E-Mini S&P, Nasdaq Analysis: Are Major Banks Predicting a Sell Signal?

2023.08.02 07:04

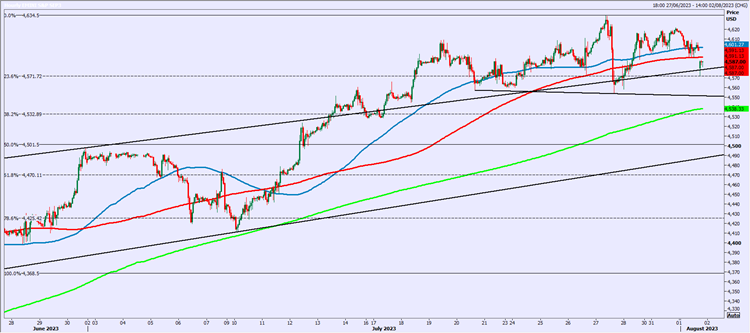

September could be forming a short-term head & shoulders or a diamond top after we failed to retest last week’s high at 4634.

We are trading below the 100 & 200-hour moving averages, which is a warning to short-term bulls. We are testing support at 4570/60, but I am less confident this will hold today & a break below 4550 should be a sell signal to target 4535 & 4510/4500.

Resistance at 4600/4610. A break higher can retest 4630/35. A break above 4640 is a buy signal & can target 4670/75, perhaps as far as 4695/99.

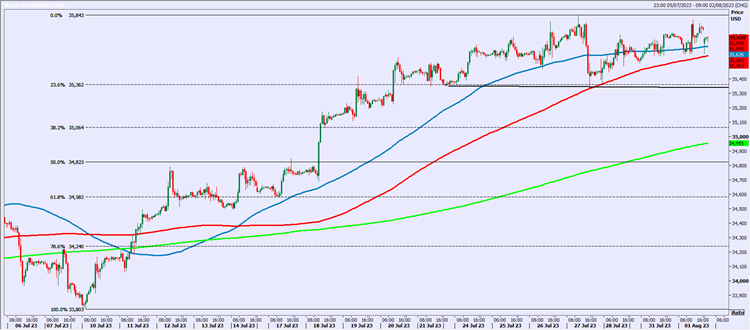

September has traded sideways for 2 weeks in a range from 15522/483 up to 16062.

Short-term support at 15700/650. A break below here is a sell signal for today & can target 15470/420.

A break below 15400 is the next sell signal for this week targeting 15300/250.

Minor 2-week trend line resistance at 15800/850. A break above 15900 can retest the July recovery high at 16040/16060. A break above here can target 16300/350.

September staged a recovery after Thursday’s negative action & we retested Friday’s high but held which means we have a potential double top pattern forming. The question now is whether we break above Thursday’s high at 35843 to continue the bull trend or Thursday’s low & support at 35375/345. (I favour a break lower but I am only guessing).

A lower break confirms the double top for a sell signal targeting 35100/35000, probably as far as 34850.

Video Analysis: