Delta Air Lines Soars to New Heights: Can the Profit, Revenue Surge Last?

2023.07.14 10:49

- Delta Air Lines reported record revenues and profits in the second quarter

- Demand and fuel costs were key factors in the company’s strong performance

- The stock has soared so far this year, but will the rally continue?

Yesterday, after the market closed, Delta Air Lines, Inc. (NYSE:) delivered a robust indication of recovery in the air transportation industry with its second quarter . The Atlanta, Georgia-based company achieved remarkable growth, setting new records for revenues and profits.

During the second quarter, Delta Air reported an impressive revenue of $15.6 billion, marking a substantial 12.7% year-on-year increase. Furthermore, the company witnessed a rise in gross profit margin, recording a gross profit of $4.2 billion for the quarter. Delta Air’s pre-tax profit amounted to $2.4 billion, with earnings per share reaching $2.68.

These exceptional figures underscore Delta Air Lines’ outstanding performance during the second quarter and offer encouraging indications of ongoing recovery within the air transportation sector.

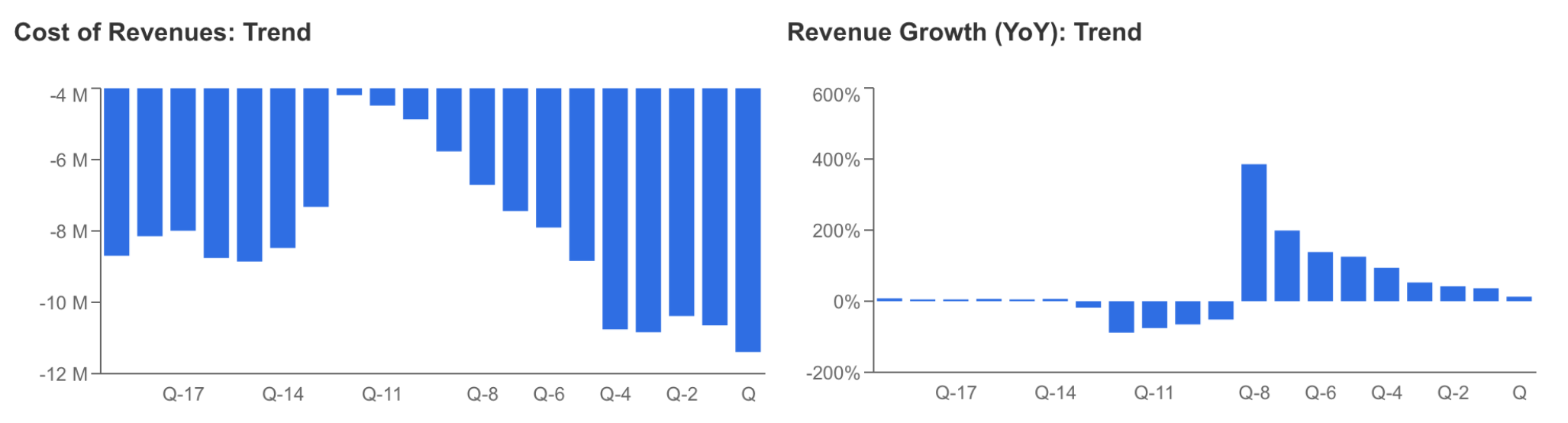

Gross Profit Margin and Revenue Trend

Gross Profit Margin and Revenue Trend

Source: InvestingPro

Despite a continued downward trend in revenue growth, Delta Air Lines announced record quarterly revenues. However, the company effectively managed the increasing industry demand despite the rising revenue costs. As a result, the airline successfully offset the previous quarter’s loss and achieved a net profit of $1.8 billion.

Source: InvestingPro

Robust Demand Boosts Profits

Delta achieved record profitability due to the effective management of international flights and the strong domestic demand in the US. The reopening of Japanese flights and the increase in transatlantic flights contributed to the popularity of transpacific and transatlantic routes among US citizens, respectively. As a result, international revenues, which hit a low point in 2022, increased by over 60% compared to the previous year. The company also highlighted the importance of the growing demand for Latin American flights, which positively impacted profitability by 20%.

Despite some economic challenges and the resilience of in the US, travel demand remained robust. During the 4th of July holiday, the US set a record for the highest number of passenger trips per day, with over 12 million passengers passing through US airports.

The continued buoyancy in travel demand offset the downward trend in ticket prices, while lower fuel costs contributed to solid financial results. Delta Air Lines remains optimistic about the trend continuing throughout the year.

