Don’t Overlook Small-Cap Earnings

2022.10.25 07:16

[ad_1]

- Small caps enjoyed a strong 13% profit advance in Q2

- But forecasts for Q3 bottom line have been slashed

- High inflation is a top concern, strong U.S. dollar could be a relative tailwind

- Relative valuations remain attractive for small-caps

Most of the attention goes to large-cap stocks during earnings season. This week, a host of the monster tech names report third quarter results, but I like to keep tabs on what’s happening with small caps. The group had a strong Q2 reporting season, with an EPS growth rate that topped analyst expectations by a solid five percentage points, according to Bank of America (BofA) Global Research. Moreover, the Index reported year-on-year (yoy) per-share profit growth of 13% through late last reporting season. Is there more upside to come? Let’s assess the situation.

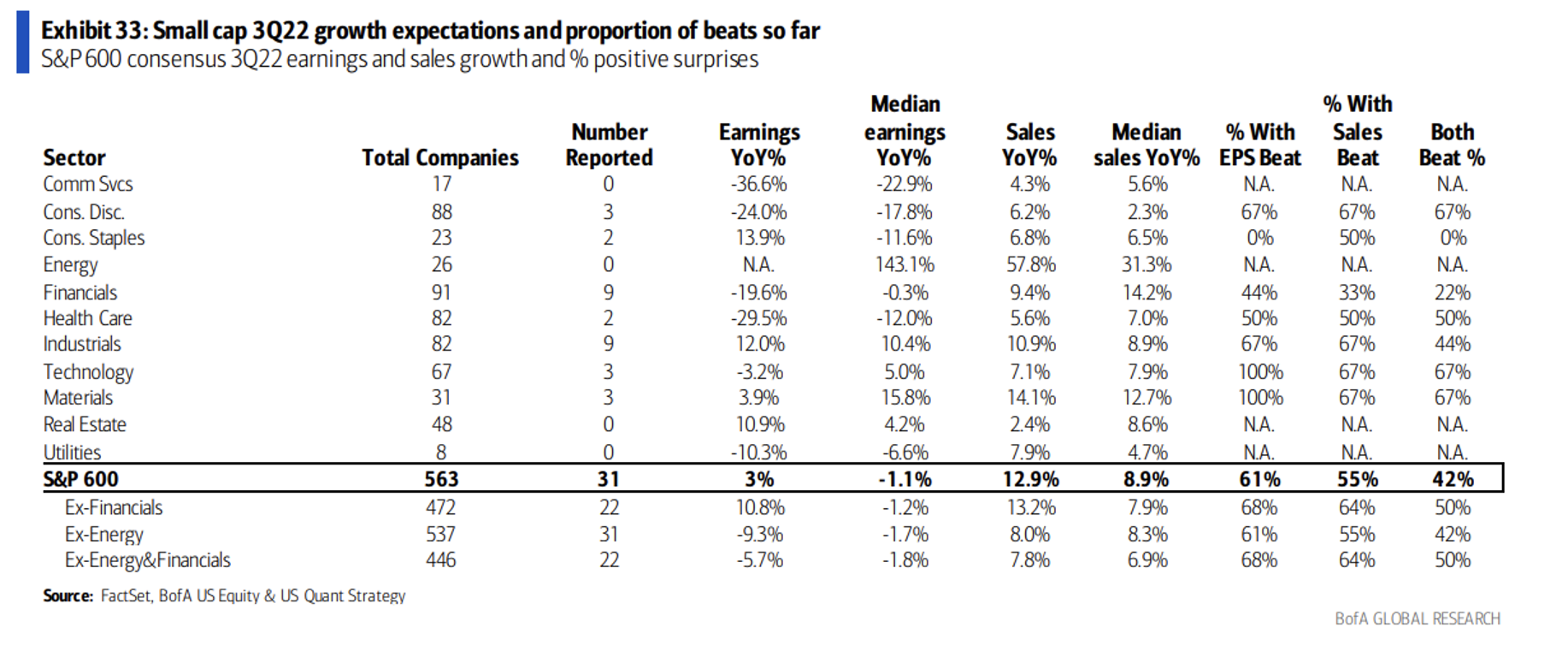

Small caps tend to report later in the season than large caps, so there is still not much visibility on how they are faring. BofA weekly earnings tracker issued Monday morning revealed that 31 firms in the Small Cap 600 Index have reported. The beat rate is a lackluster 61%, while just 42% of firms have beat on both the bottom and top lines. Following a 3% downward EPS forecast revision just since the start of earning season, yoy EPS is expected to have risen by just 3% with sales growth of 12%. That’s a steep slowdown.

Small Cap Earnings Growth Rate Drops To Just 3%

Small Cap Earnings In Q3 2022.

Small Cap Earnings In Q3 2022.

