoft’s stock.

By Thursday investors seemed disenchanted with Apple Inc’s (NASDAQ:) mostly strong results, punishing the stock for net income that fell YoY. Disappointing net income results were due to a one-time tax charge of $10.2B that the company paid to resolve a 2016 case that challenged how they handled taxes in Ireland. But the week ended as it began, with impressive results from the last of the Magnificent 7 to report for the week. Amazon (NASDAQ:) handily beat earnings and sales estimates, while CEO Andy Jassy echoed the sentiment of many other tech companies this week, that AI bets were starting to pay off. Closely watched metrics such as Amazon Web Services and advertising revenues also popped on a YoY basis. That pleased investors who took the stock up 6% after the call.

There were also some promising results from consumer-facing industries such as fast and fast-casual restaurants. McDonald’s (NYSE:) reported a rebound in sales thanks to value meals after a weaker Q2 result, and was able to reverse negative same store sales in the US. Shake Shack (NYSE:) also reported improved sales and announced plans for expansion. But it wasn’t all good news from the fast casual space. Chipotle (NYSE:), who had been performing well this year, missed Wall Street revenue estimates.

With over 70% of the reported thus far, the YoY growth rate stands at 5.1%, the fifth consecutive quarter of growth, and an increase from 3.6% last week.

Solid Economic Data Continues to Support the Soft Landing Scenario

Economic data reported last week came up roses, and continued to support the soft landing narrative in the for October surged to its highest level since March 2021. as measured by ADP came in at 233,000 for October, much higher than the 113,000 estimate and the highest level since July 2023. And the first (of three) Q3 reading for US came in at 2.8%, a solid number despite missing expectations of 3.1%.

US showed it continues to move in the right direction when the personal expenditures price index (PCEPI) saw a 12-month inflation rate of 2.1% for September, moving closer to the Federal Reserve’s target. The Fed is still expected to lower rates this week despite a strong economy and steady inflation, with CME Group’s FedWatch tool putting the probability of a 25bp decline at 94%.

Throwing a bit of a wrench in this story is October which reported on Friday that the US economy only added 12,000 jobs during the month, well below the estimate for 100,000. A lot of this softness was attributed to the Boeing (NYSE:) strike and hurricanes Helene and Milton. held steady at 4.1%.

Outlier Earnings Dates This Week

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share bad news on their upcoming call, while moving a release date earlier suggests the opposite.

This week we get results from a number of large companies on major indexes that have pushed their Q3 2024 earnings dates outside of their historical norms. Thirteen companies within the S&P 500 confirmed outlier earnings dates for this week, all of which are later than usual and therefore have negative DateBreaks Factors*. Those names are AvalonBay Communities (NYSE:), Public Service Enterprise Group (NYSE:), Cummins Group (NYSE:), Gartner Inc (NYSE:), American Electric Power Company (NASDAQ:), Host Hotels & Resorts (NASDAQ:), APA Corporation (NASDAQ:), MarketAxess Holdings (NASDAQ:), Williams Companies (NYSE:), Fortinet (NASDAQ:), Arista Networks (NYSE:), Halliburton Company (NYSE:), and Baxter International (NYSE:).

Energy Outliers

It’s no secret that energy companies are not expected to be winners this earnings season. In fact, they are expected to be the biggest laggard of all the 11 sectors as far as YoY earnings (-27.3%) and revenue growth (-4.8%) are concerned. oil is down around 6% YTD while Crude, the global benchmark, is down 7%. As such, we see three energy names with outlier dates:

Williams Companies

Company Confirmed Report Date: Wednesday, November 6, AMC

Projected Report Date (based on historical data): Wednesday, October 30, AMC

DateBreaks Factor: -3*

is set to report their Q3 2024 results on Wednesday, November 6, a week later than expected. This will be the latest WMB has ever reported for Q3, and pushes the report date into the 45th week of the year, after reporting in the 44th WOY in 2023.

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company’s 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

APA Corporation

Company Confirmed Report Date: Wednesday, November 6, AMC

Projected Report Date (based on historical data): Wednesday, October 30, AMC

DateBreaks Factor: -2*

Similarly to Williams, is also set to report their Q3 2024 results on Wednesday, November 6, a week later than expected. This will be the latest APA has ever reported for Q3, and pushes the report date into the 45th week of the year, after reporting in the 44th WOY in 2023, but still adheres to their Wednesday reporting trend.