Furthermore, Delta benefited from lower-than-expected fuel costs in the first half of the year, leading to a 22% decrease in fuel-related tax costs compared to the same period last year. However, personnel costs increased by 25% in the same period, offsetting some of the fuel cost savings. Nonetheless, the ability to meet increased staffing needs while enjoying reduced fuel and tax costs is seen as a positive development for future periods.

The company also saw an increase in free cash flow, reaching $2.9 billion in the first half of the year, enabling accelerated debt payments. Delta aims to pay off over $4 billion in debt this year as free cash flow continues to rise in 2023.

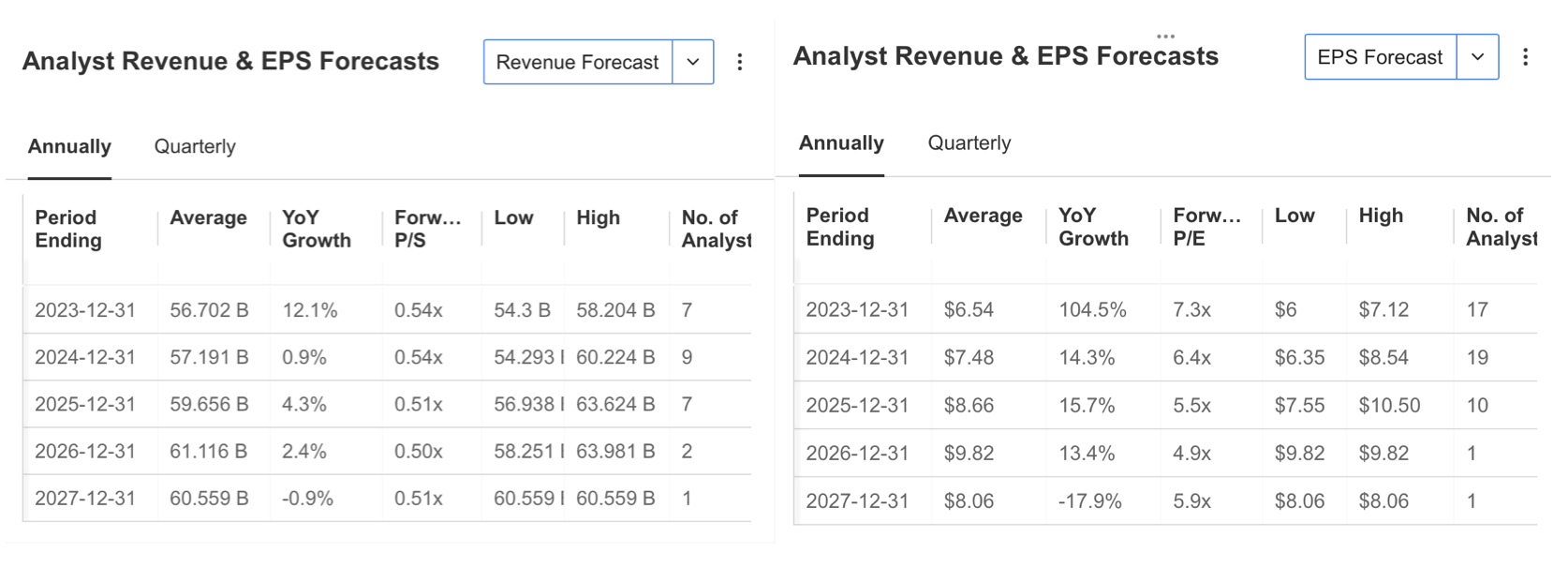

Based on the positive financial results, Delta raised its annual earnings per share guidance to a range of $6 to $7, compared to the previous range of $5 to $6. Analysts’ year-end earnings per share forecast align with the company’s expectation, standing at $6.54, a 12% increase above InvestingPro expectations. The revenue forecast for the year-end is estimated at $56.7 billion, reflecting a 12% increase.