Source: BofA Global Research

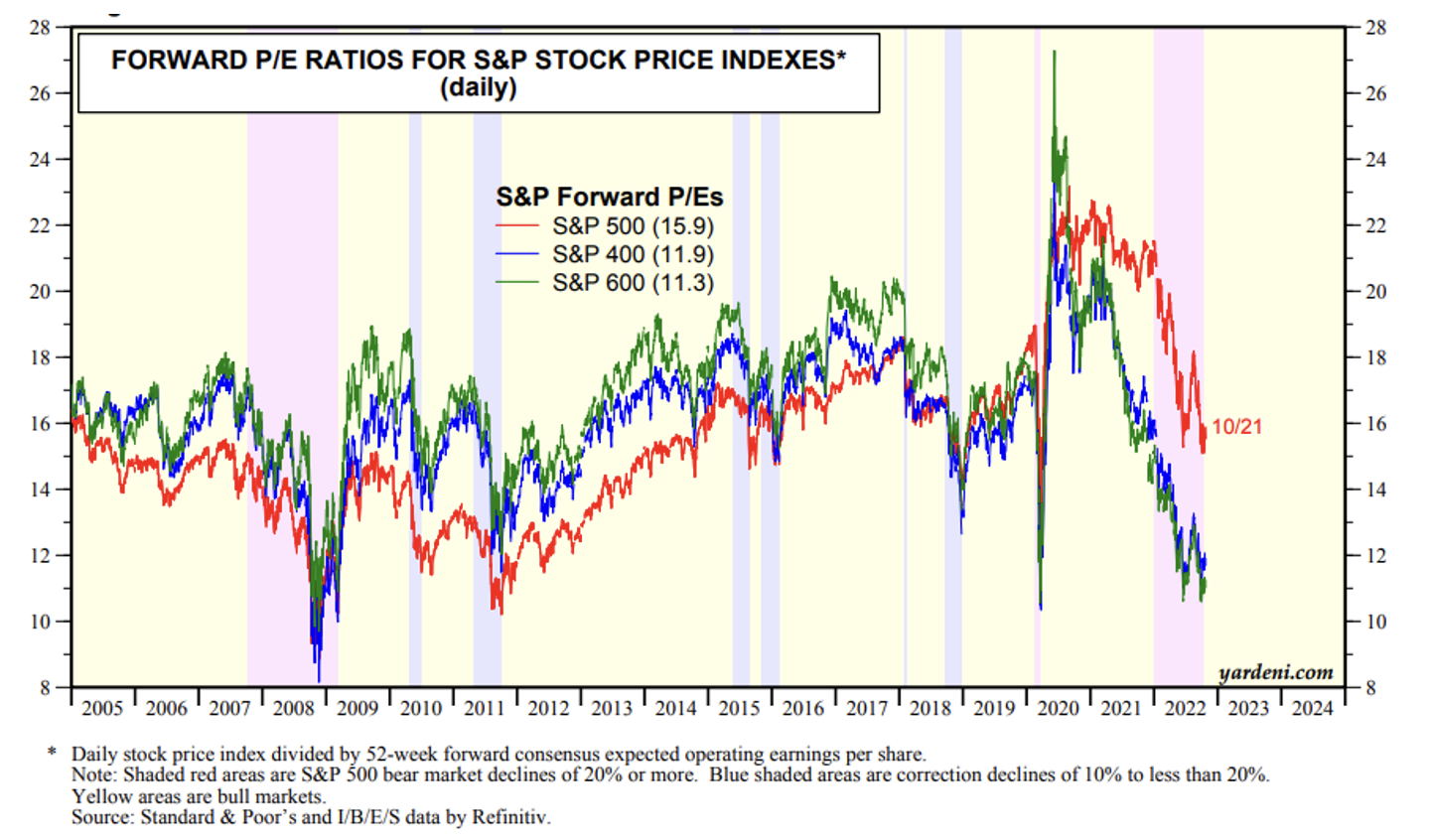

I’ve written on small-cap valuations before, and that thesis has not altered much. The Small Cap 600 still trades at a discount to the with a forward price-to-earnings ratio slightly above 11 versus near 16 on the S&P. The index has a higher valuation, above 18, thanks to its sizeable chunk of non-profitable constituents.

SMID-Cap Valuations Remain Attractive Against Large Caps

Source: Yardeni Research

In terms of price action, the iShares Russell 2000 ETF (NYSE:) is simply treading water against the SPDR® S&P 500 ETF (NYSE:) so far in 2022, though there is a slight relative uptrend since its comparative low versus SPY in May. The small-cap bulls can also point to a successful retest of the June multi-year bottom in price in September and October as large-caps notched fresh 2022 lows.

