Dell Positioned for Q3 Preview: How AI Partnerships Could Influence Results

2024.11.25 11:54

Business Description:

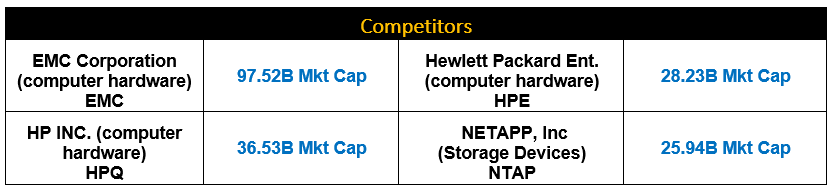

Dell Technologies Inc. (NYSE:) designs, develops, manufactures, markets, sells, and supports various comprehensive and integrated solutions, products, and services in the Americas, Europe, the Middle East, Asia, and internationally. The company operates through two segments, Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG). The ISG segment provides modern and traditional storage solutions, including all-flash arrays, scale-out file, object platforms, hyper-converged infrastructure, and software-defined storage; and general-purpose and AI-optimized servers.

The company also offers networking products and services comprising wide area network infrastructure, data center and edge networking switches, and cables and optics that help its business customers to transform and modernize their infrastructure, mobilize and enrich end-user experiences, and accelerate business applications and processes; software and peripherals; and consulting, support, and deployment services. The CSG segment provides desktops, workstations, and notebooks; displays, docking stations, keyboards, mice, webcam, and audio devices; and third-party software and peripherals, as well as configuration, support and deployment, and extended warranty services. As well cybersecurity technology-driven security solutions to prevent security breaches, detect malicious activity, and respond rapidly. The company serves enterprises, public institutions, and small and medium-sized businesses through its direct sales channel, value-added resellers, system integrators, distributors, and retailers.

DELL Q3 2024 reports earnings at 4:050 PM ET Monday, Nov 26, 2024

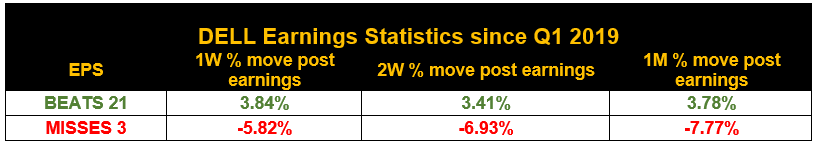

- 21 beats since Q1 2019

- 3 Misses since Q1 2019

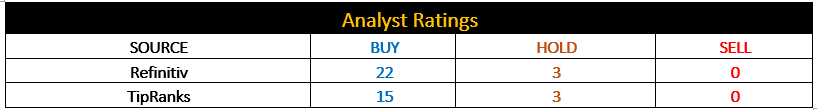

Analyst Ratings:

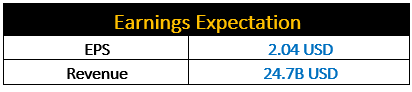

Earnings Expectation:

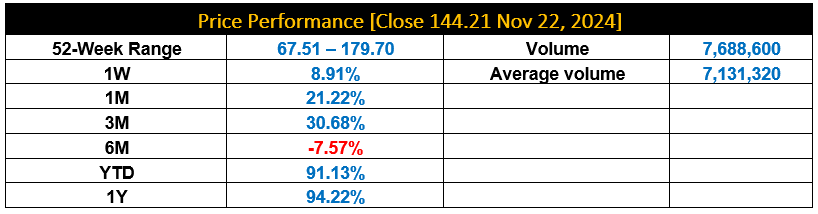

Price Performance:

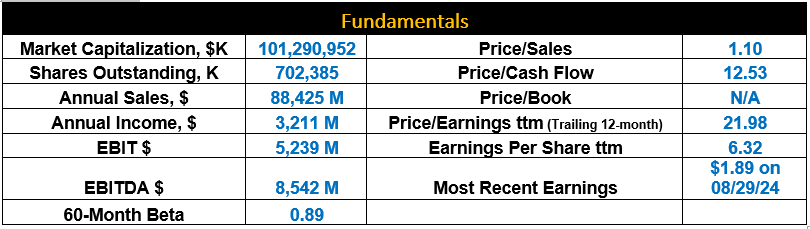

Fundamentals:

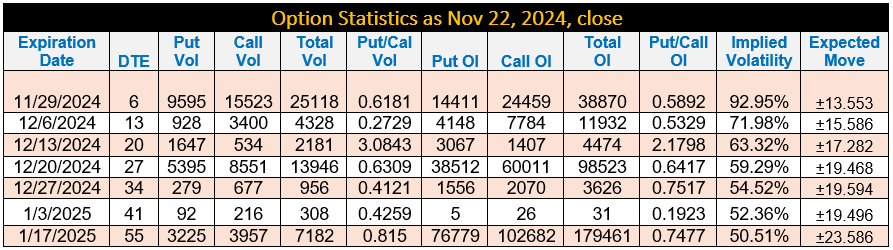

Option Statistics:

- Put/Call ratio for Nov. 29 expiry is 0.5892% more calls than puts which suggests the following three scenarios:

- With Put/Call ratio is around 0.5892 to 0.5329 for the next two upcoming expiries suggest that the traders are bullish.

- Earning miss or lower guidance could trigger a short-lived sell-off followed by a gradual rally.

- Earning and guidance in line or better than estimates may trigger a sharp rally.

Key Highlights:

- Dell will be a key beneficiary of AI Server growth wave which will create a higher margin service revenue.

- As AI PC will be the game changer – Dell will be the beneficiary of PC growth in 2025/2026.

- A major growth contributor is the expansion in partner base with NVIDIA (NASDAQ:), Microsoft (NASDAQ:), Meta Platforms (NASDAQ:), AMD (NASDAQ:), and Intel (NASDAQ:).

- A shareholder friendly approach through buybacks and dividend payouts makes it an attractive investment.

Technical Analysis Perspective:

- Dell is hovering inside a rising channel on weekly charts. The mid-point of the channel is holding this week at 140/141, and the upper channel resistance is at 153/154.

- Prices are targeting 153 -155 near term objective, which is the center point of 169 to 143 downside price gap after Q1 earnings.

- A strong and sustained breakout of 155 barrier would target 165 to 169 resistance zone.

- The above upside scenario is valid as long as 140 base remains intact pre and post earnings Tuesday November 26, 2024.

DELL Weekly Chart:

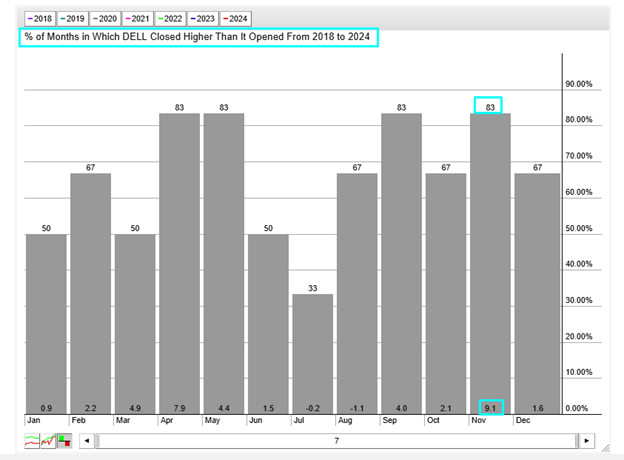

DELL Seasonality Chart

- DELL closes 9.1% higher in November 83% of the time since 2018.

Conclusion:

Dell needs to hold 140/141 pre and post earnings to target 153/155 with more room to 165/169.

Motivational Quotes:

Intensity is the price of excellence by Warren Buffet.

***

Ali Merchant is a seasoned financial market professional with expertise in Technical Analysis, Treasury & Capital Markets, Trading, Sales, Research, Training, Fund & Relationship Management, Fintech, and Digitalization. He is a CMT charter holder and an active member of CMT Association, USA, American Association of Professional Technical Analysts, and CMT Association of Canada. He has worked on various roles and organizations in North America and the GCC, such as ABN Amro bank, Thomson Reuters, Refinitiv, MAK Allen & Day Capital Partners, and Bridge Information Systems.

He is the founder of TwT Learnings, provides financial market training. Follow us on “X” formerly Twitter “@twtlearning.”