Analyst Revenue and EPS Forecasts

Analyst Revenue and EPS Forecasts

Source: InvestingPro

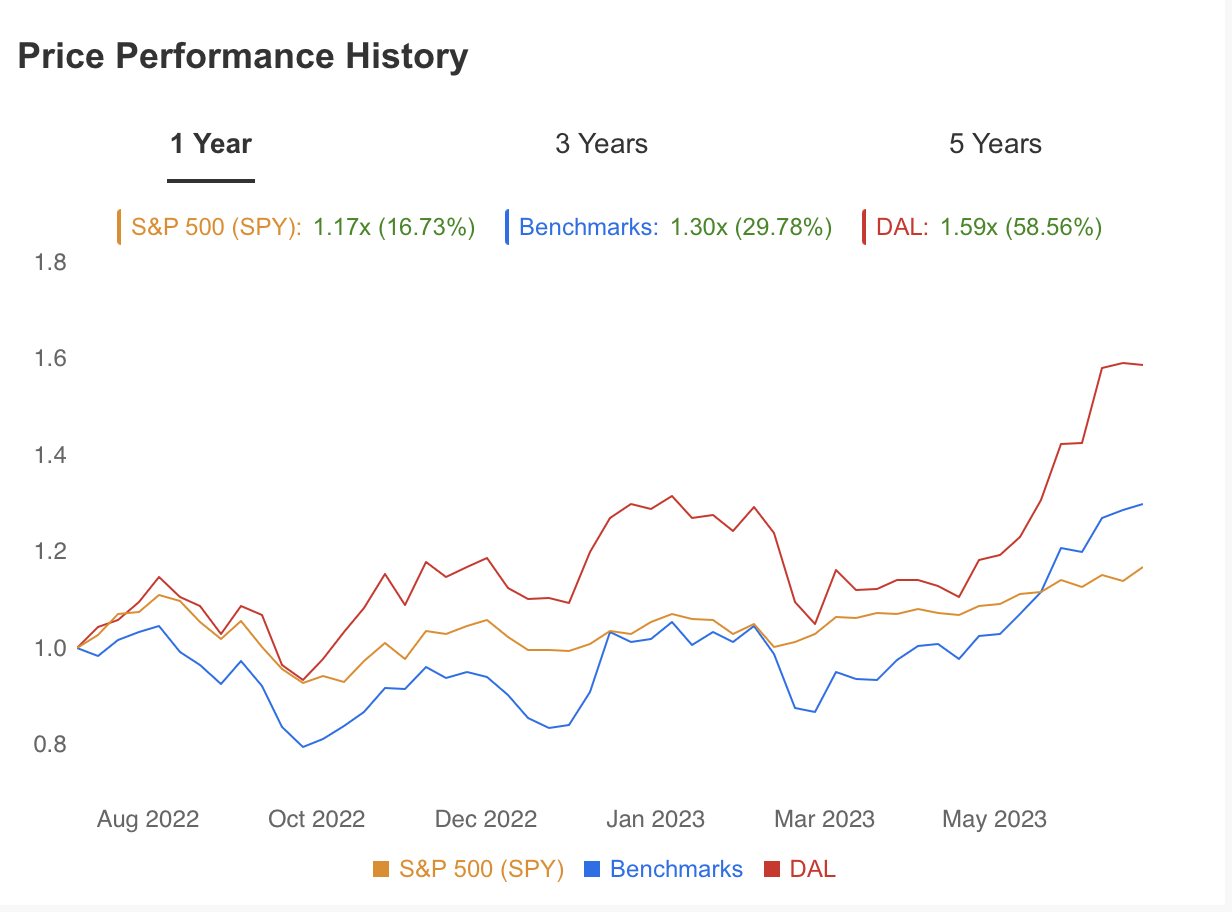

Delta’s stock has exhibited a strong performance compared to other stocks in the sector and the , showing a consistent upward trend since the start of the year. Since the beginning of the year, it has gained almost 50%, outperforming the broader market. This highlights Delta Air’s robust performance and indicates positive investor sentiment toward the company.

Price Performance History

Price Performance History

Source: InvestingPro

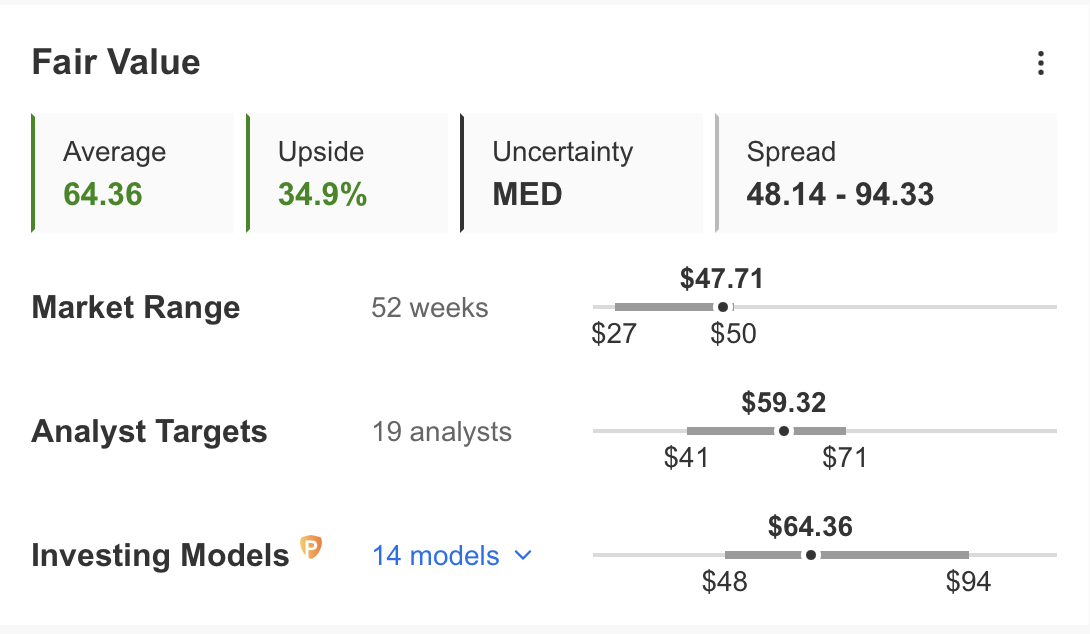

According to InvestingPro’s fair value estimate, the uptrend will continue. The fair value, calculated based on 14 financial models on the InvestingPro platform, is currently at $64.36. This data suggests the stock is currently trading at a discount of approximately 35% compared to its current price of $47.

Additionally, taking into account the average of 19 analyst estimates, the fair value is estimated to be around $60. These figures indicate that there is potential for further growth and that the stock may be undervalued.

Source: InvestingPro

Based on the financial model-based forecast and analyst projections, Delta Air Lines is anticipated to sustain its strong financial outlook in the second half of 2023. These forecasts suggest there is still some potential for DAL to continue its upward trajectory.

Source: InvestingPro

Conclusion

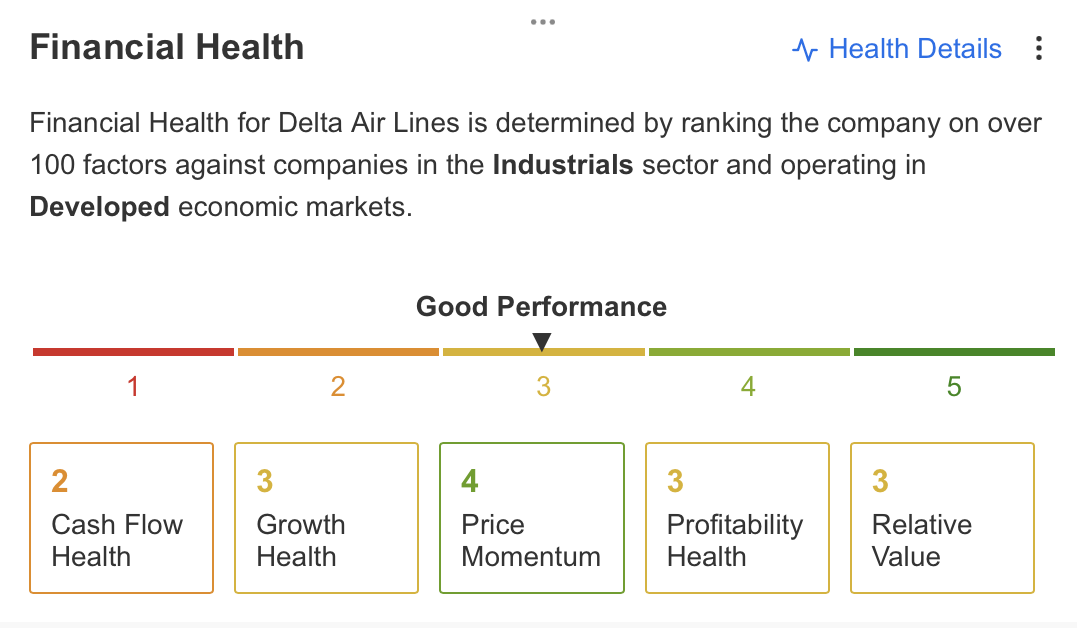

Delta Air’s overall financial situation appears favorable. The company has exhibited strong price momentum in its stock, indicating positive market sentiment. While the cash situation is gradually recovering, it has not reached the desired level yet. Delta Air’s profitability, growth, and relative value indicators remain stable.

***

Access first-hand market data, factors affecting stocks, and comprehensive analysis. Take advantage of this opportunity by subscribing and unlocking the potential of InvestingPro to enhance your investment decisions.

And now, you can purchase the subscription at a fraction of the regular price. Our exclusive summer discount sale has been extended!

InvestingPro is back on sale!

Enjoy incredible discounts on our subscription plans:

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

Don’t miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the Summer Sale won’t last forever!

Summer Sale Is Live Again!

Summer Sale Is Live Again!

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling or recommendation to invest. We remind you that all assets are considered from different perspectives and are extremely risky, so the investment decision and the associated risk is the investor’s.