Despite WarnerMedia Spinoff, AT&T Struggles To Deliver Reasonable Returns

2022.06.21 21:30

- AT&T’s performance over the past 15 years has been disappointing

- April spinoff of WarnerMedia refocuses on telecommunications

- Wall Street analyst consensus rating is bullish

- Market-implied outlook is moderately bullish

- For tools, data, and content to help you make better investing decisions, try InvestingPro+.

AT&T (NYSE:T) completed the spinoff of WarnerMedia on April 8. WarnerMedia and Discovery (NASDAQ:WBD) are now one company and trade under the ticker WBD, with a current market cap of $34.5 billion. AT&T’s market cap is $138.7 billion. AT&T shares rose following the spinoff, but have fallen 9.4% from the 2022 close high of $21.30 on May 25. The spinoff allows AT&T to refocus on its core business, telecommunications, while creating a consolidated streaming media giant. AT&T acquired Time Warner back in 2018, but the consolidated business did not provide the anticipated synergies.

AT&T 12-Month Price History.

AT&T 12-Month Price History.

AT&T has been struggling for a number of years, and the trailing three-, five- and 10-year annualized total returns are -2.6%, -2.8% and 1.9% per year, respectively. This magnitude of underperformance is especially stark when compared with the returns from the S&P 500 over the same periods (9.3%, 10.4%, and 12.6% per year).

Post-spinoff, AT&T is focusing on building out its 5G and fiber networks and strengthening the balance sheet using the proceeds from the WarnerMedia transaction. Management has also indicated a commitment to the dividend (see previous link). The forward dividend yield is 5.7%.

It is very hard to have confidence in AT&T management, given the company’s poor long-term performance and failure to provide value from the acquisition of Time Warner four years ago. The spinoff of the media properties is probably the right thing to do, given the poor performance since the acquisition, but the ultimate result has been one of value destruction.

The shares look cheap with a P/E of 8.2, but the consensus outlook for earnings growth over the next three to five years is -1.3% per year. The expectation of essentially stagnant EPS suggests that the shares are cheap relative to current earnings for a good reason.

I last wrote about AT&T on December 6, 2021, prior to the spinoff, and I had assigned a neutral/hold rating. At that time, the Wall Street analyst consensus outlook for T was bullish, with a consensus 12-month price target that implied a 30% rise in the share price over the next year. By contrast, the consensus view calculated from options prices, the market-implied outlook, was neutral on T to mid-2022 and bearish to early 2023. So far in 2022, T has returned a total of 0.36%.

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probable price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

I have calculated the market-implied outlook for T to early 2023 and to the middle of 2023 and I have compared these with the current Wall Street consensus outlook in revisiting my rating on the stock.

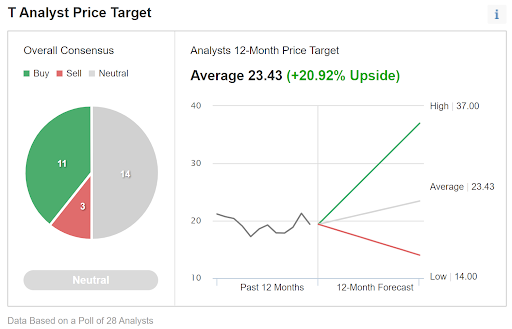

Wall Street Consensus Outlook For T

E-Trade calculates the Wall Street consensus outlook for T using ratings and price targets from 18 ranked analysts who have published their views over the past three months. The consensus rating is bullish and the consensus 12-month price target is 20.1% above the current share price. There is a fairly high dispersion among the individual price targets, reducing confidence in the predictive value of the consensus.

Wall Street Consensus Rating And 12-Month Price Target For T.

Wall Street Consensus Rating And 12-Month Price Target For T.

Investing.com’s version of the Wall Street consensus outlook is calculated using ratings and price targets from 28 analysts. The results are very similar to those from E-Trade, with a bullish rating and a 12-month price target that is 20.9% above the current share price.

Wall Street Consensus Rating And 12-Month Price Target For T.

Wall Street Consensus Rating And 12-Month Price Target For T.

The Wall Street consensus outlook suggests that the prevailing view is that AT&T will perform considerably better than before the spinoff, with expected total return (including the dividend) of around 26% over the next year. This is a bold view given the overall poor performance for more than a decade, with a 15-year annualized total return of 1.6% per year.