Halliburton Company

Company Confirmed Report Date: Thursday, November 7, BMO

Projected Report Date (based on historical data): Tuesday, October 22, BMO

DateBreaks Factor: -3*

is set to report their Q3 2024 2024 results on Thursday, November 7, more than two weeks later than expected. This is by far the latest HAL has ever reported for Q3, with the next latest report date being October 25 in 2022. This pushes this year’s report into the 45th WOY when they typically report in the 43rd WOY. This also ends a three-year tradition of reporting on Tuesdays.

On Deck This Week

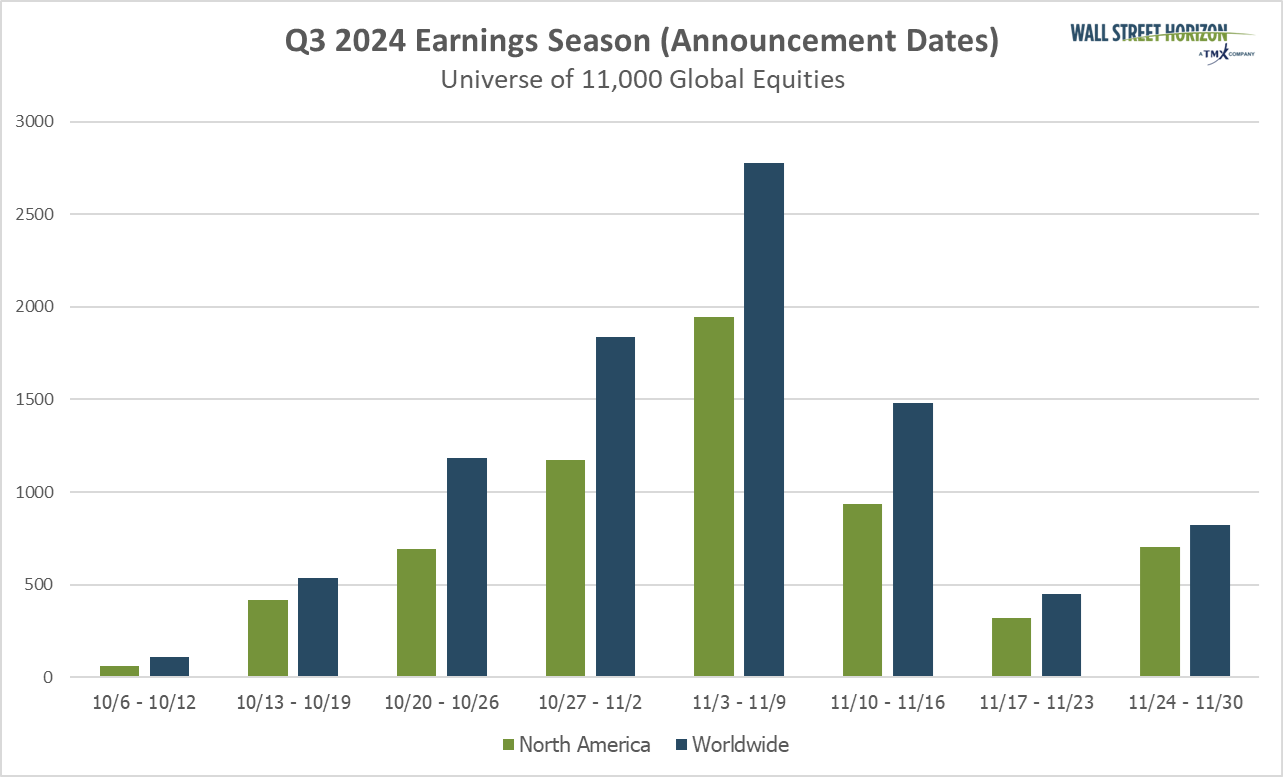

This week marks the second peak week of earnings season, with over 3,700 global companies expected to report results.

Source: Wall Street Horizon

Q3 Earnings Wave

This earnings season, the peak weeks will fall between October 28 – November 15, with each week expected to see over 2,000 reports. Currently, November 7 is predicted to be the most active day with 1,448 companies anticipated to report. Thus far, 81% of companies have confirmed their earnings date (out of our universe of 11,000+ global names), and 33% have reported actual results. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon