Debt limit progress, weak Chinese data – what’s moving markets

2023.05.31 05:51

© Reuters

Investing.com — The stage is set for a dramatic vote on the debt ceiling bill in the House of Representatives as the June 5 default deadline ticks ever closer. Meanwhile, disappointing economic data casts doubt over the strength of China’s post-COVID recovery and Goldman Sachs reportedly plans fresh job cuts.

1. Debt ceiling deal heads to the House

The U.S. House of Representatives could vote on a bill to raise the $31.4 trillion debt ceiling as soon as today, with only days left until the country could tip into a damaging default.

Despite objections from hard-line conservative Republicans, the House Rules committee signed off on the deal on Tuesday, clearing the way for it to be brought before the lower chamber of Congress.

The agreement, which would suspend the borrowing limit until 2025 and place caps on some government spending, needs approval from both the House and the Senate before it can be enacted into law. The Treasury Department has warned that the federal government may run out of funds to pay its bills on June 5 if the debt ceiling is not lifted.

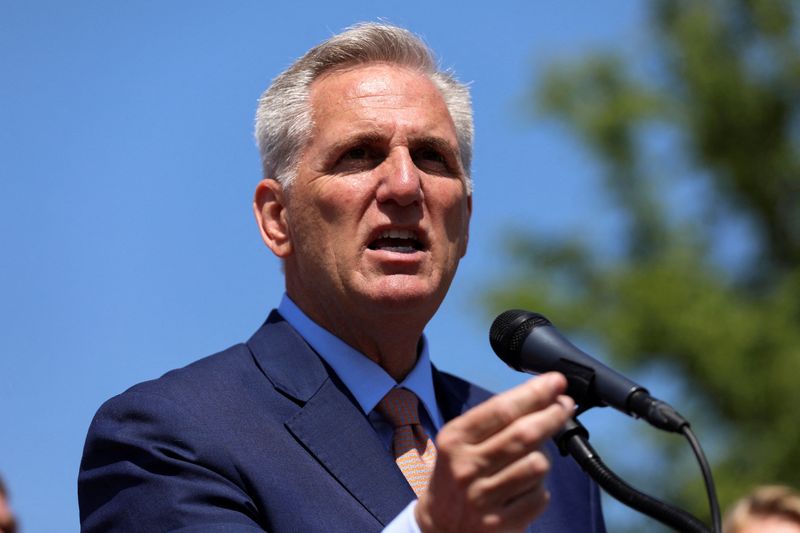

U.S. President Joe Biden and Republican House Speaker Kevin McCarthy – the two major players in a weeks-long series of fraught negotiations – have said they are hopeful that Congress will give a green light to the deal they hashed out last weekend. However, lawmakers on both sides of the aisle have spoken out against it, meaning its passage is still not a certainty.

2. Chinese economic data disappoints

The nascent recovery in China’s key manufacturing sector may be losing steam after new data showed that in the country tumbled for the second month in a row.

China’s official manufacturing purchasing managers’ index was 48.8 in May, below the expected 51.4 and the prior month’s reading of 49.2. The sub-50 reading, which indicates contraction, signaled sluggishness in a rebound in the world’s second-largest economy that began earlier in the year following the removal of strict COVID-19 rules.

, a gauge of activity in other industries including services, also slowed.

The fading post-pandemic consumption surge has some economists predicting that Beijing could roll out new stimulus measures to boost growth. But deeper structural issues, including a waning property boom and ongoing tensions with key Western trading partners, remain.

3. Futures inch lower

U.S. stock futures pointed lower on Wednesday, as investors kept a cautious eye on the debt ceiling drama in Washington and the weak manufacturing figures in China.

At 04:51 ET (08:51 GMT), the contract lost 97 points or 0.29%, dipped by 14 points or 0.32%, and fell by 51 points or 0.35%.

The benchmark ended the previous session broadly unchanged, while the added 0.32%. Tech shares in particular were boosted by a fresh rally in Nvidia (NASDAQ:) stock that briefly brought the chipmaker — itself a beneficiary of a surge in interest in artificial intelligence-related companies — above a $1 trillion valuation.

Elsewhere, the edged down by around 51 points, or 0.1%.

4. Oil drops amid Chinese data worries

Oil prices slipped on Wednesday, with the weaker-than-anticipated economic data out of China raising concerns around the outlook for the world’s biggest crude importer.

Questions swirled around whether the country’s post-pandemic rebound will still drive oil demand to record highs this year, as had initially been hoped for at the beginning of 2023.

Sentiment was, however, partly aided by the progress of the debt ceiling bill in Washington. Traders are anxious to see if lawmakers can avert a possibly catastrophic default that threatens to plunge the U.S. — the largest oil consumer — into a recession.

By 04:49 ET, futures traded 1.05% lower at $68.73 a barrel, while the contract dropped 1.11% to $72.89 per barrel.

5. Goldman Sachs reportedly mulls more layoffs

The job cuts may not be over yet at Goldman Sachs (NYSE:).

According to multiple media reports, the investment banking giant is planning to reduce its headcount by under 250 in the coming weeks, with the roles of managing directors and some partners potentially on the chopping block. The Wall Street Journal first reported on the layoffs.

Goldman, helmed by Chief Executive David Solomon, has already unveiled two recent rounds of dismissals. The bank released about 500 workers last September and around 3,200 workers earlier this year.

At the end of March, the bank employed 45,400 people — 6% less than the total in the fourth quarter of 2022.

A source quoted by Reuters said Goldman is looking to keep a tight hold on its budget this year as elevated interest rates hit dealmaking.