Small Caps Holding Its Lows Heading Into Year-End

Source: Stockcharts.com

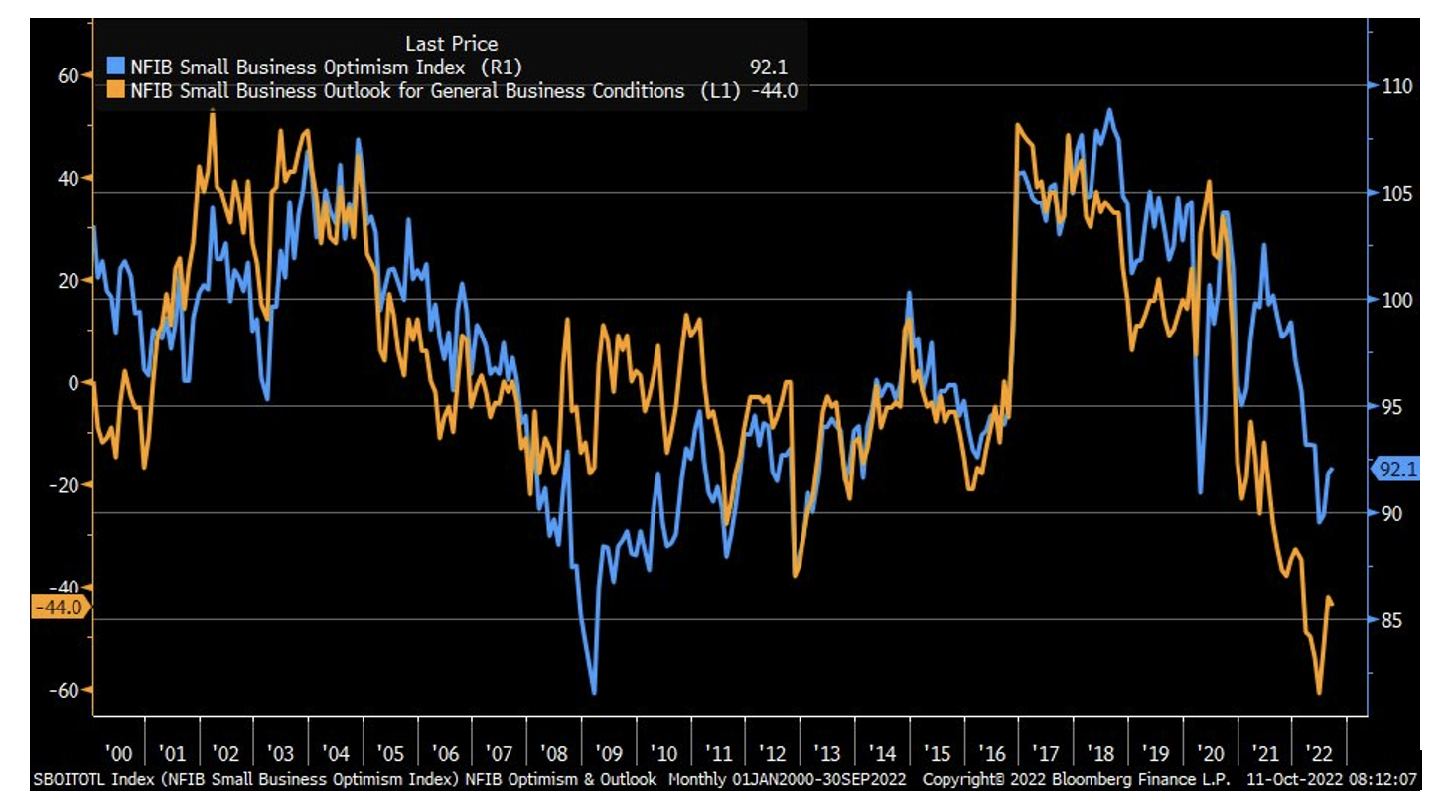

A potential bullish turn in the September reading of the Index suggests some of the inflation-driven pessimism could be waning. While not a stellar report by any means, with a ninth-consecutive monthly reading below its 48-year average of 98, last month’s 92.1 did tick up from lows reached during the summer. Keep your eye on expectations for future business conditions to see if a bullish reversal continues. Sentiment and expectations often drive investing decisions, so this will be a key report to watch for the small-cap space.

NFIB Small Business Optimism Bounces, Remains Weak

NFIB Small Business Optimism Index.

NFIB Small Business Optimism Index.

Eye On The Dollar

Investors worried about a rising should consider going overweight small caps. These domestic stocks are not only immune from currency hits related to overseas sales, but they could benefit from investment flows as portfolio managers seek equities that can hold up in the face of a rising greenback.

The Bottom Line

Small-cap earnings season is not off to a great start, but there’s a long way to go. With slight EPS growth still expected for Q3, the group’s low price-to-earnings ratio, on an absolute basis and relative to large caps, suggests that the foundation is set for a solid turnaround should the market stage a rally into the usually bullish pre-election year.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.

[ad_2]

Source link