Market-Implied Outlook For T

I have calculated the market-implied outlooks for T for the seven-month period from now until Jan. 20, 2023, and for the 11.8-month period from now until June 16, 2023, using options that expire on each of these two dates. I selected these two expiration dates to provide a view through the end of 2022 and for approximately the next 12 months.

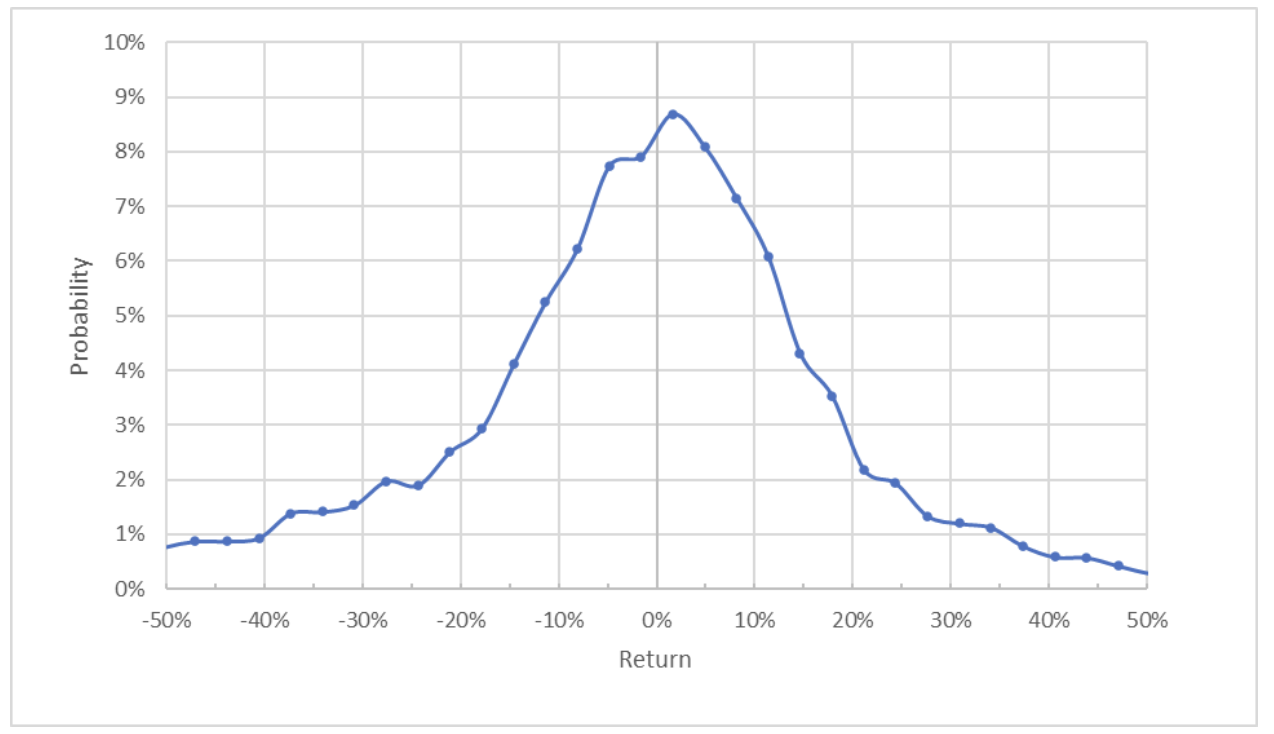

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Market-Implied Price Return Probabilities From Now until Jan. 20.

Market-Implied Price Return Probabilities From Now until Jan. 20.

The market-implied outlook to early 2023 is generally symmetric, with comparable probabilities for positive and negative returns of the same magnitude, but the peak in probability is slightly tilted to favor positive returns. The expected volatility calculated from this outlook is 28% (annualized).

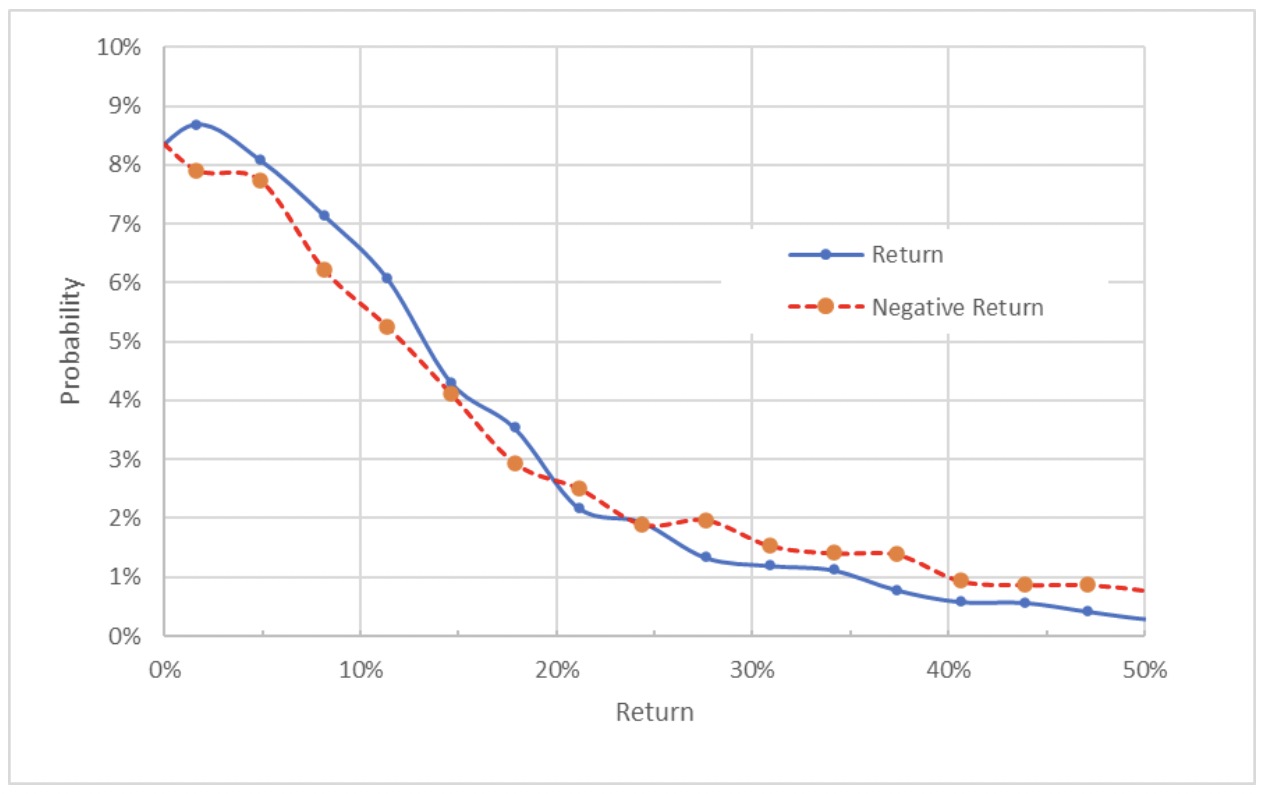

To make it easier to directly compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Market-Implied Price Return Probabilities From Now until Jan. 20.

Market-Implied Price Return Probabilities From Now until Jan. 20.

This view shows that the probabilities of positive returns are slightly higher than for negative returns of the same size, across a range of the most-probable outcomes. (The solid blue line is above the dashed red line over the left two-fifths of the chart above). The probabilities of large negative returns are slightly elevated to those for positive returns (the dashed red line is above the solid blue line over the right two-fifths of the chart), although these outcomes are projected to occur with a very low overall probability.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and, thus, tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. Considering the expectation for a negative bias, along with the elevated probabilities of positive returns for the most likely outcomes, the market-implied outlook is moderately bullish to early 2023.

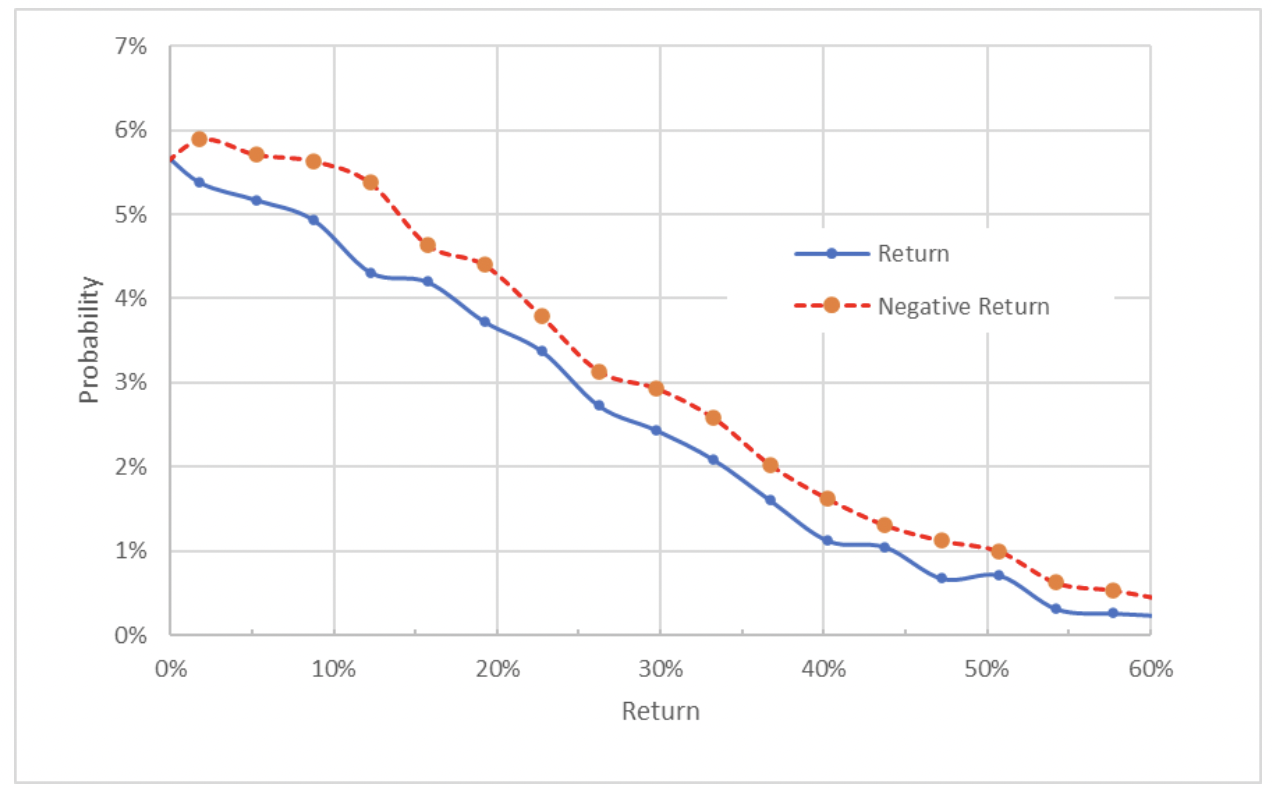

Looking out to the middle of 2023, a year from now, the probabilities of negative returns are consistently, albeit modestly, higher than for positive returns. With the expected negative bias in the market-implied outlook, this result is best interpreted as neutral. The expected volatility calculated from this distribution is 28% (annualized), consistent with the shorter-term outlook.

Market-Implied Price Return Probabilities Until June 16, 2023.

Market-Implied Price Return Probabilities Until June 16, 2023.

The market-implied outlooks for T have improved since the end of 2021. The outlook to January of 2023 is now slightly bullish, as compared with the bearish outlook for this same expiration date in my last analysis. The outlook for the next year is neutral.

Summary

As AT&T continues to attempt to navigate the changes in telecom and digital media, investors are faced with a dilemma. Management has not been able to deliver anything close to reasonable shareholder returns for a number of years. If one has faith that the company is finally heading in the right direction, the shares could look attractive. The current valuation is low and the forward dividend yield is high.

On the other hand, there is little reason for faith that the company has finally found a path to growth. The consensus outlook is that earnings per share will fall slightly over the next three to five years. The Wall Street consensus outlook for T is bullish and the consensus 12-month price target implies a total return of 26% over the next year. With high expected return, but negative expected earnings growth, the overall consensus view suggests that the shares are oversold even with the muted earnings outlook. The market-implied outlook is moderately bullish to early 2023, but neutral for the 12-month period from now until mid-2023. This is consistent with the view that the shares are somewhat oversold, with the potential for a bounce off of current lows. The longer term prospects, however, are muted. I am maintaining my neutral/hold rating.

***