Stock Markets Analysis and Opinion

E-Mini: Bulls Want Reversal Higher From Trend Channel Line

2022.06.27 16:16

Market Overview: S&P 500 E-mini Futures

The S&P 500 E-mini reversed higher from trend channel line overshoot and a wedge bottom. The bears failed to create follow-through selling below May low on the weekly chart. Bulls want a reversal higher from a trend channel line overshoot and a wedge bottom, but they will need to create follow-through buying next week to convince traders that a reversal higher may be underway.

S&P500 E-mini futures

The S&P 500 E-mini chart

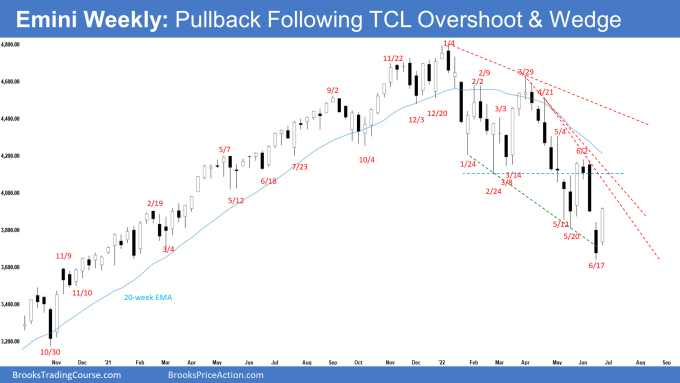

S&P 500 E-Mini Weekly Chart

S&P 500 E-Mini Weekly Chart

- This week’s E-mini candlestick was a bull bar closing near the high. It closed the gap from last week.

- Last week, we said that odds slightly favor sideways to down for the week. The bears want another bear bar closing near the low, while for the bulls a bull reversal bar closing near the high, with a long tail below – even though the E-mini may trade slightly lower first.

- This week gapped higher at the open and continued to trade higher for the rest of the week.

- The bulls want a failed breakout below the May low.

- They see a trend channel line overshoot, and a wedge bottom (Feb 24, May 20 and June 17).

- Since this week was a bull bar closing near the high, it is a good buy signal bar for next week. It may even gap up on Monday, but small gaps usually close early.

- The bulls need to create a consecutive bull bar next week to convince traders that a reversal higher may be underway.

- Bears want a continuation of the measured move down to 3600 or lower around 3450, based on the height of the 12-month trading range starting from May 2021.

- However, they failed to get follow-through selling following last week’s breakout below May low.

- They hope that the current pullback will stall around or below the June 2 high, or the bear trend line and reverse lower from a double top bear flag.

- This week’s candlestick is a weak sell signal bar. Odds are they will be buyers below.

- We have said that the trend channel line overshoot increases the odds of a 2-legged sideways to up pullback beginning within 1 to 3 weeks. The pullback phase may have begun this week.

- With this week closing near the high, the odds are next week should trade at least slightly higher.

- Traders will be monitoring if the bulls get a consecutive bull bar (follow-through buying), something they have failed to do since April.

- If the bulls get that, the odds of a test of the June 2 high and the 20-week exponential moving average increases.

The S&P 500 E-mini chart

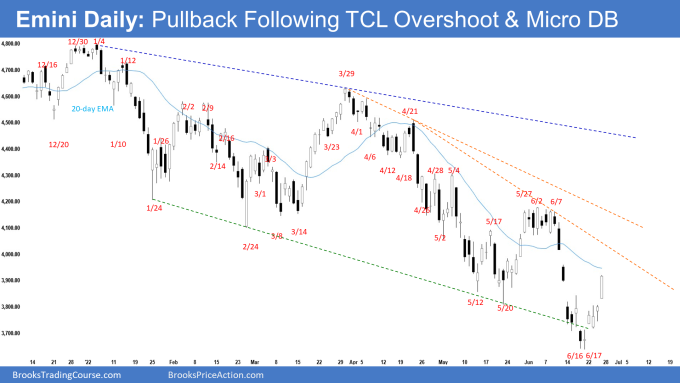

S&P 500 E-Mini Daily Chart

S&P 500 E-Mini Daily Chart

- The E-mini gapped up on Monday and continue to trade higher with 4 consecutive bull bars for the rest of the week closing near the week’s high.

- Last week, we said that odds slightly favor sideways to down and at least a small second leg sideways to down after a slightly larger pullback.

- However, because the selling is climactic with a trend channel line overshoot, traders should be prepared for at least a small 2-legged sideways to up pullback to begin within 1 to 3 weeks.

- This week traded higher for the whole week. The pullback phase may have begun.

- The bulls want a failed breakout below the May low.

- They want a reversal higher from a micro double bottom following a trend channel line overshoot and a wedge bottom (Feb 24, May 20 and June 17).

- This week’s move up was strong enough for traders to expect at least a small second leg sideways to up.

- The next targets for the bulls are the 20-day exponential moving average, the bear trend line and the June 2 high.

- The bulls need to trade far above the June 2 high to convince traders that the correction since January may be ending.

- Bears want a continuation of the measured move down to around 3600 based on the height of the 9-month trading range or lower around 3450 based on the height of the 12-month trading range starting with May 2021.

- However, they were not able to create sustained follow-through selling below May low.

- Bears hope that this week was simply another pullback and wants the E-mini to stall at one of the resistances above.

- If the E-mini trades higher, but stalls around the 20-day exponential moving average, the bear trend line or the June 2 high, odds are the bears will return to sell the double top bear flag for a retest of the low.

- For now, odds slightly favor sideways to up for next week. The move up is strong enough for traders to expect at least a small second leg sideways to up after a slight pullback.