Decentralized Stablecoins Take Off After USDC Funds Frozen

2022.08.12 13:41

Market participants opt for decentralized stablecoins as censorship fears mount over their centralized counterparts.

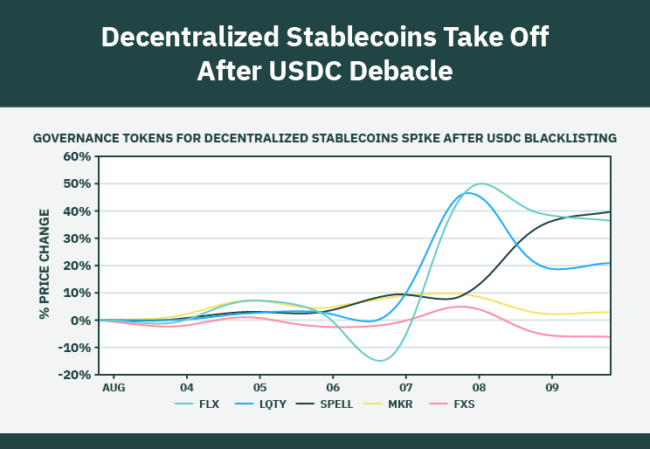

The decentralized stablecoin market seems to be the primary beneficiary in the ongoing Tornado Cash saga. Following the US Treasury’s sanction and the subsequent freezing of addresses linked with the mixer by the stablecoin issuer circle, decentralized stablecoins have surged between 21-40%.

Decentralized Stablecoins Surge

The backers of the USDC stablecoin have heeded the sanctions placed on Tornado cash and addresses linked with it. The stablecoin issuer froze over $75,000 worth of funds linked to 81 addresses under the embargo, sending massive shockwaves through the decentralized finance (DeFi) ecosystem.

Consequently, Circle’s actions have led to serious concerns amongst market participants over censorship resistance of the top stablecoins, all backed by centralized bodies. The centralized nature of the top stablecoins means their issuers can freeze transactions as they please. This has, in turn, led them to seek alternatives that are censorship resistant.

Decentralized Stablecoins.

Decentralized Stablecoins.

According to Delphi Digital, the prices of governance tokens issued by decentralized stablecoin projects have significantly surged as investors switch over to them. The chart above shows that FLEX, SPELL, and LQTY have all spiked considerably, with the former two gaining almost 40% since the sanctions. However, the latter gained 21% in the same period.

Meanwhile, MKR and FXS did not reflect the shift in market sentiment and remained flat. This might be because USDC tokens make up a sizable amount of the collateral supporting DAI and FRAX stablecoins.

Investors Seek Alternatives

The surge in market share for decentralized stablecoins is linked with DeFi users seeking alternatives to the “big three.” According to DEX Screener, the USD-pegged LUSD for Liquity, a protocol that uses collateralized debt holdings, has increased to $1.04. Given that Liquity only accepts ETH as collateral, LUSD has been gaining popularity as a more decentralized choice.

Consequently, stablecoins collateralized by digital assets like ETH, BTC, and not other stablecoins have gained significant transactions. Several influencers like Tetranode have also taken to social media to discuss them. The growing fears over censorship with centralized stablecoins have provided the decentralized option with an opportunity to gain market share.

However, the competition amongst decentralized stablecoin is set to get fiercer. Aave and Curve, two leading DeFi platforms, have revealed their intentions to launch their stablecoins.

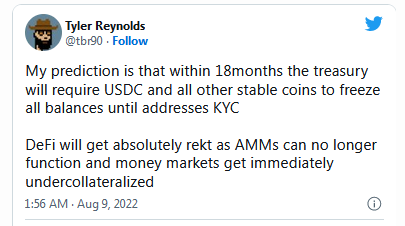

Meanwhile, while investors continue to look for alternatives, Tyler Reynolds, an angel investor, doesn’t necessarily think users will abandon the likes of USDC just yet. He said investors would not leave the USDC stablecoin until regulations became stricter. He further predicted that know-your-customer restrictions would affect all stablecoin within 18 months.

Tweet

Tweet

USDT Demand Rises Amidst Censorship Concerns

With investors fleeing from the USDC, several have opted for the USDT issued by Tether, which recently regained its dollar peg. Curve Finance, an automated machine manufacturer (AMM) focused on like-priced assets, has recorded a decrease in the percentage of USDT in its 3-pool. Since the announcement of Tornado’s sanctions, the proportion of the USDT has fallen from 29.60% to 22.13%.

Consequently, the 3-pool is Curve’s second largest pool, with $987 million in assets. Hence, the decline in USDT is probably due to people using the pool to exchange their USDC for USDT and DAI—3-pool’s other two dollar-pegged assets.

With investor fears growing over stablecoins censorship resistance, the stakes are set to grow higher with the sub-sector. Decentralization is now more important than ever since censorship, which contradicts crypto’s key principles, is becoming more prevalent.