Earnings Coming in Better-Than-Expected, but Stocks Still Getting Punished

2023.10.31 12:55

- Despite an OK earnings season thus far, stocks are bearing the brunt of softening investor sentiment and corporate uncertainty

- This week 2,357 companies are expected to report for Q3, 170 from the S&P 500

- Potential Surprises this week: Caterpillar, JetBlue Airways

- Peak weeks for Q3 season run from October 23 – November 10

Big tech kicked off the first peak week of Q3 earnings season last week, and while the most watched names ( (NASDAQ:), (NASDAQ:), (NASDAQ:), and (NASDAQ:)) beat on the top and bottom-lines, it didn’t necessarily guarantee a bump in those stocks.

Despite posting better-than-expected headline results, Alphabet (NASDAQ:) missed expectations for cloud revenues, causing shares to drop 12% in the 3-day post-earnings period. Meta posted stellar results, yet it was commentary from CFO Susan Li that had investors take the stock lower in after-hours trading.

“We have observed softer ads in the beginning of the fourth quarter, correlating with the start of the conflict, which is captured in our Q4 revenue outlook,” Li said during the call.

Of the five ‘Magnificent 7’ stocks that have reported thus far for Q3, only Microsoft and Amazon have trended higher in the following trading period, while Tesla (NASDAQ:), Alphabet and Meta Platforms all fell lower the day following their earnings releases. NVIDIA (NASDAQ:) and Apple (NASDAQ:) have yet to report.

In spite of a decent earnings season thus far (78% of companies beating estimates), stocks are getting punished more than usual. According to Factset, even those S&P 500 companies that have surpassed EPS expectations are still off by -1.0% (vs. the 5-year average of 0.9%), while those missing Wall Street estimates see their stocks plunge by -5.2% on average (vs. the 5-year average of -2.3%). Softening sentiment paired with an uncertain macro backdrop often results in a more reactive and panicked investor that is quicker to react to negative news.

The current macroeconomic environment may also have CEOs feeling a bit uncertain. The most recent reading of our Late Earnings Report Index (LERI) shows that more companies are delaying earnings reports than advancing them, pushing the current score to 120, the highest since the COVID-19 pandemic.

With nearly 49% of S&P 500 constituents reporting at this point, the blended EPS growth rate for Q3 has grown to 2.7% vs. last week’s -0.4%.

Earnings on Deck – Week of Oct 30, 2023

Peak earnings season continues this week with expected earnings releases from 2,357 publicly traded companies (out of our universe of 10,000), with 170 of those coming from S&P 500 companies. Highly-anticipated results from Apple will be out Thursday, with a smattering of other tech results throughout the week from PayPal (NASDAQ:), Qualcomm (NASDAQ:), Advanced Micro Devices (NASDAQ:), Block (NYSE:) and more. We’ll also get more of a read on the consumer with reports from McDonald’s (NYSE:), Under Armour (NYSE:), Crocs (NASDAQ:), Airbnb Inc (NASDAQ:), etc.

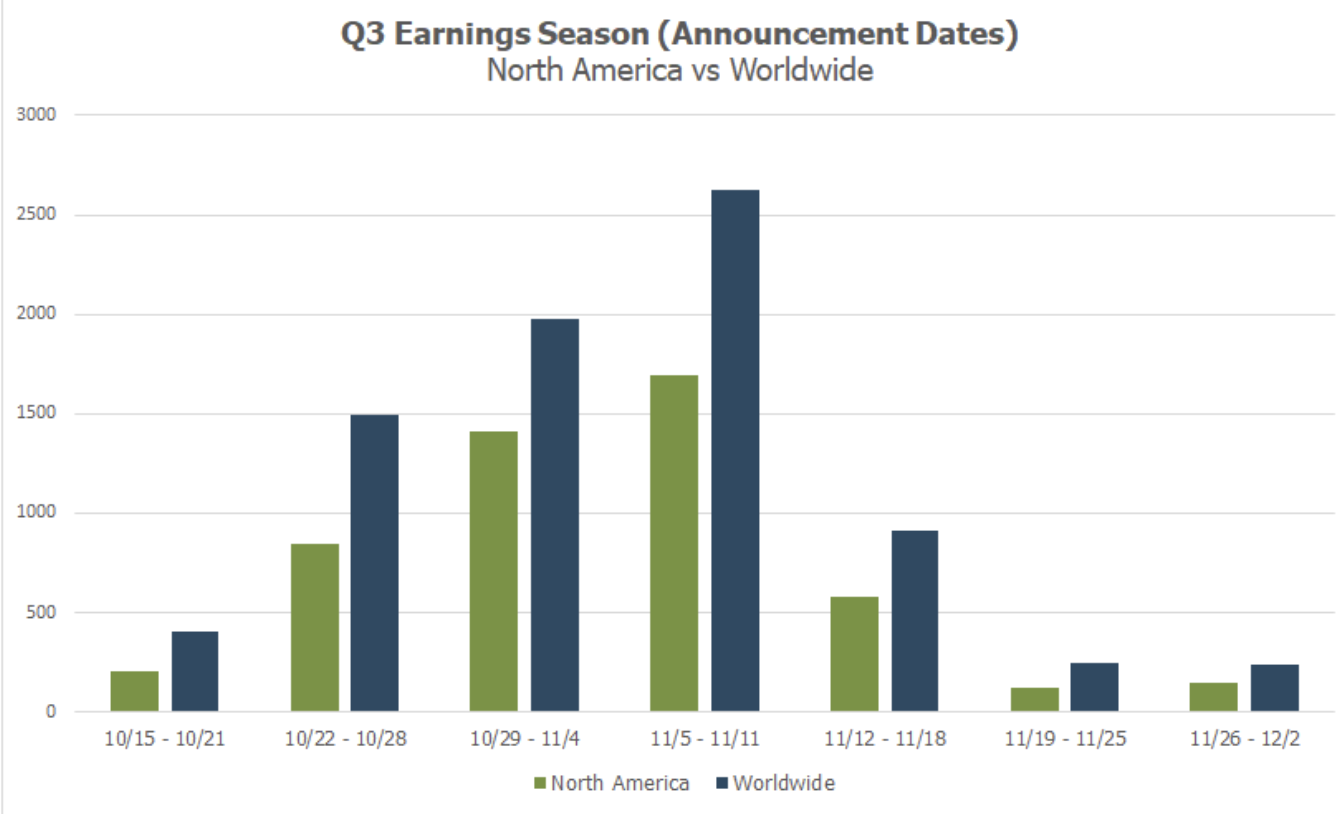

This season peak weeks will fall between October 23 – November 10, with each week expected to see nearly 2,000 reports or more. Currently November 9 is predicted to be the most active day with 1,116 companies anticipated to report. Thus far 74% of companies have confirmed their earnings date (out of our universe of 9,500+ global names), with 22% reporting. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon

Source: Wall Street Horizon

Potential Surprises This Week: CAT & JBLU

This week we get results from a number of large companies on major indexes that have pushed their Q3 2023 earnings dates outside of their historical norms.

Ten companies within the confirmed outlier earnings dates for this week, nine of which are later than usual and therefore have negative DateBreaks Factors. Those are:

- Allegion (NYSE:)

- Caterpillar (NYSE:)

- Equity Residential (NYSE:)

- Hubbell (NYSE:)

- IQVIA Holdings (NYSE:)

- American Electric Power Company (NASDAQ:)

- Baxter International (NYSE:)

- S&P Global (NYSE:)

- Stryker Corporation (NYSE:)

According to academic research, the later-than-usual earnings date suggest these companies will report “bad news” on their upcoming calls. Only Norwegian Cruise Line Holdings (NYSE:) confirmed an earlier than usual date, suggesting they will report “good news” on their upcoming calls.

Also of note, of the nine S&P 500 names with later than usual earnings dates this week, three are from the Industrials sector and three are from the Health Care sector.

Potential Surprises This Week

1. Caterpillar

- Company Confirmed Report Date: Tuesday, October 31, BMO

- Projected Report Date (based on historical data): Thursday, October 26, BMO

- DateBreaks Factor: -2*

Caterpillar is set to report Q3 2023 results on Tuesday, October 31, five days later than expected. While this would be the latest they’ve ever reported (since we began collecting this data in 2006), it does seem in-line with their more recent trend to release Q3 results on a Tuesday or Thursday in the 44th week of the year (WoY).

Academic research⁹ shows when a corporation reports earnings later than they have historically, it typically signals bad news to come on the conference call. While CAT has benefitted from increased infrastructure spending and the push towards clean energy which has increased demand for construction equipment, there is worry that the latest headwinds could cause a slowdown in the industry. High interest rates, sustained higher inflation rates and geopolitical tensions are all straining the global economy, and one of the first industries that tends to be impacted is industrials.

2. JetBlue Airways

- Company Confirmed Report Date: Tuesday, October 31, BMO

- Projected Report Date (based on historical data): Tuesday, October 24, BMO

- DateBreaks Factor: -3*

Here’s another Industrials name to add to the list of earnings date delayers. JetBlue Airways (NASDAQ:) is also set to report Q3 2023 results on Tuesday, October 31, a full week later than expected.

Similar to Caterpillar, while this does adhere to the more recent trend of reporting on a Tuesday in the 44th WoY, it is still the latest they’ve reported (since 2006) and it does fall out of line with their tendency to report during the fourth week of October, regardless of whether that’s in the 43rd or 44th WoY. In previous years when October fell into a 5th week JetBlue would move their earnings date earlier, which they did not do this quarter.

JetBlue narrowly surpassed analyst expectations last quarter, and are anticipated to post YoY declines on the top and bottom-line in Q3. Just as several other airlines have reported (Southwest Airlines (NYSE:), Spirit Airlines (NYSE:), American Airlines (NASDAQ:)) rising jet fuel and labor expenses as well as slowing travel demand are crimping Q3 results and 2024 outlooks. The Q3 earnings call will coincide with the airline’s Department of Justice (DOJ) antitrust trial challenging their proposed acquisition of Spirit Airlines.