Dollar edges lower ahead of Fed’s Powell comments

2023.12.01 05:34

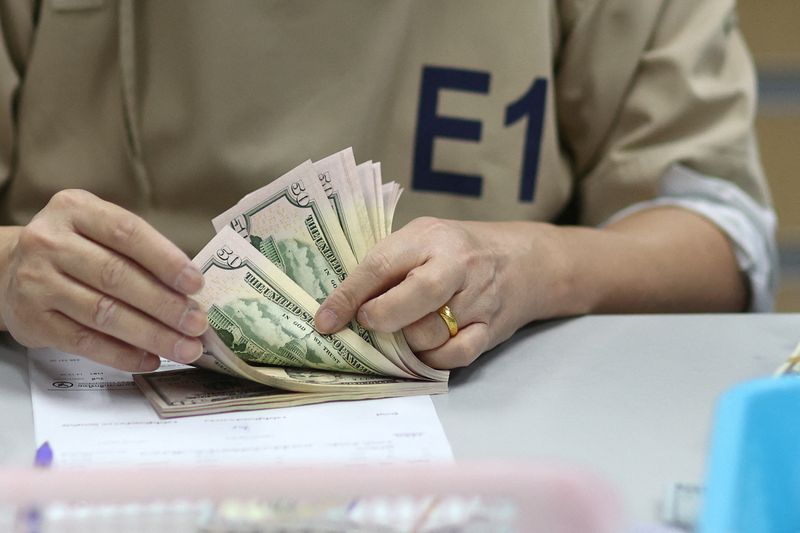

© Reuters. FILE PHOTO: A bank employee counts U.S. dollar notes at a Kasikornbank in Bangkok, Thailand, January 26, 2023. REUTERS/Athit Perawongmetha

By Iain Withers

LONDON (Reuters) – The dollar edged lower on Friday, while the euro rebounded slightly after steep overnight losses, as traders weighed data showing inflation was easing and looked ahead to a talk later in the day by U.S. Federal Reserve Chair Jerome Powell.

Softer inflation data in both the United States and the eurozone on Thursday reinforced expectations that both central banks might be done raising interest rates in their battle against price rises and led traders to bet on earlier cuts next year.

Goldman Sachs on Friday said it now expects the European Central Bank (ECB) to deliver its first rate cut in the second quarter of 2024, compared to an earlier forecast of a cut in the third quarter of next year.

Investors will have their sights trained on a talk due to be given by the Fed’s Powell later on Friday for any clues about the future path of interest rates in the U.S.

Currency movements were more muted on Friday, after month-end trades on Thursday contributed to bigger swings, analysts said.

The – which tracks the currency against six major counterparts – was last down 0.2% at 103.3, after clocking its weakest monthly performance in a year in November.

Mixed economic data across Europe failed to set the tone for the euro, with a survey showing a downturn in eurozone manufacturing activity eased slightly last month but remained deeply in the red. Britain also reported contraction in manufacturing, but an improved reading for a third straight month.

The euro was last up 0.1% at $1.08990, while sterling was up 0.3% at $1.26665.

The dollar dipped 0.2% versus the yen to 147.855 per dollar, putting the yen on course for its third straight week of gains and pulling it away from the near 33-year low of 151.92 it touched in the middle of November.

Rising expectations of the Bank of Japan abandoning its ultra-easy monetary policy next year along with a drop in U.S. yields have buoyed the Asian currency in the past few weeks.

In cryptocurrencies, bitcoin continued to strengthen, gaining as much as 2.6% to a fresh 18-month high of $38,707.